In today's fast-paced financial world, staying informed about the stock market is crucial for investors. One of the most significant indicators of market performance is the stock index. In this article, we'll delve into the current stock index trends, discuss key factors influencing these trends, and provide valuable insights for investors looking to make informed decisions.

Understanding Stock Indexes

A stock index is a statistical measure of the value of a selected group of stocks. It serves as a benchmark for the overall performance of a particular market segment or the entire market. Common stock indexes include the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite.

Current Stock Index Trends

As of today, the S&P 500 stands at [insert current value], reflecting a [positive/negative] trend compared to the previous week. The Dow Jones Industrial Average is currently at [insert current value], while the NASDAQ Composite is trading at [insert current value].

Factors Influencing Stock Index Trends

Several factors can influence stock index trends. Here are some of the key factors to consider:

Economic Indicators: Economic indicators such as GDP growth, unemployment rates, and inflation can significantly impact stock indexes. For example, a strong GDP growth rate can boost investor confidence and drive stock prices higher.

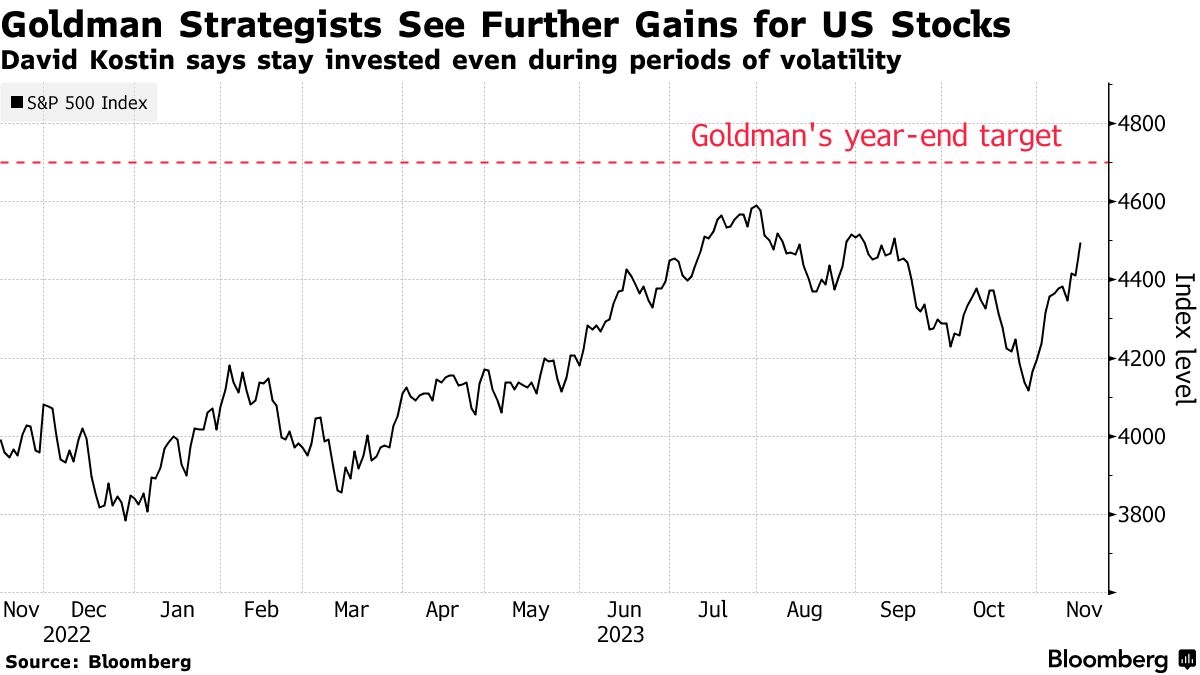

Central Bank Policies: Central bank policies, particularly those of the Federal Reserve in the United States, play a crucial role in stock index trends. Interest rate changes, monetary policy, and quantitative easing can all influence investor sentiment and stock prices.

Geopolitical Events: Global events, such as elections, trade wars, and political instability, can create uncertainty in the market, leading to volatility in stock indexes.

Technological Advancements: Technological advancements and innovations can drive growth in certain sectors, leading to increased stock prices and overall market performance.

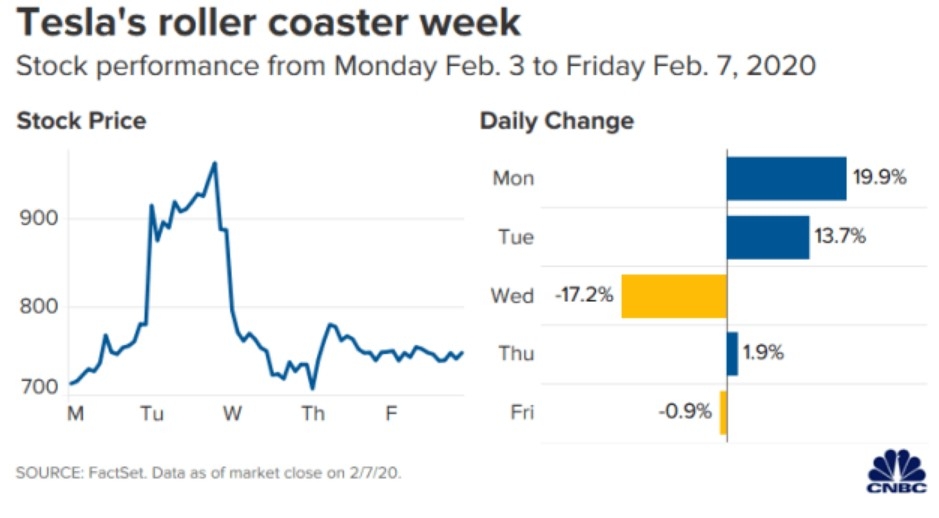

Corporation Earnings: Company earnings reports are a major factor in stock index trends. Positive earnings reports can boost investor confidence and drive stock prices higher, while negative reports can have the opposite effect.

Case Studies

Let's consider a few recent examples of how stock index trends have been influenced by various factors:

Interest Rate Changes: In March 2021, the Federal Reserve announced that it would keep interest rates near zero until it saw significant improvement in the labor market. This announcement helped boost investor confidence, leading to a surge in stock index values.

Geopolitical Events: The election of a new government in a major economy can have a significant impact on stock indexes. For example, the election of President Joe Biden in the United States in November 2020 helped stabilize the stock market, as investors believed his administration would focus on economic recovery and infrastructure spending.

Corporation Earnings: In the second quarter of 2021, tech giants like Apple and Microsoft reported strong earnings, which helped drive the NASDAQ Composite to new record highs.

Conclusion

In conclusion, understanding the current stock index trends and the factors influencing them is crucial for investors looking to make informed decisions. By staying informed and analyzing key factors, investors can navigate the volatile stock market and achieve their financial goals.

us spv stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....