The stock market is a complex and ever-evolving landscape, with countless factors influencing its direction. As we approach 2025, many investors and analysts are eager to predict the future of the US stock market. In this article, we'll delve into some of the key trends and predictions that could shape the market over the next few years.

Economic Growth and Inflation

One of the most critical factors impacting the stock market is economic growth. Many analysts predict that the US economy will continue to grow steadily over the next few years, driven by factors such as technological advancements, a strong labor market, and increasing consumer spending. However, this growth may be accompanied by rising inflation, which could lead to higher interest rates and potentially impact stock prices.

Technology and Innovation

Technology has been a major driver of stock market growth over the past few decades, and this trend is expected to continue. Innovation in sectors such as artificial intelligence, biotechnology, and renewable energy could lead to significant growth in the tech industry. Companies like Apple, Microsoft, and Amazon are likely to remain key players in the market, while new startups may emerge as leaders in emerging technologies.

Healthcare and Pharmaceuticals

The healthcare industry is another sector that could see significant growth in the coming years. As the population ages and healthcare needs increase, companies involved in pharmaceuticals, biotechnology, and medical devices may experience strong growth. Investors should keep an eye on companies like Johnson & Johnson, Pfizer, and Amgen.

Energy and Climate Change

With growing concerns about climate change, the energy sector is undergoing a significant transformation. Renewable energy sources such as solar and wind power are becoming increasingly viable, and companies involved in these sectors could see substantial growth. At the same time, traditional energy companies may face challenges as they transition to cleaner technologies.

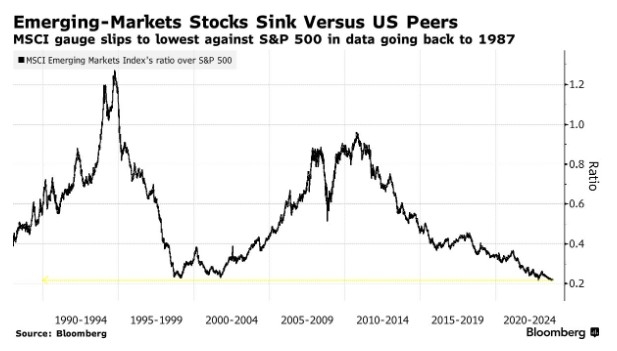

International Markets

While the US stock market will undoubtedly play a significant role in 2025, international markets will also be important. Emerging markets such as China and India are expected to continue their rapid growth, providing opportunities for investors to diversify their portfolios.

Risks to Consider

Despite the promising outlook, there are risks that could impact the stock market in 2025. Geopolitical tensions, economic instability, and regulatory changes are just a few of the potential threats. Investors should stay informed and be prepared to adjust their portfolios accordingly.

Case Studies

To illustrate these trends, let's consider a few case studies:

- Tesla: As a leader in electric vehicles and renewable energy, Tesla has seen significant growth in recent years. With continued innovation and expanding market share, Tesla could remain a strong investment for the next few years.

- Moderna: The biotechnology company has gained attention for its role in developing mRNA vaccines. As the global demand for vaccines continues, Moderna could see substantial growth.

- BP: The oil and gas company has been investing heavily in renewable energy, and its commitment to a low-carbon future could position it as a leader in the energy sector.

In conclusion, the US stock market in 2025 is expected to be shaped by economic growth, technological innovation, and changing industry dynamics. While there are risks to consider, investors who stay informed and diversify their portfolios may find opportunities for significant growth.

us stock market today

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....