The stock market has been a rollercoaster ride for investors in recent years, with fluctuations causing many to question whether a crash is imminent. In this article, we delve into the current state of the market, analyze key indicators, and discuss the potential for a stock market crash.

Understanding the Market's Current State

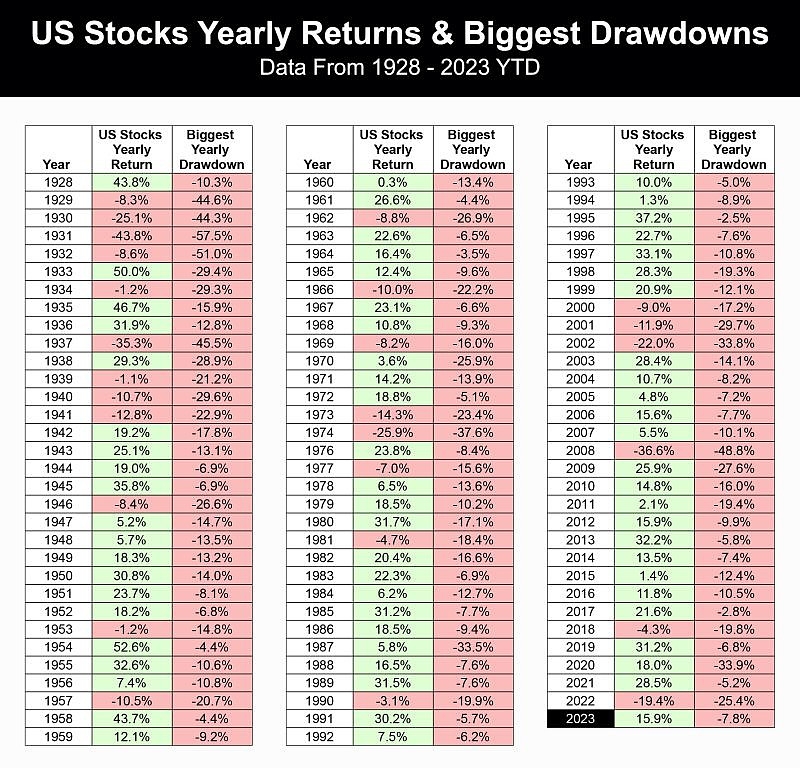

Firstly, it's important to understand that the stock market is inherently volatile. Market crashes are not uncommon, and they often occur due to a combination of economic factors, political events, and investor sentiment. Currently, the market is facing several challenges, including rising interest rates, inflation concerns, and geopolitical tensions.

Rising Interest Rates

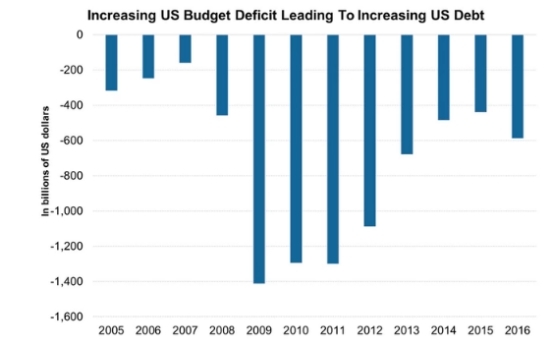

One of the primary factors contributing to market uncertainty is the rising interest rates. The Federal Reserve has been gradually increasing rates to combat inflation, which has led to higher borrowing costs for companies. This has caused a sell-off in bond markets and put pressure on stock prices.

Inflation Concerns

Inflation has been a hot topic in recent years, and it remains a significant concern for investors. When prices rise, the value of stocks can decrease, leading to a potential market crash. The Federal Reserve's efforts to control inflation may further exacerbate market volatility.

Geopolitical Tensions

Political events, such as trade disputes and elections, can also trigger market crashes. The ongoing tensions between the United States and China, for example, have caused concerns about global trade and economic stability.

Key Indicators to Watch

Several key indicators can help investors gauge the potential for a stock market crash. These include:

- Volatility Index (VIX): Often referred to as the "fear gauge," the VIX measures the market's expectation of volatility over the next 30 days. A high VIX reading suggests that investors are concerned about market instability.

- Earnings Reports: Companies' earnings reports can provide insights into the overall health of the market. A significant decline in earnings can trigger a sell-off and potentially lead to a crash.

- Economic Data: Economic indicators, such as unemployment rates, GDP growth, and consumer spending, can provide insights into the overall economic environment and the potential for a market crash.

Case Study: 2008 Financial Crisis

A prime example of a stock market crash is the 2008 financial crisis. The crisis was triggered by a combination of factors, including the subprime mortgage crisis, excessive leverage in financial institutions, and a loss of investor confidence. The resulting crash led to significant declines in stock prices and had a lasting impact on the global economy.

Conclusion

While it is impossible to predict when a stock market crash will occur, it is important for investors to stay informed and vigilant. By monitoring key indicators and understanding the factors that contribute to market volatility, investors can better navigate the risks and potential rewards of the stock market.

Note: The information provided in this article is for educational purposes only and should not be considered financial advice.

us spv stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....