Are you an investor in India looking to expand your portfolio by trading in US stocks? If so, you're not alone. The allure of the US stock market, with its diverse range of companies and potentially higher returns, is a strong draw for investors worldwide. This guide will provide you with everything you need to know about trading in US stocks from India, including the process, the benefits, and some key considerations.

Understanding the Basics

Before diving into trading, it’s crucial to understand the basics. The US stock market is one of the largest and most liquid in the world, with thousands of companies listed on exchanges like the New York Stock Exchange (NYSE) and the NASDAQ. Trading in US stocks allows Indian investors to gain exposure to some of the world's most successful and innovative companies, including tech giants like Apple, Microsoft, and Google.

How to Trade in US Stocks from India

Open a Brokerage Account: The first step is to open a brokerage account with a reputable online broker that offers trading in US stocks. Many Indian brokers, such as Zerodha and Upstox, offer this service.

Understand the Regulations: It's important to understand the regulations and tax implications of trading in US stocks from India. While there are no specific restrictions on trading, you should be aware of the tax obligations and reporting requirements.

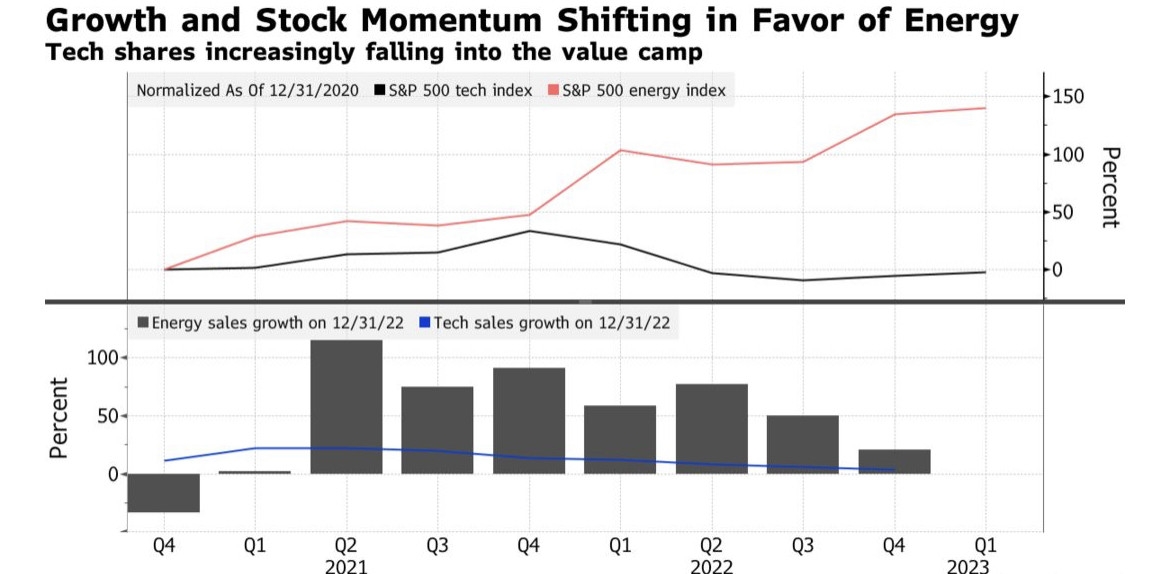

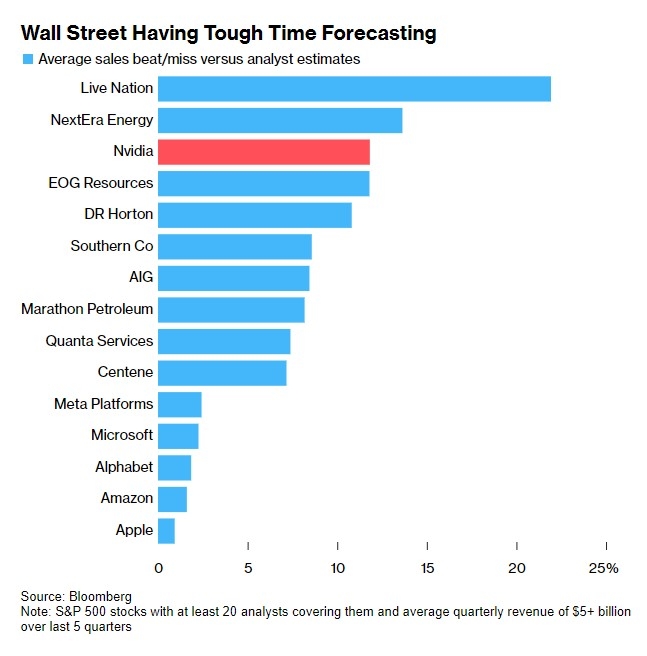

Choose Your Stocks: Research and analyze the companies you're interested in. Consider factors like their financial health, growth potential, and market trends.

Place Your Order: Once you've chosen your stocks, you can place your order through your brokerage account. Most brokers offer a variety of order types, including market orders, limit orders, and stop orders.

Monitor Your Investments: Regularly review your investments and stay informed about market trends and company news that could impact your portfolio.

Benefits of Trading in US Stocks from India

Diversification: By investing in US stocks, you can diversify your portfolio and reduce your exposure to local market risks.

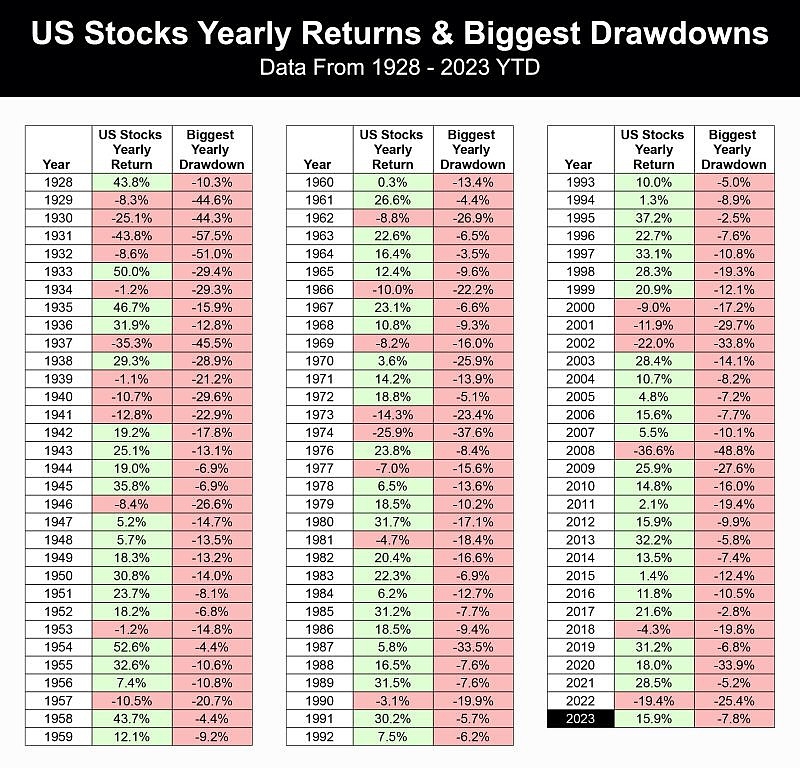

Potential for Higher Returns: The US stock market has historically offered higher returns compared to the Indian market.

Access to World-Class Companies: You can invest in some of the world's most successful and innovative companies.

Key Considerations

Currency Risk: Fluctuations in the USD-INR exchange rate can impact your investment returns. Consider using hedging strategies to mitigate this risk.

Transaction Costs: Be aware of the transaction costs associated with trading in US stocks, including brokerage fees, exchange fees, and other related expenses.

Tax Implications: Ensure you understand the tax obligations and reporting requirements for trading in US stocks from India.

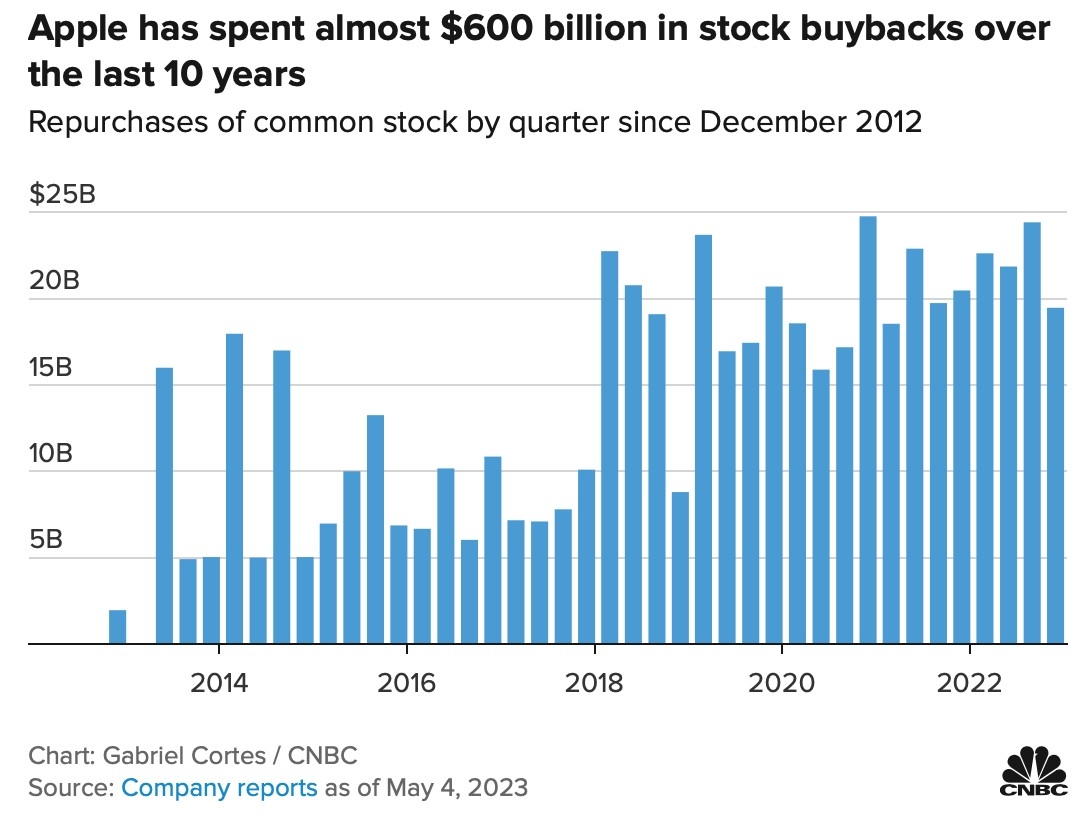

Case Study: Investing in Apple Stock

Let's consider a hypothetical case where an Indian investor decides to invest in Apple stock. After conducting thorough research, the investor believes that Apple's strong financial health and growth potential make it a solid investment. By opening a brokerage account that offers trading in US stocks, the investor places a market order for 100 shares of Apple at $150 per share. A few months later, as Apple's stock price increases, the investor decides to sell their shares, realizing a profit.

Conclusion

Trading in US stocks from India can be a valuable addition to your investment portfolio. By understanding the process, the benefits, and the key considerations, you can make informed decisions and potentially benefit from the opportunities the US stock market offers.

us spv stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....