In the annals of financial history, 2018 stands out as a pivotal year for the US stock market. It was marked by a dramatic downturn, making it the worst year for stocks in a decade. This article delves into the factors that contributed to this downturn and examines the implications for investors.

Market Volatility and Economic Concerns

The year 2018 was characterized by heightened market volatility, driven by a variety of factors. One of the primary concerns was the rising interest rates, which were a result of the Federal Reserve's tightening monetary policy. This increase in interest rates made borrowing more expensive, which in turn affected corporate earnings and consumer spending.

Trade Tensions and Geopolitical Risks

Trade tensions between the United States and China also played a significant role in the market downturn. The imposition of tariffs on both sides created uncertainty and disrupted global supply chains. Additionally, geopolitical risks, such as tensions in the Middle East and North Korea, added to the market's volatility.

Sector Performance

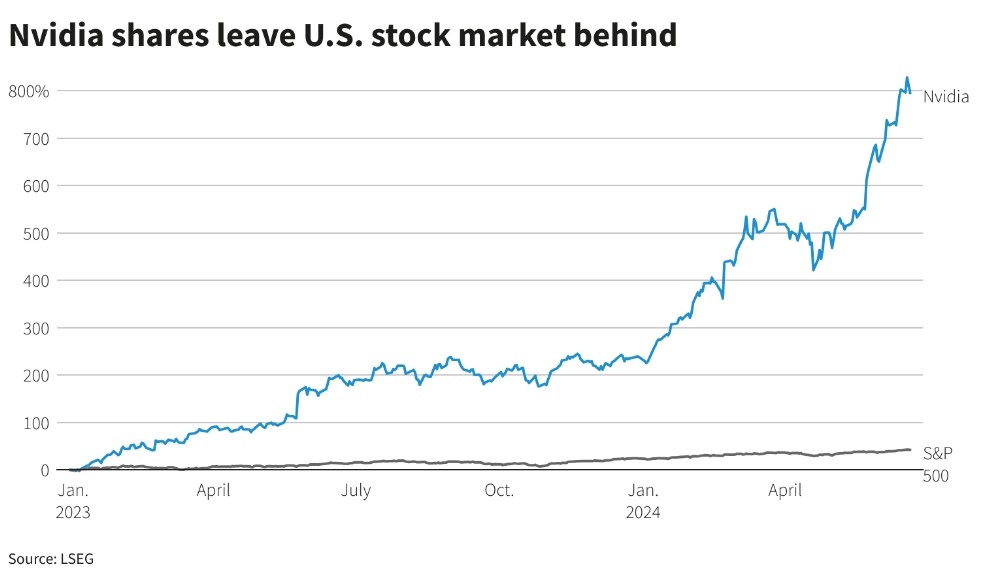

The downturn in 2018 was not uniform across all sectors. Tech stocks, which had been the main drivers of the market's growth in previous years, experienced significant declines. The NASDAQ, which is heavily weighted with tech stocks, saw its worst performance since 2008. On the other hand, sectors like utilities and consumer staples, which are considered defensive, performed relatively better.

Impact on Investors

The market downturn had a significant impact on investors. Many investors who had been riding the market's upward trend since the financial crisis of 2008 faced substantial losses. This led to increased scrutiny of investment strategies and a renewed focus on risk management.

Case Studies

One notable case study of the 2018 downturn is the collapse of WeWork, a co-working space company. WeWork was valued at $47 billion before its IPO was canceled. This event highlighted the risks associated with high valuations and the potential for market downturns to lead to significant losses.

Conclusion

The year 2018 was a challenging one for the US stock market. The combination of rising interest rates, trade tensions, and geopolitical risks led to a significant downturn. While the market has since recovered, the events of 2018 serve as a reminder of the importance of diversification and risk management in investment strategies.

us stock market today

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....