The year 2015 was a pivotal moment in the United States stock market. As the market corrections became evident, investors were forced to confront the realities of a changing economy and financial landscape. This article delves into the details of the stock correction in 2015, examining the factors that contributed to it, its impact on the market, and lessons learned from the experience.

Understanding the Stock Correction of 2015

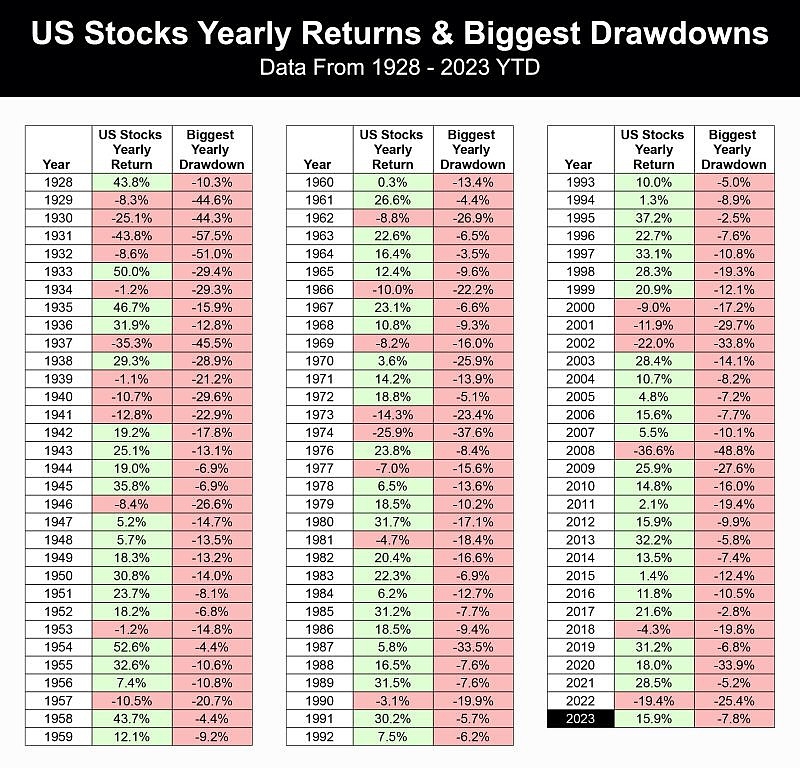

In 2015, the U.S. stock market experienced a significant correction. The S&P 500 index, a widely followed benchmark for the U.S. stock market, saw a drop of around 10% in just a few months. This correction was a sharp contrast to the strong rally in the previous years.

Several factors contributed to the stock correction. The Federal Reserve’s decision to raise interest rates was a significant catalyst. As the U.S. economy improved, the Fed believed it was time to normalize interest rates. However, the increase in interest rates was seen by some investors as a signal of economic slowdown, leading to a sell-off in the stock market.

Impact on the Stock Market

The stock correction had a significant impact on the market. It led to widespread concerns about the future of the economy and the stock market. However, it also provided an opportunity for investors to reassess their portfolios and adjust their strategies.

The correction also led to increased volatility in the market. The days of smooth upward trends were replaced by sharp ups and downs, making it more challenging for investors to navigate the market. However, for those who were prepared, the correction offered opportunities to buy quality stocks at lower prices.

Lessons Learned

The stock correction of 2015 offered several valuable lessons. First, it emphasized the importance of diversification. Investors who had a well-diversified portfolio were better able to weather the correction. Second, it highlighted the need for a long-term investment horizon. Those who panicked and sold their stocks during the correction missed out on the subsequent rally.

Another lesson learned was the importance of not chasing returns. Many investors were worried that they would miss out on the next big rally and made risky investments. However, the correction served as a reminder that risk and reward are closely linked.

Case Studies

A prime example of how the correction played out was the technology sector. Companies like Facebook and Google, which were considered "safe bets" by many investors, saw significant drops in their share prices. However, patient investors who held onto their positions saw their stocks recover and eventually surpass their pre-correction levels.

In conclusion, the stock correction of 2015 was a wake-up call for many investors. It underscored the importance of having a well-thought-out investment strategy, diversification, and a long-term investment horizon. While the market's volatility can be daunting, those who remain disciplined and patient can come out ahead in the long run.

us spv stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....