Investing in the stock market can be a daunting task, especially when it comes to selecting the best large cap value stocks. Large cap companies, with market capitalizations over $10 billion, are often seen as stable investments. But finding value in these companies can be a challenge. In this article, we delve into some of the best large cap value stocks in the US for 2023, providing you with insights into their potential for growth and stability.

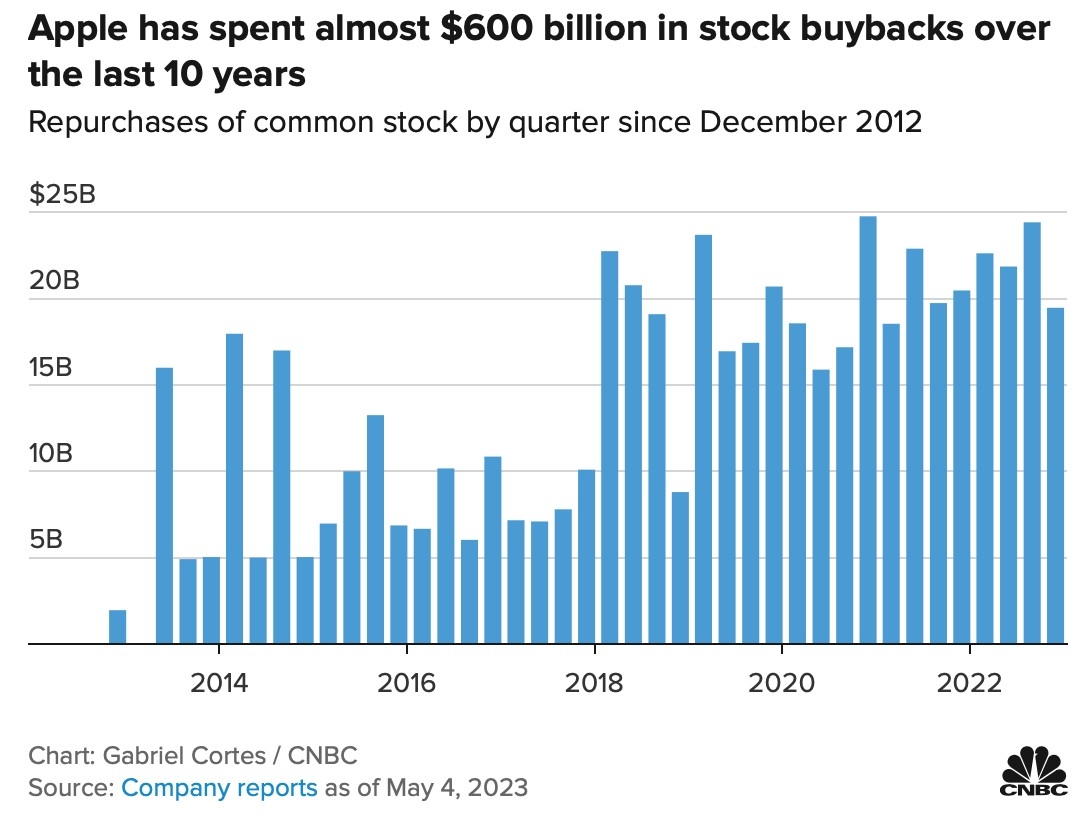

Apple Inc. (AAPL)

Leading the pack is Apple Inc., a tech giant that has consistently proven its worth over the years. With a market cap of over $2.5 trillion, Apple is not just a large cap stock but also a blue-chip company. Despite its high valuation, Apple continues to innovate and expand its product line, making it a solid value investment. The company’s strong financials, robust revenue streams, and diverse product offerings make it a compelling choice for investors looking for long-term growth.

Amazon.com Inc. (AMZN)

Another top pick for large cap value stocks is Amazon.com Inc.. As the world’s largest online retailer, Amazon has transformed the way we shop and consume. With a market cap of over $1.7 trillion, Amazon is a force to be reckoned with. Its subscription-based services, such as Amazon Prime, continue to attract millions of customers. The company’s strong e-commerce platform, coupled with its expansion into new markets and industries, positions it as a top value investment for 2023.

Johnson & Johnson (JNJ)

In the healthcare sector, Johnson & Johnson stands out as a top large cap value stock. With a market cap of over $400 billion, Johnson & Johnson is a diversified healthcare company that offers a wide range of products and services. From consumer healthcare products to pharmaceuticals, JNJ has a solid presence in various markets. The company’s strong brand reputation and robust financials make it a reliable investment for those seeking stability and growth.

Walmart Inc. (WMT)

Walmart Inc., with a market cap of over $350 billion, is another excellent large cap value stock. As the world’s largest retailer, Walmart has a vast footprint across the globe. The company has been successful in adapting to the changing retail landscape, embracing e-commerce and technology. Its strong supply chain and cost management strategies have allowed it to maintain profitability and growth, making it a top pick for value investors.

Case Study: Procter & Gamble (PG)

To illustrate the potential of large cap value stocks, let’s take a look at Procter & Gamble (PG). P&G is a consumer goods company with a market cap of over $200 billion. Despite facing headwinds in the retail sector, P&G has managed to maintain its value. The company’s strong brand portfolio and cost-saving initiatives have helped it navigate the challenging market conditions. Its commitment to innovation and product development ensures a steady stream of revenue, making P&G a valuable investment for long-term growth.

In conclusion, investing in the best US large cap value stocks can offer investors stability and potential for growth. By focusing on companies with strong fundamentals, diverse product offerings, and innovative strategies, investors can make informed decisions that align with their financial goals. As always, it’s important to conduct thorough research and consult with a financial advisor before making any investment decisions.

us spv stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....