In an industry often dominated by giants, small U.S. defense stocks have been making waves lately. These hidden gems have seen significant growth, offering investors an opportunity to capitalize on a thriving sector. In this article, we'll delve into why these small defense stocks are soaring and explore the potential investment opportunities they present.

Understanding the Rise of Small Defense Stocks

The defense industry in the United States is a massive sector that plays a crucial role in national security. Traditionally, this industry has been characterized by large, well-established companies. However, in recent years, small defense stocks have started to gain traction, primarily due to several key factors:

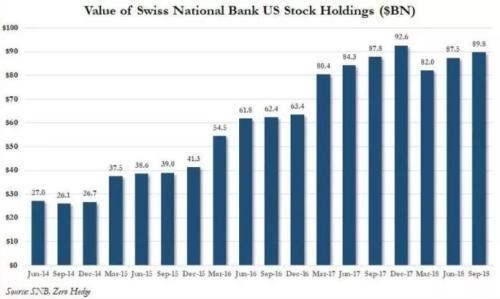

Government Spending: The U.S. government has been increasing its defense budget to strengthen its military capabilities. This has created a demand for various defense-related products and services, benefiting small companies in the industry.

Innovation: Smaller defense stocks often have a more agile structure, allowing them to innovate more rapidly. They can adapt to emerging technologies and market demands, giving them a competitive edge over larger companies.

Focus on Niche Markets: These small companies often specialize in specific niches within the defense sector, such as cybersecurity, unmanned systems, or advanced materials. This specialization can lead to higher profitability and growth potential.

Case Studies: Success Stories in the Small Defense Stock Arena

To understand the potential of small defense stocks, let's take a look at a couple of success stories:

us stock market today

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....