In the ever-evolving tech industry, Advanced Micro Devices (AMD) has made a significant mark with its innovative processors and graphics cards. If you're considering investing in AMD stock, it's crucial to understand the key factors that can impact its performance in the US market. This article delves into the essential aspects of AMD's stock, providing you with valuable insights to make informed decisions.

Understanding AMD's Market Position

AMD has been a prominent player in the semiconductor industry, challenging the dominance of Intel for years. The company's products are widely used in desktops, laptops, servers, and gaming consoles. Its recent advancements in processor technology, such as the Ryzen series, have garnered significant attention and market share.

Factors Influencing AMD Stock Performance

Revenue Growth: One of the primary factors that drive AMD stock performance is its revenue growth. The company's strong financial performance, driven by increased sales of its processors and graphics cards, has contributed to its rising stock price.

Market Trends: The tech industry is highly dynamic, and staying ahead of market trends is crucial for AMD's success. The rise of cloud computing, artificial intelligence, and gaming has created new opportunities for AMD to expand its market presence.

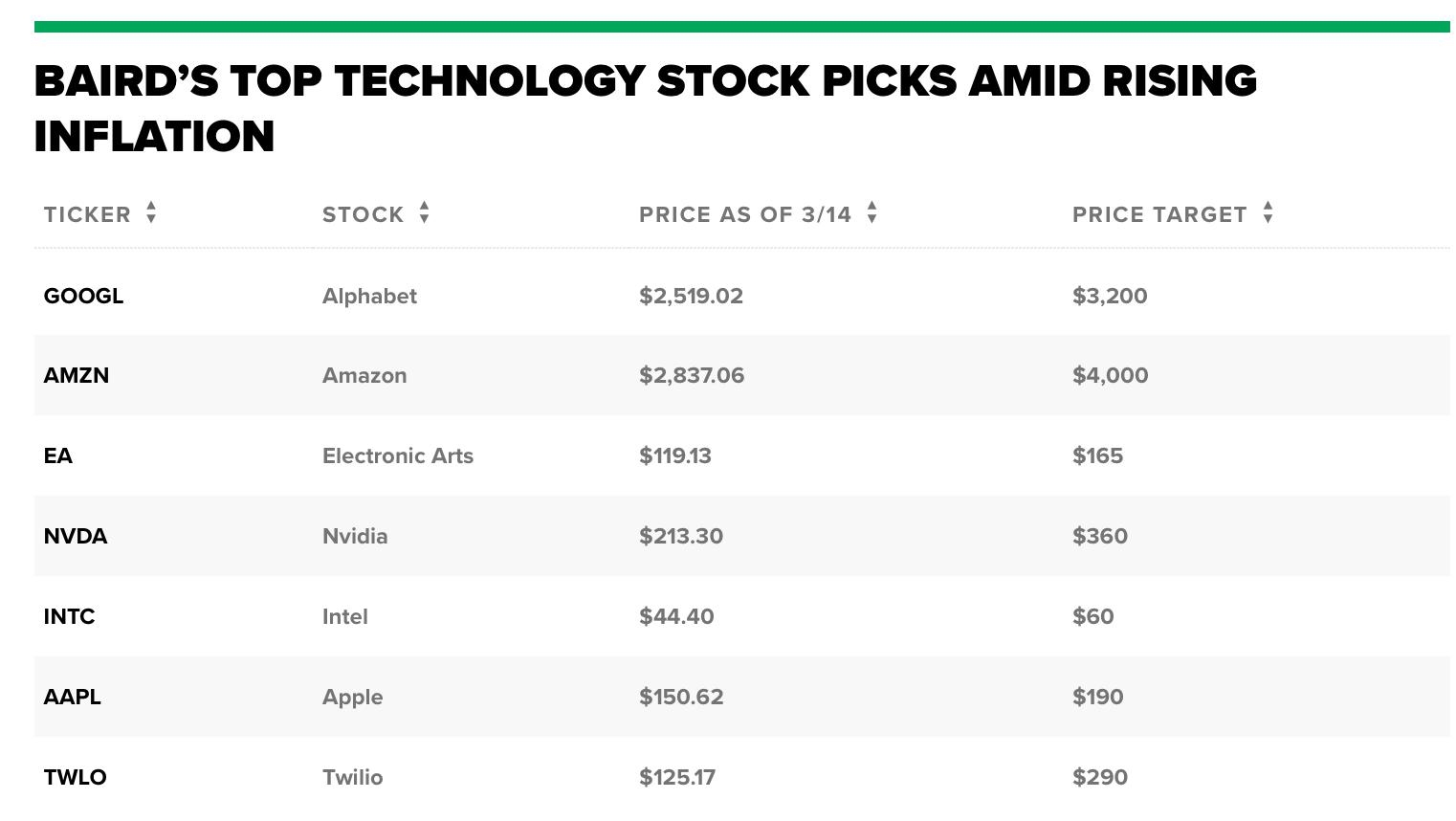

Competitive Landscape: AMD's performance is also influenced by its competition with other major players in the industry, such as Intel and NVIDIA. The company's ability to innovate and stay competitive in this landscape is a key factor in its stock performance.

Product Launches: AMD's product launches, especially new processors and graphics cards, often drive significant interest in its stock. These launches not only showcase the company's technological advancements but also attract potential investors.

Analyzing AMD Stock Performance

To understand AMD's stock performance, it's essential to analyze key metrics such as revenue, earnings per share (EPS), and price-to-earnings (P/E) ratio. Here's a brief analysis of these metrics:

Revenue: AMD's revenue has been consistently growing over the years, driven by increased sales of its processors and graphics cards. The company's revenue for the fiscal year 2020 was approximately $21.5 billion, a significant increase from the previous year.

EPS: AMD's EPS has also been on the rise, reflecting the company's profitability. For the fiscal year 2020, the company's EPS was $1.06, a significant improvement from the previous year.

P/E Ratio: The P/E ratio is a valuation metric that compares a company's stock price to its EPS. AMD's P/E ratio has been fluctuating over the years, reflecting market sentiment and the company's performance.

Case Study: AMD's Ryzen Series Success

One of the most significant factors contributing to AMD's stock performance is the success of its Ryzen series processors. The Ryzen series has been well-received by both consumers and industry experts, thanks to its high performance and competitive pricing. This success has not only increased AMD's market share but also driven interest in its stock.

Conclusion

Investing in AMD stock requires a thorough understanding of the company's market position, competitive landscape, and key performance indicators. By analyzing these factors, you can make informed decisions and potentially benefit from AMD's growth in the US market.

us stock market today live cha

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....