In the fast-paced world of investing, staying ahead of the curve is crucial. One of the most valuable tools for investors is access to real-time stock price data. This information allows traders to make informed decisions quickly, react to market changes, and potentially capitalize on opportunities that others may miss. In this article, we'll explore the importance of real-time stock price data, how it can be utilized, and some key considerations for investors.

Understanding Real-Time Stock Price Data

Real-time stock price data refers to the current price of a stock at any given moment. This information is updated continuously, providing investors with the most up-to-date information possible. Unlike historical data, which can only provide insights into past trends, real-time data allows investors to react to current market conditions.

Why Is Real-Time Stock Price Data Important?

Quick Decision Making: The ability to access real-time stock price data is crucial for making quick decisions. In the stock market, timing is everything, and having access to real-time information can mean the difference between a successful trade and a missed opportunity.

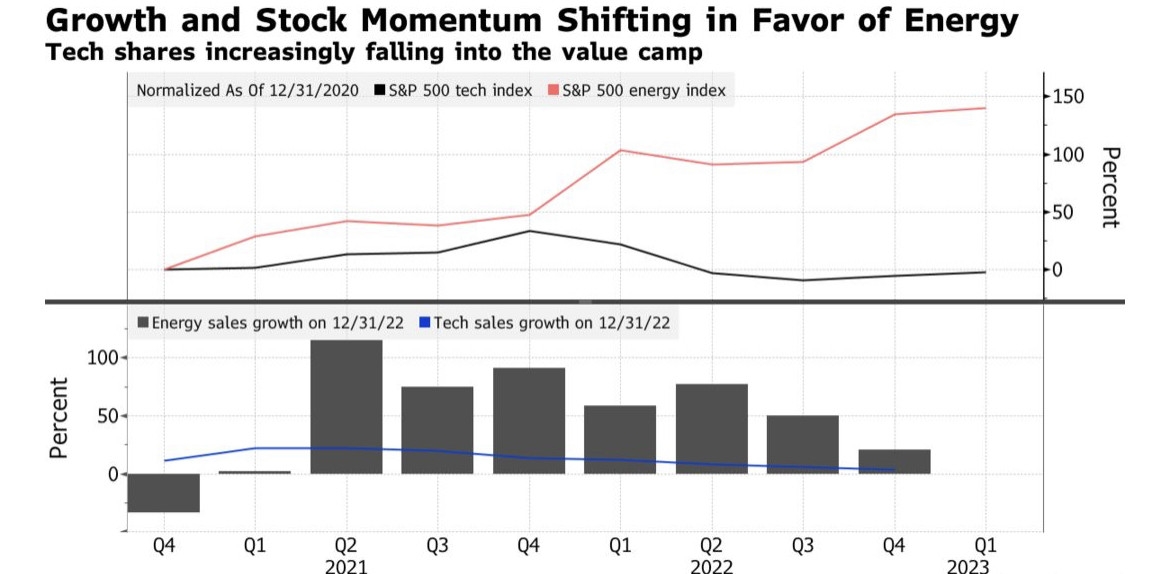

Market Trends: Real-time stock price data allows investors to identify and capitalize on market trends. By analyzing the current price movements, investors can gain insights into the direction of the market and adjust their strategies accordingly.

Risk Management: Real-time data helps investors manage their risk by providing them with the latest information on their investments. This allows them to make informed decisions about when to buy, sell, or hold.

How to Utilize Real-Time Stock Price Data

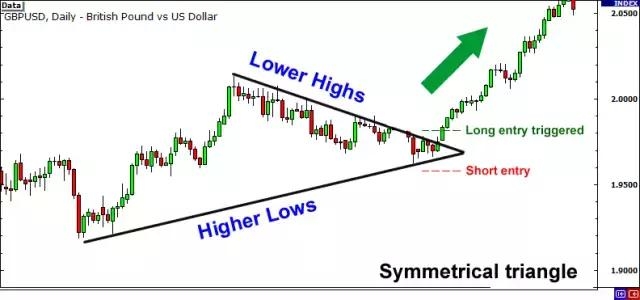

Technical Analysis: Real-time stock price data is essential for technical analysis, which involves analyzing historical price and volume data to identify patterns and trends. This information can help investors make predictions about future price movements.

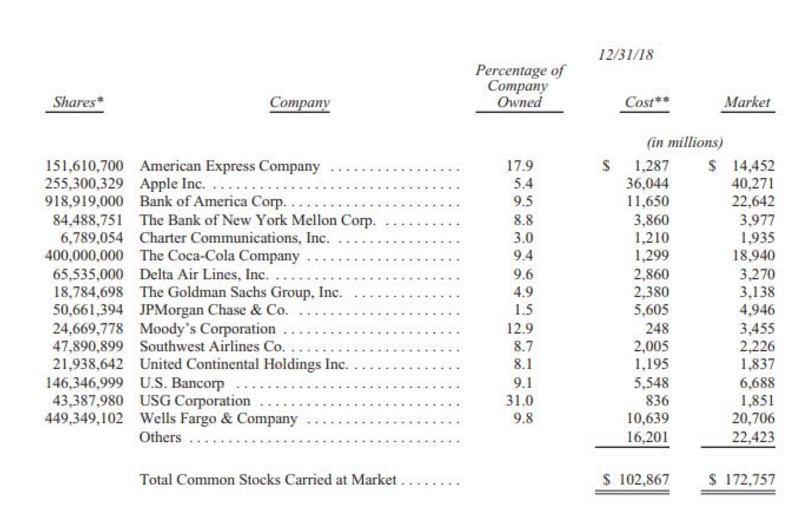

Fundamental Analysis: While real-time stock price data is primarily used for technical analysis, it can also be valuable for fundamental analysis. Investors can use real-time data to stay informed about the financial health of a company and its potential for growth.

Algorithmic Trading: Real-time stock price data is a key component of algorithmic trading, which involves using computer programs to execute trades. These programs can analyze real-time data and make trades automatically, allowing investors to capitalize on opportunities that may not be visible to the naked eye.

Case Study: Real-Time Stock Price Data in Action

Let's consider a hypothetical scenario. An investor is tracking a particular stock and notices that its real-time stock price has been steadily rising over the past few hours. By analyzing the data, the investor determines that this increase is due to positive news about the company's upcoming product launch. The investor decides to buy the stock, capitalizing on the upward trend.

Key Considerations for Investors

Data Accuracy: It's important to ensure that the real-time stock price data you're using is accurate and reliable. Choose a reputable source for your data to avoid making decisions based on incorrect information.

Data Overload: While real-time stock price data can be valuable, it's important to avoid becoming overwhelmed by too much information. Focus on the data that is most relevant to your investment strategy.

Risk Management: Always remember to manage your risk when using real-time stock price data. Never invest more than you can afford to lose, and be prepared to exit a trade if the market changes unexpectedly.

In conclusion, real-time stock price data is a powerful tool for investors looking to stay ahead of the market. By understanding its importance and how to utilize it effectively, investors can make informed decisions and potentially capitalize on opportunities that others may miss.

us spv stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....