The healthcare industry is a cornerstone of the American economy, and one of the key players in this sector is Aetna US Healthcare. In this article, we delve into the latest trends and insights regarding the Aetna US Healthcare stock price. Whether you are an investor, a healthcare professional, or simply curious about the financial landscape of the healthcare industry, this overview will provide you with the necessary information.

Understanding Aetna US Healthcare

Aetna is a Fortune 100 company that offers a comprehensive range of health benefits and insurance products to individuals, employers, and healthcare providers. The company operates in multiple segments, including commercial health care, Medicare, Medicaid, and other government health programs. Aetna's robust offerings have helped it become a dominant force in the healthcare industry.

Current Stock Price Dynamics

The Aetna US Healthcare stock price has seen its fair share of ups and downs over the years. As of the latest trading session, the stock is currently trading at

Factors Influencing the Stock Price

Several factors influence the Aetna US Healthcare stock price. Here are some of the key factors to consider:

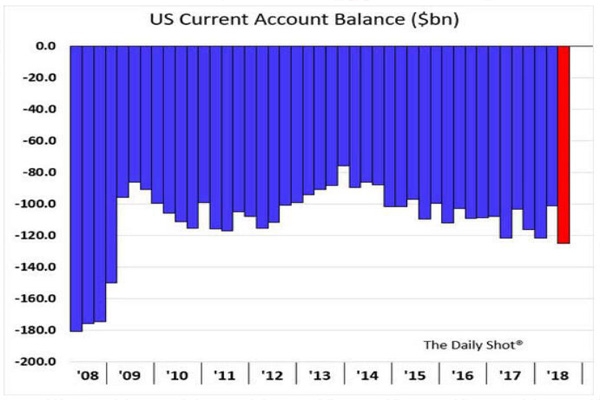

- Economic Conditions: Economic downturns can negatively impact the stock price of healthcare companies like Aetna. During these periods, employers may reduce their health insurance budgets, leading to a decrease in demand for Aetna's products.

- Regulatory Environment: Changes in healthcare regulations can have a significant impact on the stock price. For example, the Affordable Care Act (ACA) has both positively and negatively impacted Aetna's business.

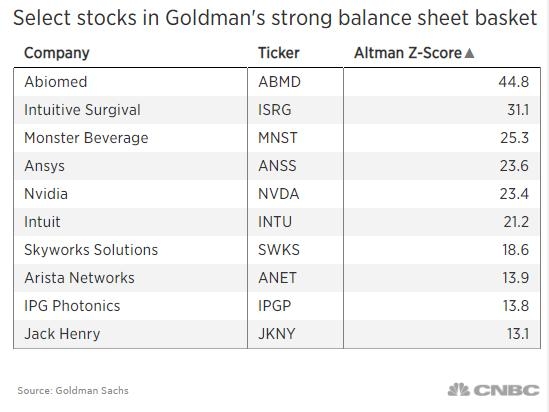

- Company Performance: Aetna's financial performance, including revenue growth, earnings per share (EPS), and dividend yield, plays a crucial role in determining its stock price. Strong performance can lead to an increase in the stock price, while weak performance can have the opposite effect.

- Industry Trends: Trends in the healthcare industry, such as increased demand for telemedicine and personalized medicine, can influence Aetna's stock price.

Case Studies

Let's consider a couple of case studies to illustrate how these factors have impacted Aetna's stock price:

- Impact of ACA: The implementation of the Affordable Care Act in 2010 had a significant impact on Aetna's business. Initially, the company experienced an increase in enrollments due to the expansion of Medicaid and the introduction of insurance exchanges. However, as the ACA's impact waned, Aetna faced challenges in maintaining its enrollments, leading to a decrease in the stock price.

- COVID-19 Pandemic: The COVID-19 pandemic has had a mixed impact on Aetna's stock price. While the company faced increased costs due to increased hospitalizations and administrative expenses, it also benefited from a surge in telemedicine usage. The overall impact on the stock price has been volatile, reflecting the uncertainty of the pandemic's duration and its effects on the healthcare industry.

Conclusion

In conclusion, the Aetna US Healthcare stock price is influenced by a variety of factors, including economic conditions, regulatory changes, company performance, and industry trends. By understanding these factors, investors can make informed decisions about their investments in Aetna. As the healthcare industry continues to evolve, Aetna's ability to adapt to these changes will play a crucial role in determining the future direction of its stock price.

us stock market today

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....