In the fast-paced world of finance, understanding the stock market's trends over a 5-year period can provide invaluable insights for investors. This article delves into the intricacies of a 5-year stock market chart, offering a comprehensive analysis of key market movements and factors that have influenced these trends. By examining historical data, we can better predict future market behavior and make informed investment decisions.

Understanding the 5-Year Stock Market Chart

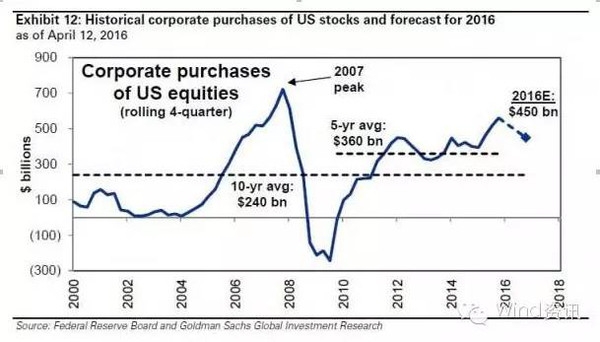

A 5-year stock market chart is a visual representation of the performance of a particular stock or index over a five-year period. It provides a clear and concise overview of the stock's price movements, including peaks, troughs, and overall trends. By analyzing this chart, investors can identify patterns, potential buy and sell opportunities, and the overall health of the market.

Key Components of a 5-Year Stock Market Chart

Price Movement: The most crucial aspect of a 5-year stock market chart is the price movement. This is typically represented by a line graph, showing the stock's price over time. By observing the chart, investors can identify trends such as upward or downward movements, as well as any significant price spikes or drops.

Volume: The volume of a stock represents the number of shares traded during a specific period. This information is often displayed as a bar graph on the chart. Analyzing volume can help investors gauge the level of interest in a stock and identify potential support or resistance levels.

Technical Indicators: Technical indicators are mathematical calculations based on historical price and volume data. Common indicators include moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence). These indicators can provide additional insights into a stock's potential future movements.

Analyzing the 5-Year Stock Market Chart

To effectively analyze a 5-year stock market chart, investors should consider the following factors:

Trends: Identify whether the stock has been trending upward, downward, or sideways over the past five years. This can help determine the stock's overall health and potential future performance.

Support and Resistance Levels: These are price levels where the stock has repeatedly struggled to move above or below. Understanding these levels can help investors identify potential entry and exit points.

Breakouts and Breakdowns: A breakout occurs when a stock moves above a significant resistance level, indicating strong momentum. Conversely, a breakdown occurs when a stock falls below a critical support level, suggesting potential weakness. Identifying these events can provide valuable insights for trading decisions.

Case Study: Apple Inc. (AAPL)

Let's take a look at Apple Inc. (AAPL) as an example. Over the past five years, AAPL has experienced significant growth, with the stock price rising from around

- Uptrend: The stock has been in an uptrend over the past five years, with several minor pullbacks but no significant downward movements.

- Support and Resistance: The stock has consistently found support around the

150 mark and resistance around the 180 mark. - Breakouts and Breakdowns: In late 2020, AAPL experienced a significant breakout above the $180 resistance level, indicating strong momentum.

By analyzing these factors, investors can make informed decisions regarding their investments in AAPL.

Conclusion

A 5-year stock market chart is a powerful tool for investors looking to gain insights into the performance and potential future movements of a stock. By understanding the key components of the chart and analyzing historical data, investors can make more informed decisions and increase their chances of success in the stock market.

us stock market live

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....