Introduction:

The stock market is often considered a bellwether for the health of the economy. During periods of economic downturn, such as recessions, investors often become nervous, and stock prices can fluctuate dramatically. This article aims to delve into the performance of the stock market during US recessions, highlighting key trends and providing insights for investors.

Stock Market Performance During Recessions

Historically, the stock market has shown mixed results during US recessions. While some recessions have been accompanied by significant declines in stock prices, others have seen relatively stable or even rising markets.

One notable example is the recession of 2001, which was sparked by the dot-com bubble bursting. During this period, the S&P 500 index fell by nearly 50%. However, the market recovered relatively quickly, with the index reaching new highs by 2004.

In contrast, the 2007-2009 recession, often referred to as the Great Recession, saw a more prolonged decline in stock prices. The S&P 500 index dropped by about 57% from its peak in October 2007 to its trough in March 2009. However, much like in 2001, the market made a strong recovery, with the S&P 500 reaching new highs by 2013.

Factors Influencing Stock Market Performance During Recessions

Several factors can influence the stock market's performance during recessions, including:

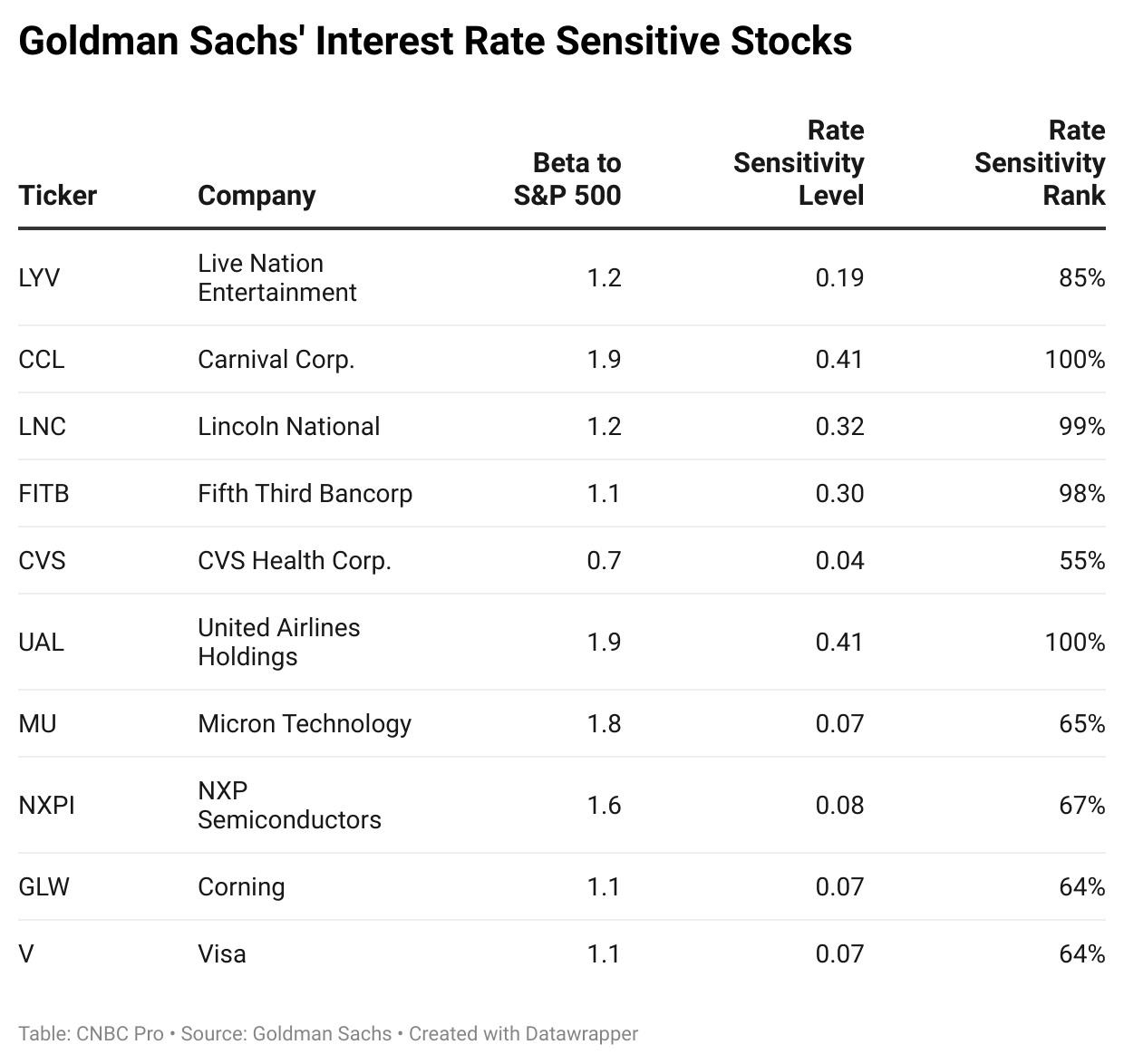

- Monetary Policy: The Federal Reserve often responds to recessions by lowering interest rates, which can stimulate economic growth and boost stock prices.

- Fiscal Policy: Government spending and tax cuts can also help mitigate the effects of a recession and support stock market performance.

- Economic Indicators: Economic indicators such as unemployment rates, GDP growth, and inflation can provide insights into the market's potential performance.

Strategies for Investing During Recessions

Investors looking to navigate the stock market during recessions should consider the following strategies:

- Diversification: Diversifying your portfolio across various asset classes can help reduce risk during economic downturns.

- Quality Stocks: Investing in companies with strong fundamentals and a history of resilience can provide a cushion during recessions.

- Long-Term Perspective: While short-term market volatility can be unsettling, focusing on long-term investment goals can help mitigate the impact of recessions.

Conclusion

The stock market's performance during US recessions has been varied, with some periods seeing significant declines and others witnessing relatively stable or even rising markets. By understanding the factors that influence market performance during recessions and adopting a prudent investment strategy, investors can navigate these challenging periods more effectively.

us stock market live

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....