Dividend payments on US stocks are a crucial aspect of investing, offering investors a steady stream of income. Understanding how these payments work and what they mean for your investments can significantly impact your financial strategy. In this article, we will delve into the factors influencing dividend payments on US stocks, their importance, and how to analyze them effectively.

What Are Dividend Payments?

Dividend payments are distributions of a company's profits to its shareholders. These payments are typically made in the form of cash or additional shares of stock. Companies issue dividends to reward shareholders for their investment and to attract new investors who are seeking a steady source of income.

Factors Influencing Dividend Payments

Several factors influence dividend payments on US stocks:

- Company Performance: Companies with strong financial performance are more likely to pay dividends. This includes factors like revenue growth, profit margins, and cash flow.

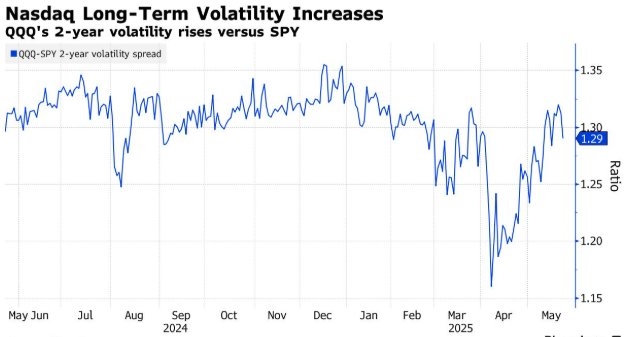

- Industry Trends: Dividends can be affected by industry-specific trends. For example, utility companies often have higher dividend yields compared to technology companies.

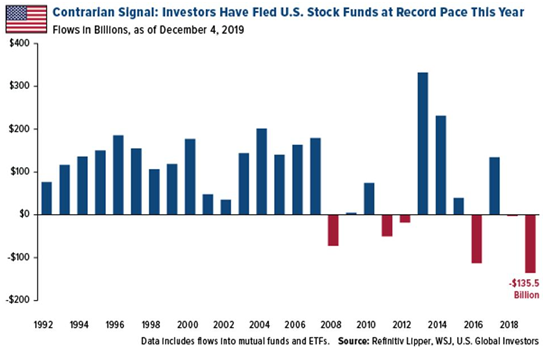

- Economic Conditions: Economic downturns can lead to reduced dividend payments, as companies may cut costs and focus on maintaining their financial stability.

- Dividend Policy: Companies have different dividend policies, which can affect their dividend payments. Some companies have a stable dividend policy, paying dividends consistently, while others may increase or decrease their payments based on their financial needs.

Importance of Dividend Payments

Dividend payments offer several benefits to investors:

- Income Stream: Dividends provide a steady source of income, particularly for investors seeking passive income.

- Shareholder Loyalty: Companies that pay dividends are often seen as more stable and reliable, attracting long-term investors.

- Potential for Capital Gains: Dividend-paying stocks can offer potential capital gains, as the share price may increase over time.

How to Analyze Dividend Payments

To effectively analyze dividend payments on US stocks, consider the following:

- Dividend Yield: This is the annual dividend payment divided by the stock's price. A higher dividend yield can indicate a more attractive investment opportunity.

- Dividend Payout Ratio: This ratio compares the company's dividend payments to its earnings per share (EPS). A lower payout ratio suggests the company has more earnings available to reinvest or increase dividends.

- Dividend Growth: Companies with a history of increasing dividends may be more attractive to investors, as it indicates a commitment to shareholder value.

Case Studies

- ExxonMobil: As one of the largest oil and gas companies in the world, ExxonMobil has a long history of paying dividends. Its stable dividend yield and consistent dividend increases make it an attractive investment for income-focused investors.

- Procter & Gamble: This consumer goods giant has paid dividends for over 130 years. Its strong financial performance and commitment to shareholder value make it a popular dividend-paying stock.

In conclusion, dividend payments on US stocks are an essential component of investing. Understanding the factors influencing dividend payments, their importance, and how to analyze them can help you make informed investment decisions and build a diversified portfolio. Remember to consider the specific dividend policies and performance of each company when evaluating potential investments.

us spv stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....