When it comes to global investment opportunities, two markets often top the list: the United States and India. Each offers unique advantages and challenges, making the decision of where to invest a critical one. This article provides a comprehensive comparison of investing in US stocks versus Indian stocks, focusing on factors like market stability, growth potential, and diversification benefits.

Market Stability

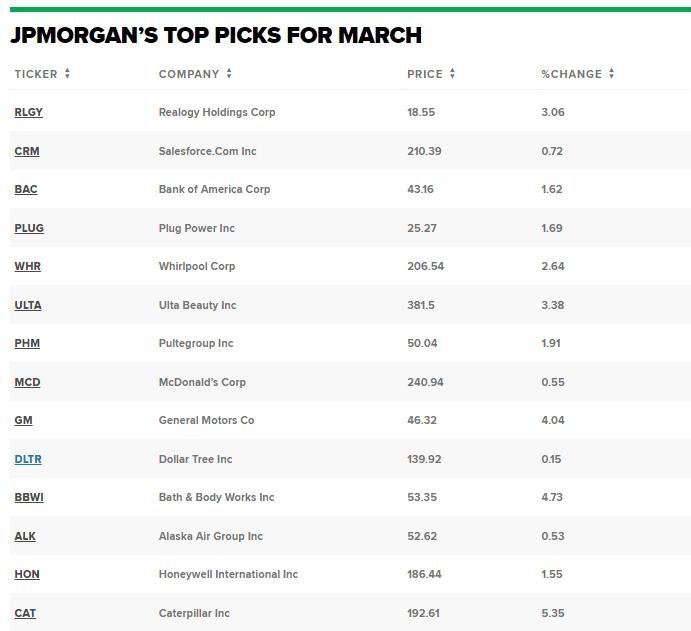

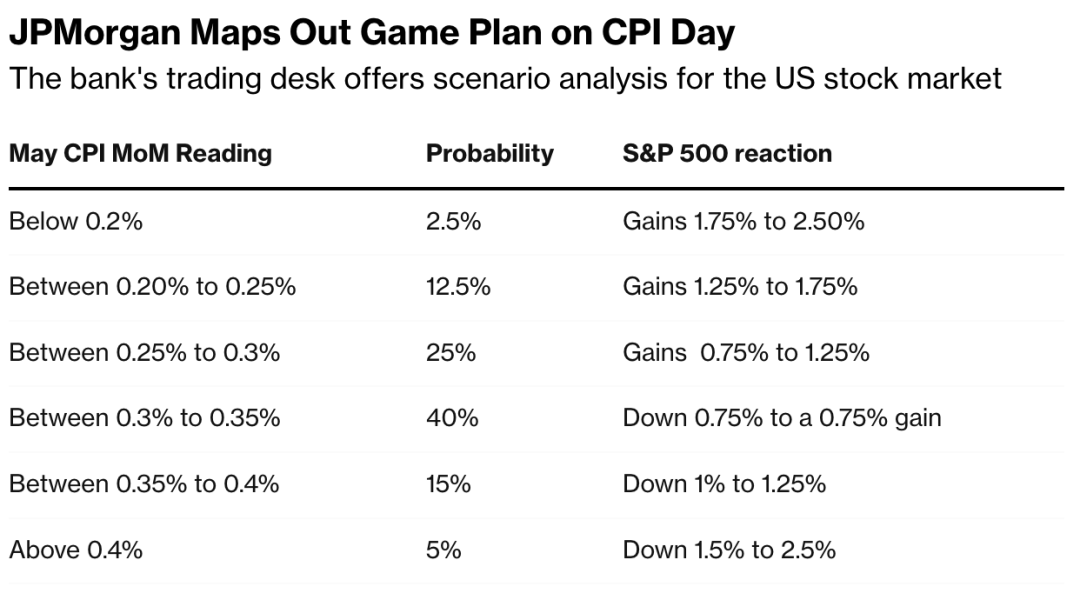

One of the primary reasons investors consider US stocks is the country's established and stable market. The United States has a robust financial system, with well-regulated exchanges and transparent trading practices. This stability has led to consistent growth over the years, making it a favorable choice for long-term investors. For instance, the S&P 500 index has returned an average of around 10% annually over the past century.

On the other hand, the Indian stock market is relatively young compared to the US. While it has shown remarkable growth in recent years, it is also more volatile and susceptible to political and economic changes. The Indian market has returned an average of approximately 10-12% annually over the past decade, but this figure can fluctuate widely due to various factors.

Growth Potential

When considering growth potential, both markets offer promising opportunities, but in different ways. The US stock market is dominated by established companies with significant market capitalization. While these companies provide stability, their growth potential may be limited. For example, companies like Apple, Microsoft, and Amazon have seen substantial growth, but their stock prices have plateaued in recent years.

In contrast, the Indian stock market is home to numerous fast-growing startups and emerging companies, offering significant growth potential. For instance, companies like Reliance Industries, TCS, and Infosys have seen explosive growth over the past decade, with stock prices soaring. However, this growth comes with higher risk due to the volatility mentioned earlier.

Diversification Benefits

Investing in stocks from different countries can provide diversification benefits, helping to mitigate risk and potentially increase returns. The US and Indian stock markets offer diverse sectors, including technology, healthcare, and finance. Investing in both markets allows investors to tap into different economic cycles and benefit from the strengths of each country.

However, the US stock market generally offers more mature and diversified sectors compared to India. This can be advantageous for investors looking for stability and a wide range of investment options.

Conclusion

When deciding between investing in US stocks versus Indian stocks, it is essential to consider various factors, including market stability, growth potential, and diversification benefits. While both markets offer unique advantages, investors must align their investment goals and risk tolerance with their choice. As with any investment decision, it is crucial to conduct thorough research and consider seeking advice from a financial advisor.

us spv stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....