In the ever-evolving world of stock market investing, understanding the different tools and strategies available to investors is crucial. One such tool that has gained significant attention is the Moving Average (MA). This article delves into the concept of US stock market moving averages, explaining how they work and why they are essential for investors looking to make informed decisions.

What are Moving Averages?

A moving average is a technical indicator used to analyze financial market data over a specified period. It is calculated by taking the average of the closing prices of a security over a defined number of time periods, typically days, weeks, or months. There are various types of moving averages, such as the Simple Moving Average (SMA), Exponential Moving Average (EMA), and Weighted Moving Average (WMA).

Why Use Moving Averages?

Moving averages are popular among investors for several reasons:

Trend Identification: One of the primary uses of moving averages is to identify the overall trend of a stock or other financial instruments. When the price of a security is above its moving average, it is often considered to be in an uptrend, and vice versa.

Support and Resistance: Moving averages can act as support and resistance levels, helping investors determine where the price may find support or face resistance. When the price approaches a moving average, it may trigger buy or sell signals.

Overbought and Oversold Conditions: Moving averages can also help identify overbought and oversold conditions. For instance, if a stock’s price moves above its moving average, it may indicate that the stock is overbought, and a pullback could be imminent.

Understanding Different Types of Moving Averages

Simple Moving Average (SMA): The SMA is calculated by taking the sum of the closing prices over a specific period and dividing by the number of periods. It provides a straightforward representation of the average price over time.

Exponential Moving Average (EMA): The EMA is similar to the SMA but places more emphasis on recent prices. This makes it more responsive to changes in the price trend.

Weighted Moving Average (WMA): The WMA assigns different weights to each price in the time period, with more recent prices receiving higher weights. This provides a more accurate representation of recent price movements.

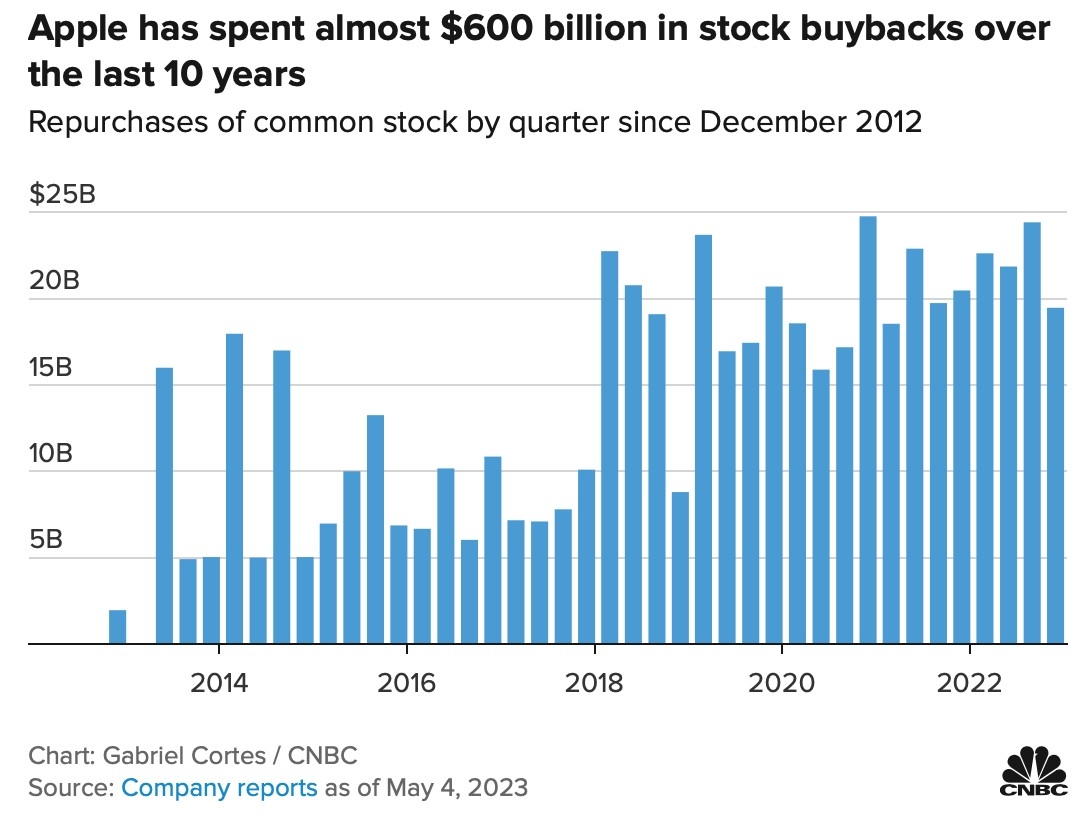

Case Study: Apple Inc. (AAPL)

Let’s consider a hypothetical scenario where an investor wants to analyze the stock of Apple Inc. (AAPL) using moving averages. The investor decides to use the 50-day and 200-day SMAs as their primary indicators.

Over the past year, the 50-day SMA has consistently remained above the 200-day SMA, indicating a bullish trend. However, when the price of AAPL dipped below the 50-day SMA, it provided a sell signal, as the stock was considered to be in a bearish trend.

By analyzing the moving averages, the investor was able to identify potential buy and sell opportunities, ultimately contributing to more informed decision-making.

In conclusion, moving averages are a valuable tool for analyzing the US stock market. By understanding the different types of moving averages and how they can be applied to various stocks, investors can gain valuable insights into market trends and make more informed decisions.

us spv stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....