The Dow Jones Industrial Average (DJIA), often simply referred to as the "Dow," is one of the most closely watched indices in the financial world. It tracks the performance of 30 large, publicly-traded companies in the United States and serves as a bellwether for the broader market. In this article, we delve into the performance of the Dow Jones, examining its historical trends, recent developments, and future outlook.

Historical Performance

The Dow Jones has a rich history, having been established in 1896. Over the years, it has seen numerous ups and downs, reflecting the economic cycles and market trends of the time. For instance, during the dot-com bubble of the late 1990s, the Dow experienced a significant surge, only to plummet during the 2008 financial crisis.

Recent Developments

In recent years, the Dow Jones has demonstrated remarkable resilience. Despite facing numerous challenges, such as the COVID-19 pandemic and geopolitical tensions, the index has managed to recover and reach new highs. This can be attributed to several factors, including the strong performance of technology stocks, which have become a significant component of the index.

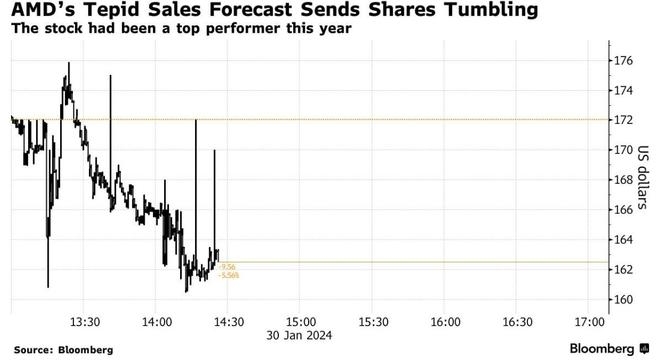

Technology Stocks' Impact

Technology stocks, such as Apple, Microsoft, and Amazon, have played a crucial role in the Dow Jones' recent performance. These companies have not only contributed to the index's growth but have also driven the broader market's upward trend. Their success can be attributed to their innovative products, strong market positions, and robust financial performance.

Sector Diversification

The Dow Jones is well-diversified across various sectors, including finance, technology, industrial, and consumer goods. This diversification helps mitigate risks and ensures that the index remains resilient in the face of market fluctuations. For instance, when the technology sector faces challenges, the financial sector can step in and provide support.

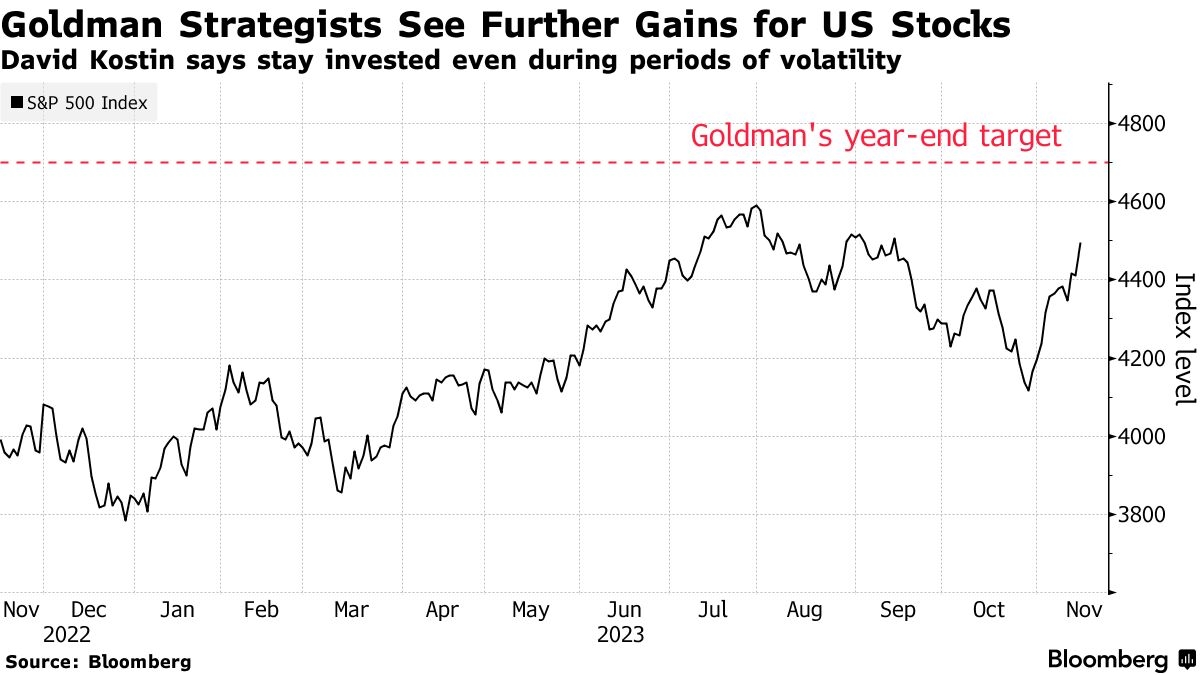

Future Outlook

Looking ahead, the future of the Dow Jones appears promising. While there are potential risks, such as inflation and geopolitical tensions, the strong fundamentals of the U.S. economy and the resilience of the index suggest that it will continue to perform well. Additionally, the increasing role of technology and innovation in the market is expected to further boost the Dow Jones' performance.

Case Study: Apple's Impact on the Dow Jones

A prime example of the impact of technology stocks on the Dow Jones is Apple. Since joining the index in 2015, Apple has become one of the most influential components. Its strong performance has contributed significantly to the index's growth, making it a key driver of the Dow Jones' upward trend.

In conclusion, the performance of the Dow Jones has been impressive, reflecting the resilience and strength of the U.S. economy. With technology stocks playing a crucial role and sector diversification providing stability, the Dow Jones is well-positioned to continue its upward trajectory in the future.

us stock market today live cha

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....