Introduction

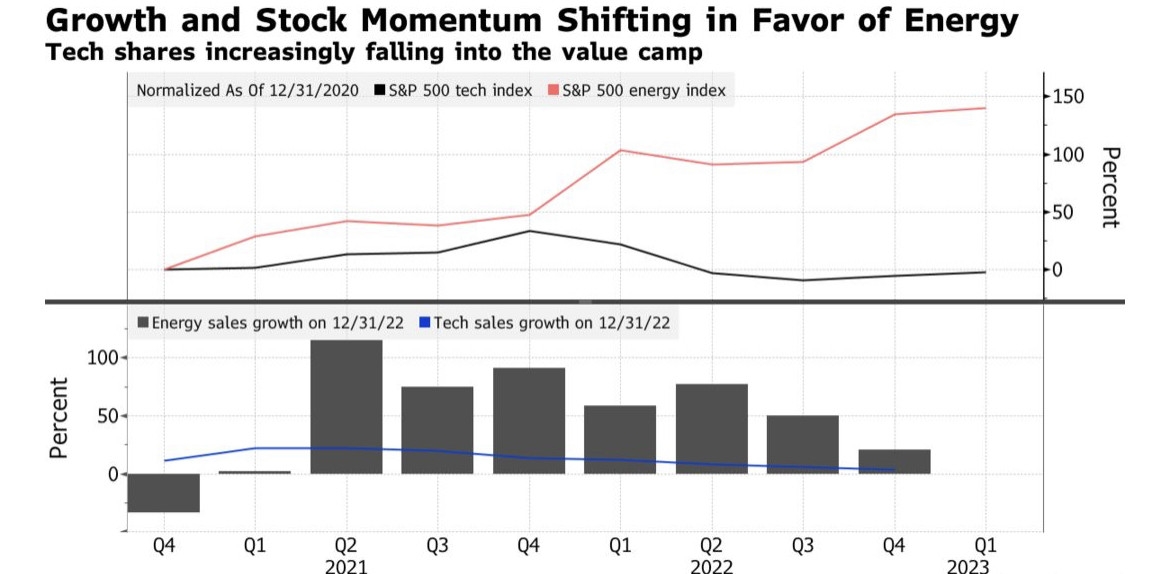

In the ever-evolving world of financial markets, US energy stocks have emerged as a cornerstone of investment opportunities. As the world grapples with the energy transition and seeks sustainable alternatives, the value of these stocks is becoming increasingly significant. This article delves into the US energy stock value, offering an in-depth analysis to help investors navigate this dynamic sector.

Understanding US Energy Stocks

What are US Energy Stocks?

US energy stocks represent shares of companies involved in the exploration, production, and distribution of energy resources. This includes traditional oil and gas companies, renewable energy firms, and even utility companies. The diversity within this sector is vast, offering investors a wide array of opportunities.

Why Invest in US Energy Stocks?

Investing in US energy stocks can be attractive for several reasons. Firstly, the energy sector is a crucial part of the global economy, with constant demand for energy resources. Secondly, advancements in technology and the push towards renewable energy have opened new avenues for growth. Lastly, the energy sector often provides stable returns and can act as a hedge against inflation.

The Current Landscape

Energy Transition and Renewable Energy

The shift towards renewable energy is a key driver in the US energy sector. Solar, wind, and hydroelectric power are becoming increasingly viable options, thanks to advancements in technology and falling costs. Companies like Tesla and Sunrun are leading the charge in this space, presenting attractive investment opportunities.

Traditional Energy Stocks

Despite the rise of renewable energy, traditional energy stocks still hold significant value. Companies like ExxonMobil and Chevron are giants in the oil and gas industry, offering stability and potential for growth. However, it's crucial to keep an eye on global oil prices and geopolitical factors that can impact these stocks.

Key Factors to Consider

When evaluating US energy stocks, several key factors should be considered:

1. Financial Health: Assess the company's financial statements, including revenue, profit margins, and debt levels.

2. Market Position: Evaluate the company's market share and competitive advantage in the industry.

3. Management Team: Look for a strong, experienced management team with a clear vision for the future.

4. Growth Prospects: Consider the company's growth potential, both in the short and long term.

Case Studies

Case Study 1: Renewable Energy Firm

Let's take a look at Sunrun, a leading residential solar provider. Despite the initial skepticism from some investors, Sunrun has seen significant growth in recent years. With the rise of solar installations and government incentives, the company's stock has surged, offering a clear example of the potential in renewable energy stocks.

Case Study 2: Traditional Energy Giant

ExxonMobil is a classic example of a traditional energy stock. Despite facing challenges from the energy transition, the company has managed to maintain its position as a market leader. With a strong balance sheet and a focus on diversification, ExxonMobil remains a viable investment option.

Conclusion

Investing in US energy stocks requires careful analysis and a clear understanding of the market. With the energy transition in full swing and technological advancements reshaping the industry, there's a wealth of opportunities available. By considering the factors outlined in this article and staying informed, investors can unlock the potential of US energy stocks and secure their financial future.

us spv stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....