As we approach the midpoint of 2025, investors are keenly focused on the current outlook for the US stock market. The July 2025 forecast presents a mix of opportunities and challenges, shaped by economic trends, geopolitical events, and market dynamics. This article delves into the key factors influencing the US stock market in July 2025, offering insights into potential investment opportunities and risks.

Economic Trends

The US economy has shown resilience in recent years, driven by strong consumer spending, robust job growth, and a favorable business environment. However, several factors could impact the stock market in July 2025:

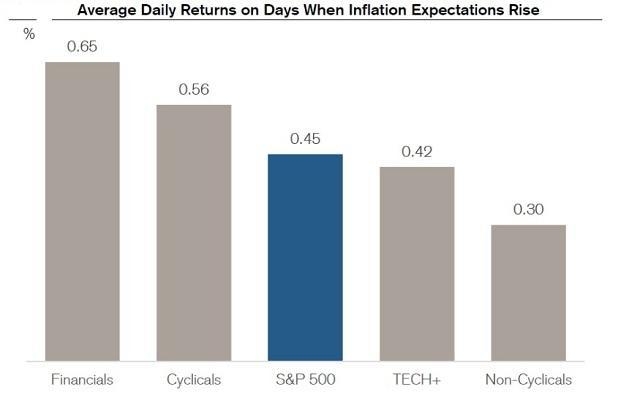

- Inflation: Persistent inflation remains a concern for investors. The Federal Reserve's monetary policy decisions will play a crucial role in managing inflation and its impact on the stock market.

- Interest Rates: The Federal Reserve's interest rate decisions will continue to influence stock market performance. A gradual increase in interest rates could lead to higher borrowing costs and potentially slower economic growth.

- Corporate Earnings: Strong corporate earnings are a key driver of stock market performance. Companies with solid financial performance and growth prospects are likely to outperform in a healthy market environment.

Geopolitical Events

Geopolitical events can have a significant impact on the US stock market. In July 2025, several factors could influence market sentiment:

- Trade Wars: Ongoing trade tensions between the US and other major economies could impact global supply chains and affect corporate earnings.

- Political Stability: Political stability in key economies, such as the US and China, is crucial for investor confidence and market stability.

- International Conflicts: Escalating international conflicts could lead to increased volatility in the stock market.

Market Dynamics

Several market dynamics could shape the US stock market in July 2025:

- Sector Rotation: Investors may shift their focus from growth sectors, such as technology and healthcare, to value sectors, such as financials and real estate.

- Dividend Stocks: Dividend-paying stocks could become more attractive as investors seek income in a low-interest-rate environment.

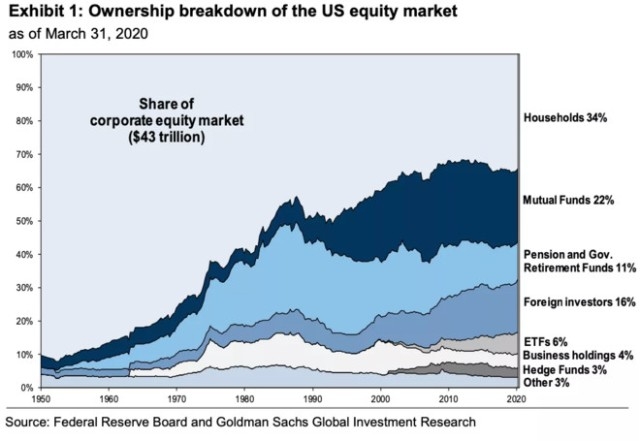

- ETFs and Mutual Funds: Exchange-traded funds (ETFs) and mutual funds continue to gain popularity among investors, offering diversification and access to various market segments.

Investment Opportunities

Several investment opportunities could arise in the US stock market in July 2025:

- Technology Stocks: Companies with strong growth prospects and innovative technologies could offer attractive investment opportunities.

- Healthcare Stocks: The healthcare sector is expected to benefit from an aging population and advancements in medical technology.

- Financial Stocks: Financial stocks could outperform as the economy continues to recover and interest rates rise.

Risks

Several risks could impact the US stock market in July 2025:

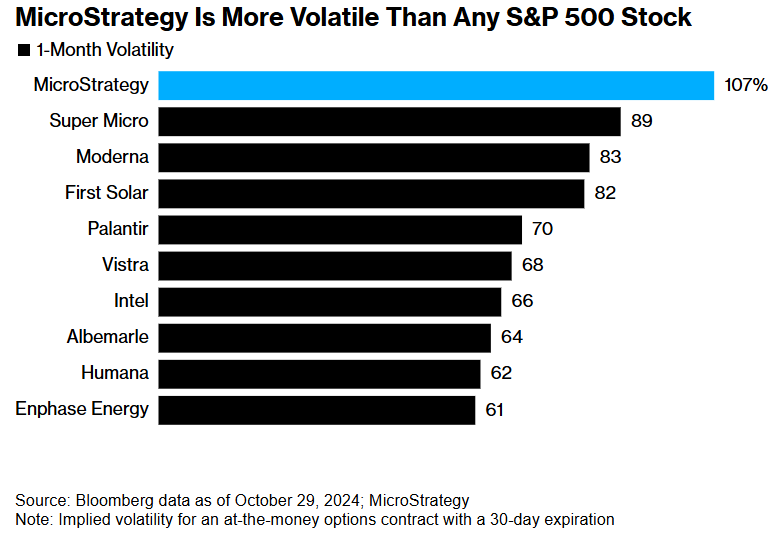

- Market Volatility: Economic uncertainty and geopolitical events could lead to increased market volatility.

- Economic Slowdown: A potential economic slowdown could negatively impact corporate earnings and stock prices.

- Regulatory Changes: Changes in regulatory policies could impact certain sectors and companies.

In conclusion, the July 2025 forecast for the US stock market presents a complex mix of opportunities and challenges. Investors should stay informed about economic trends, geopolitical events, and market dynamics to make informed investment decisions. While several investment opportunities are likely to arise, it is essential to manage risks and diversify portfolios to achieve long-term success.

us stock market today

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....