In the fast-paced world of stock trading, understanding the Dow Jones Industrial Average (DJIA) technical analysis is crucial for investors looking to make informed decisions. This article delves into the intricacies of technical analysis for the DJIA, providing valuable insights to help you navigate the stock market effectively.

Understanding the DJIA

The Dow Jones Industrial Average (DJIA) is a widely followed stock market index that tracks the performance of 30 large, publicly-traded companies in the United States. It serves as a benchmark for the overall health of the U.S. economy and is often used as a gauge for market trends.

The Basics of Technical Analysis

Technical analysis is a method used by traders and investors to predict future price movements based on historical market data. It involves analyzing various chart patterns, indicators, and statistical tools to identify potential buying and selling opportunities.

Key Technical Indicators for the DJIA

Moving Averages (MAs): MAs are one of the most popular technical indicators. They smooth out price data over a specified period, providing a clearer picture of the market trend. Traders often use different types of MAs, such as the 50-day and 200-day MAs, to identify long-term trends.

Relative Strength Index (RSI): The RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is used to identify overbought or oversold conditions in the market. A reading above 70 indicates an overbought condition, while a reading below 30 suggests an oversold condition.

Bollinger Bands: Bollinger Bands consist of a middle band, two upper bands, and two lower bands. The middle band is typically a simple moving average, while the upper and lower bands are calculated using standard deviations. Bollinger Bands help traders identify potential entry and exit points by showing price volatility.

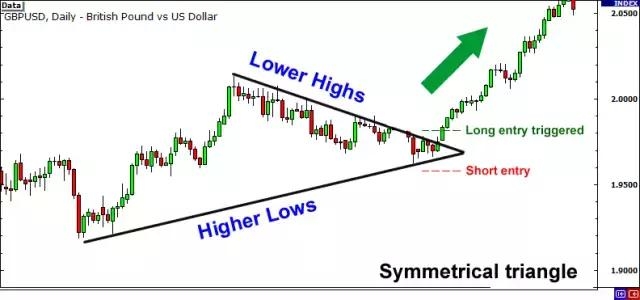

Chart Patterns for the DJIA

Head and Shoulders: This bearish pattern consists of three peaks, with the middle peak being the highest. It suggests that the market is losing momentum and may soon reverse direction.

Triple Bottom: This bullish pattern consists of three troughs, with the middle trough being the lowest. It indicates that the market is gaining momentum and may soon start to rise.

Flag and Pennant: These continuation patterns occur after a strong trend and suggest that the market will continue moving in the same direction.

Case Studies

Head and Shoulders Pattern: In 2018, the DJIA formed a head and shoulders pattern, signaling a potential reversal in the market. Traders who recognized this pattern and took appropriate action could have avoided significant losses.

Triple Bottom Pattern: In 2016, the DJIA formed a triple bottom pattern, indicating a strong bullish trend. Investors who bought during this period could have gained substantial profits.

Conclusion

Understanding DJIA technical analysis is essential for investors looking to succeed in the stock market. By analyzing key indicators and chart patterns, you can make informed decisions and potentially maximize your returns. Remember to stay updated with market trends and continuously refine your trading strategies.

us spv stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....