Introduction: Are you a Canadian investor considering buying US stocks? One of the most crucial aspects to consider is the tax implications. In this article, we will delve into the details of Canadian taxes on US stocks purchases, helping you make informed decisions.

Understanding the Basics

When Canadian investors purchase US stocks, they are subject to certain taxes. It is essential to understand these taxes to avoid any surprises and potential penalties.

Capital Gains Tax: If you sell US stocks for a profit, you will be taxed on the capital gains. The tax rate depends on the amount of your gains and your total income.

Dividend Tax: Dividends received from US stocks are also subject to taxation. The rate depends on your overall income and whether the dividends are qualified or non-qualified.

Withholding Tax: When Canadian investors buy US stocks, a portion of the dividends may be withheld at source to cover potential taxes.

Tax Rates and Calculation

The tax rates on US stocks vary depending on the province or territory in Canada. Here is a general overview:

Capital Gains Tax: The federal capital gains tax rate is 50% of the net gain. The rate is reduced to 25% if you have held the stocks for more than a year. Additional provincial taxes may apply.

Dividend Tax: Qualified dividends are taxed at the lower personal income tax rate, while non-qualified dividends are taxed at the higher rate. The withholding tax rate for US dividends is typically 15%.

Tax Planning Strategies

To minimize your tax burden on US stocks, consider the following strategies:

Use a Tax-Efficient Account: Investing in US stocks through a Tax-Free Savings Account (TFSA) or a Registered Retirement Savings Plan (RRSP) can provide tax advantages.

Dividend Reinvestment Plans: Consider participating in a DRIP (Dividend Reinvestment Plan) to reinvest dividends and potentially benefit from compounded growth.

International Tax Credit: Canadians are eligible for an international tax credit to offset taxes paid on foreign dividends. Be sure to claim this credit on your tax return.

Case Study

Let's consider a scenario where a Canadian investor purchases 100 shares of a US company for

The investor will need to calculate the capital gains tax on the

In addition, the investor may need to pay tax on the dividends received, depending on the withholding rate and their overall income.

Conclusion:

Investing in US stocks can be a lucrative opportunity for Canadian investors. However, understanding the tax implications is crucial for maximizing returns. By utilizing tax-efficient accounts, taking advantage of tax credits, and employing effective tax planning strategies, you can minimize your tax burden and enjoy the benefits of investing in US stocks.

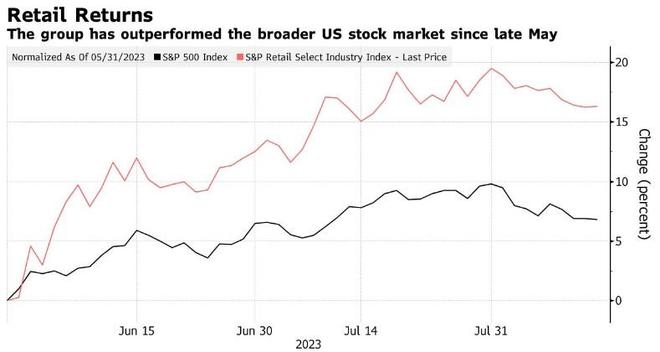

us stock market today live cha

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....