Are you looking to expand your investment portfolio by investing in India stocks from the United States? With the rise of the Indian economy and the increasing popularity of Indian stocks among global investors, this is an excellent opportunity to diversify your investments. This comprehensive guide will walk you through the process of investing in India stocks from the United States, including the benefits, risks, and the steps you need to follow.

Understanding the Indian Stock Market

The Indian stock market is one of the fastest-growing markets in the world, with a strong focus on technology, healthcare, and consumer goods. Major indices like the BSE Sensex and the NSE Nifty have shown impressive growth over the years, making it an attractive destination for investors.

Benefits of Investing in India Stocks from the US

- Diversification: Investing in India stocks allows you to diversify your portfolio beyond US markets, reducing your exposure to market-specific risks.

- Growth Potential: The Indian economy is expected to grow at a significant pace in the coming years, offering substantial growth potential for your investments.

- Currency Conversion: If the Indian rupee strengthens against the US dollar, your investments could appreciate even more when converted back to USD.

Risks of Investing in India Stocks

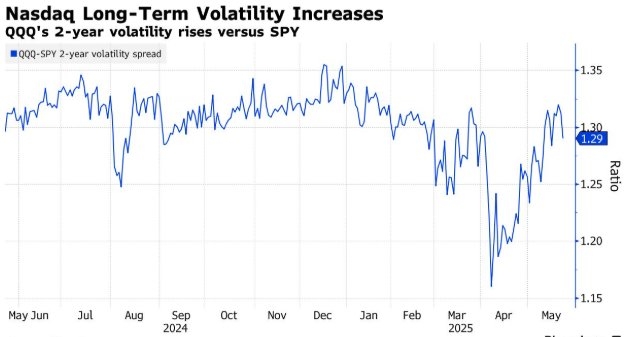

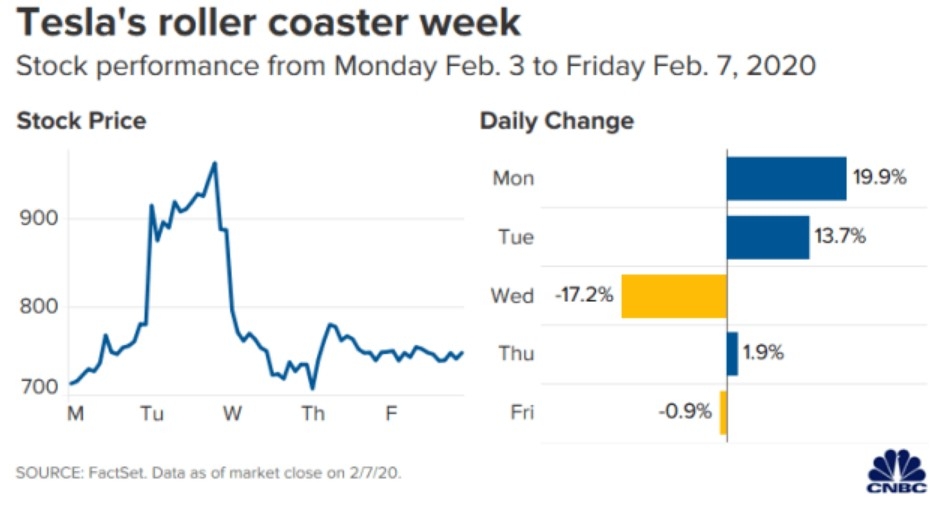

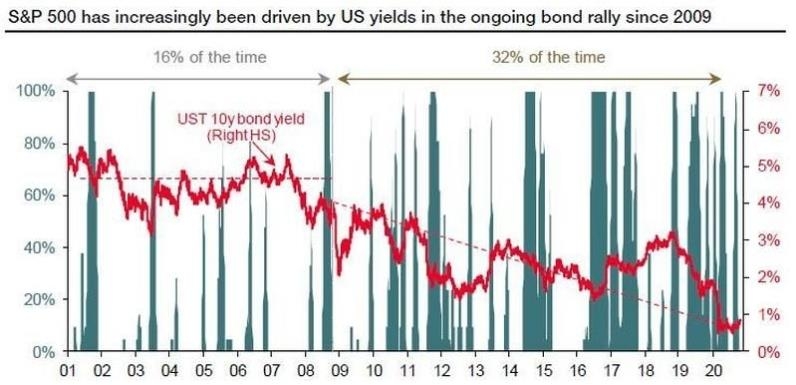

- Market Volatility: The Indian stock market can be highly volatile, especially during economic downturns.

- Regulatory Risks: Changes in regulations can impact the performance of Indian stocks.

- Political Risk: Political instability can affect the Indian economy and, subsequently, the stock market.

Steps to Invest in India Stocks from the US

- Open a Brokerage Account: Choose a reputable brokerage firm that offers access to Indian stocks. Fidelity, E*TRADE, and TD Ameritrade are popular choices among US investors.

- Understand the Stock Market: Familiarize yourself with the Indian stock market and its major indices.

- Research Stocks: Conduct thorough research on Indian companies that interest you, considering factors like their financial health, growth potential, and market position.

- Place Your Order: Once you've selected a stock, place your order through your brokerage account. You can choose from various order types, such as market, limit, and stop-loss orders.

- Monitor Your Investments: Regularly review your investments to stay informed about market trends and company performance.

Case Study: Reliance Industries Ltd

Reliance Industries Ltd, India's largest private sector company, is a prime example of a successful Indian stock. Over the past decade, Reliance has seen substantial growth, with its market capitalization soaring to over $200 billion. Investing in Reliance Industries from the US can be a wise decision, provided you conduct thorough research and understand the risks involved.

Conclusion

Investing in India stocks from the US can be an exciting opportunity for investors looking to diversify their portfolios and capitalize on the growth potential of the Indian economy. However, it's crucial to understand the risks and conduct thorough research before investing. By following the steps outlined in this guide, you can make informed decisions and potentially achieve impressive returns.

us stock market today live cha

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....