In today's fast-paced financial world, keeping up with stock prices is crucial for investors. TD Bank US stock, in particular, has been a hot topic among market enthusiasts. If you're looking to understand the current TD Bank US stock price and its potential impact on your investment portfolio, this article is for you. We'll delve into the factors influencing TD Bank's stock price, recent trends, and what the future might hold.

Understanding TD Bank US Stock Price

TD Bank Group, a leading financial institution, has a strong presence in the United States. Its US stock, known as TD US, is listed on the New York Stock Exchange (NYSE) under the ticker symbol TD. The stock price of TD US is determined by a variety of factors, including the company's financial performance, market conditions, and investor sentiment.

Financial Performance

One of the primary drivers of TD Bank's stock price is its financial performance. The bank's quarterly and annual reports provide valuable insights into its profitability, revenue growth, and expenses. By analyzing these reports, investors can gauge the bank's financial health and make informed decisions.

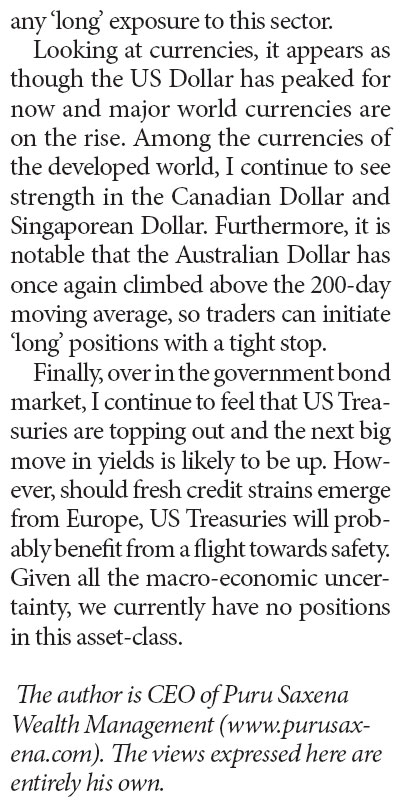

Market Conditions

Market conditions play a significant role in the stock price of TD Bank US. Economic indicators, such as interest rates, inflation, and GDP growth, can impact the banking sector. For instance, higher interest rates can boost the bank's net interest income, while a slowing economy might lead to lower loan demand and increased credit risk.

Investor Sentiment

Investor sentiment is another critical factor influencing TD Bank's stock price. News, rumors, and speculation can cause the stock to fluctuate significantly. For example, if investors believe that the bank is well-positioned to benefit from a growing economy, the stock price may rise.

Recent Trends in TD Bank US Stock Price

Over the past few years, TD Bank US has experienced a steady rise in its stock price. This trend can be attributed to several factors:

- Strong Financial Performance: The bank has reported consistent growth in revenue and earnings, which has boosted investor confidence.

- Efficient Cost Management: TD Bank has implemented effective cost management strategies, leading to improved profitability.

- Positive Market Sentiment: The overall market sentiment has been favorable for financial institutions, including TD Bank.

Case Study: TD Bank's Stock Price Movement in 2022

In 2022, TD Bank's stock price experienced a volatile year. The beginning of the year saw the stock price rise due to strong financial results and positive market sentiment. However, as the year progressed, concerns over rising inflation and the potential for a recession led to a decline in the stock price.

Despite the downward trend, TD Bank's strong financial foundation helped it weather the storm. The bank's management took proactive measures to address the challenges, leading to a gradual recovery in the stock price towards the end of the year.

Conclusion

Understanding the TD Bank US stock price requires analyzing various factors, including financial performance, market conditions, and investor sentiment. By staying informed and making informed decisions, investors can navigate the complexities of the stock market and potentially benefit from TD Bank's growth.

Keep in mind that stock prices are subject to change, and it's essential to conduct thorough research before making any investment decisions.

us spv stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....