In recent years, hedge funds have become increasingly active in shorting US stocks, a strategy that involves betting on the decline of a stock's price. This article delves into the reasons behind this trend, its potential impact on the market, and the strategies employed by hedge funds in this practice.

Understanding Short Selling

Short selling is a trading strategy where an investor sells a stock that they do not own, with the intention of buying it back at a lower price in the future. This strategy is often used by hedge funds to capitalize on market inefficiencies and to express bearish views on certain stocks or sectors.

Reasons for Shorting US Stocks

There are several reasons why hedge funds might choose to short US stocks:

- Economic Concerns: As the global economy faces challenges, such as inflation and geopolitical tensions, hedge funds may short stocks in sectors that are most vulnerable to these risks.

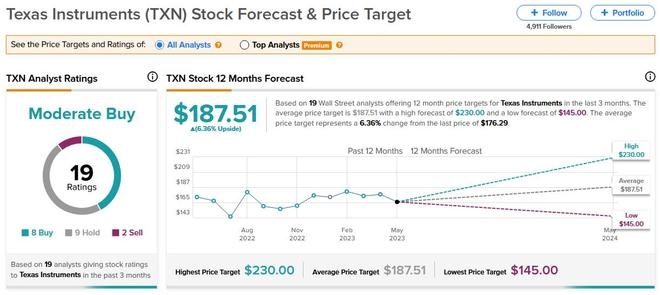

- Valuation Concerns: If a stock is overvalued, hedge funds may short it in anticipation of a price correction.

- Corporate Governance Issues: Hedge funds may short stocks with poor corporate governance, such as those with high levels of debt or management scandals.

Impact on the Market

Shorting US stocks can have a significant impact on the market, both in terms of price and liquidity. Here are some of the potential effects:

- Price Volatility: Short selling can lead to increased volatility in stock prices, as investors react to the bearish sentiment expressed by hedge funds.

- Market Manipulation: In some cases, short selling can be used to manipulate stock prices, which can harm investors and undermine market integrity.

- Liquidity Issues: Short selling can create liquidity issues, as investors may be hesitant to buy stocks that are heavily shorted.

Strategies Employed by Hedge Funds

Hedge funds employ various strategies when shorting US stocks, including:

- Short Selling: The most common strategy, where hedge funds borrow shares and sell them, with the intention of buying them back at a lower price.

- Put Options: By purchasing put options, hedge funds can profit from a decline in stock prices without actually owning the stock.

- Credit Default Swaps (CDS): CDS can be used to bet on the default of a corporate bond, which can be an indirect way of shorting a company's stock.

Case Studies

One notable example of hedge funds shorting US stocks is the case of Netflix (NFLX). In 2013, several hedge funds, including Greenlight Capital and Third Point, shorted Netflix, betting that the company's stock was overvalued. Their bearish views were based on concerns about Netflix's subscriber growth and its high debt levels. While Netflix's stock initially fell, it eventually recovered and soared to new heights, proving the hedge funds wrong.

Another example is the shorting of Tesla (TSLA) by several hedge funds, including Citron Research and Hindenburg Research. These funds argued that Tesla's stock was overvalued and that the company faced significant challenges, such as production issues and regulatory scrutiny. While Tesla's stock has experienced volatility, it has generally held up well against the bearish predictions of these hedge funds.

Conclusion

Short selling by hedge funds is a complex and often controversial practice. While it can provide valuable insights into market inefficiencies and corporate weaknesses, it also carries risks of market manipulation and volatility. Understanding the reasons behind hedge funds' shorting strategies and their potential impact on the market is crucial for investors and regulators alike.

us spv stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....