Understanding MGX Minerals Stock

The stock market is a dynamic place, where companies like MGX Minerals present unique investment opportunities. MGX Minerals Stock (US) has been capturing the attention of investors and traders alike. In this article, we delve into the company, its business model, and the potential risks and rewards of investing in its stock.

Company Overview

MGX Minerals is a Canadian-based company engaged in the exploration and development of lithium and other valuable minerals. The company operates primarily in North America, focusing on the vast lithium reserves found in the Saline Valley of Southern California.

Market Potential

Lithium is a critical element in the production of electric vehicles (EVs) and batteries, making it a crucial commodity in the energy transition. The global demand for lithium is skyrocketing, driven by the increasing adoption of EVs and the growing need for energy storage solutions. MGX Minerals is strategically positioned to benefit from this upward trend.

Business Model

MGX Minerals' business model revolves around its unique lithium extraction technology, known as the "MGX Process." This process is designed to be highly efficient and cost-effective, allowing the company to extract lithium from brine sources, which are abundant but traditionally difficult to process.

Financial Performance

The financial performance of MGX Minerals has been a mixed bag. While the company has reported significant progress in its exploration activities, its revenue has been limited. However, the potential for future growth is substantial, given the high demand for lithium and the company's promising technological advancements.

Investment Opportunities

Investing in MGX Minerals Stock presents several opportunities:

- Growth Potential: With the increasing demand for lithium, MGX Minerals has the potential for significant growth.

- Innovation: The company's unique lithium extraction technology could position it as a leader in the industry.

- Strategic Partnerships: MGX Minerals has been actively seeking strategic partnerships to enhance its operations and expand its market reach.

Risks

Despite the potential opportunities, investing in MGX Minerals Stock also comes with risks:

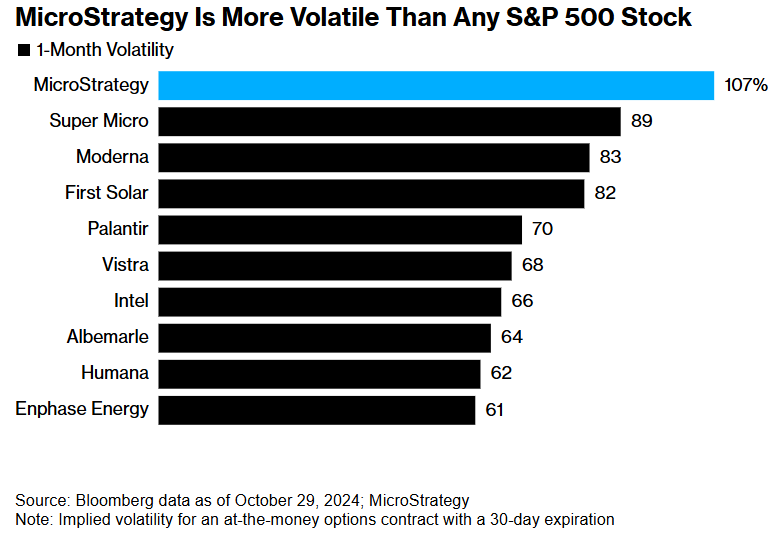

- Market Volatility: The stock market is inherently volatile, and MGX Minerals' stock is no exception.

- Regulatory Risks: The mining industry is subject to various regulations, which could impact the company's operations.

- Competition: The lithium industry is becoming increasingly competitive, with numerous companies vying for market share.

Case Study

One notable case study is the partnership between MGX Minerals and Pure Energy Minerals. This partnership aims to accelerate the development of lithium projects in Nevada and British Columbia. The collaboration is seen as a strategic move to enhance MGX Minerals' presence in the lithium market.

Conclusion

In conclusion, MGX Minerals Stock presents a unique opportunity for investors looking to capitalize on the growing demand for lithium. While there are risks involved, the potential rewards are substantial. As always, it is crucial to conduct thorough research and consider your own investment goals and risk tolerance before making any investment decisions.

us stock market today

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....