In recent months, there has been a lot of buzz about the potential for a U.S. stock market crash. With the global economy facing unprecedented challenges, investors are increasingly concerned about the stability of their portfolios. This article aims to provide a comprehensive analysis of the current state of the U.S. stock market and assess the likelihood of a crash.

Understanding the Stock Market

The U.S. stock market, often referred to as the S&P 500, is a benchmark index that tracks the performance of 500 large companies. It is considered a proxy for the overall health of the U.S. economy. The stock market is influenced by various factors, including economic indicators, corporate earnings, geopolitical events, and investor sentiment.

Economic Indicators

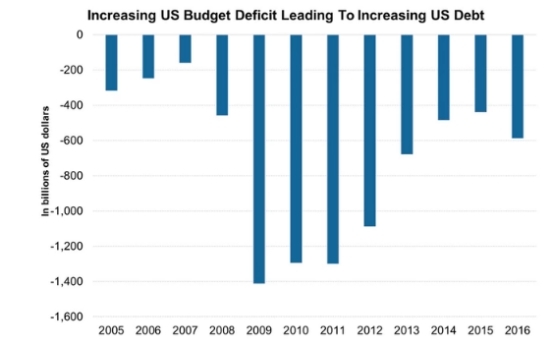

One of the primary concerns for investors is the current state of the economy. The U.S. economy has been experiencing slow growth, with inflation and unemployment rates remaining high. While the Federal Reserve has been implementing measures to stimulate the economy, such as lowering interest rates, the long-term effects of these policies are still uncertain.

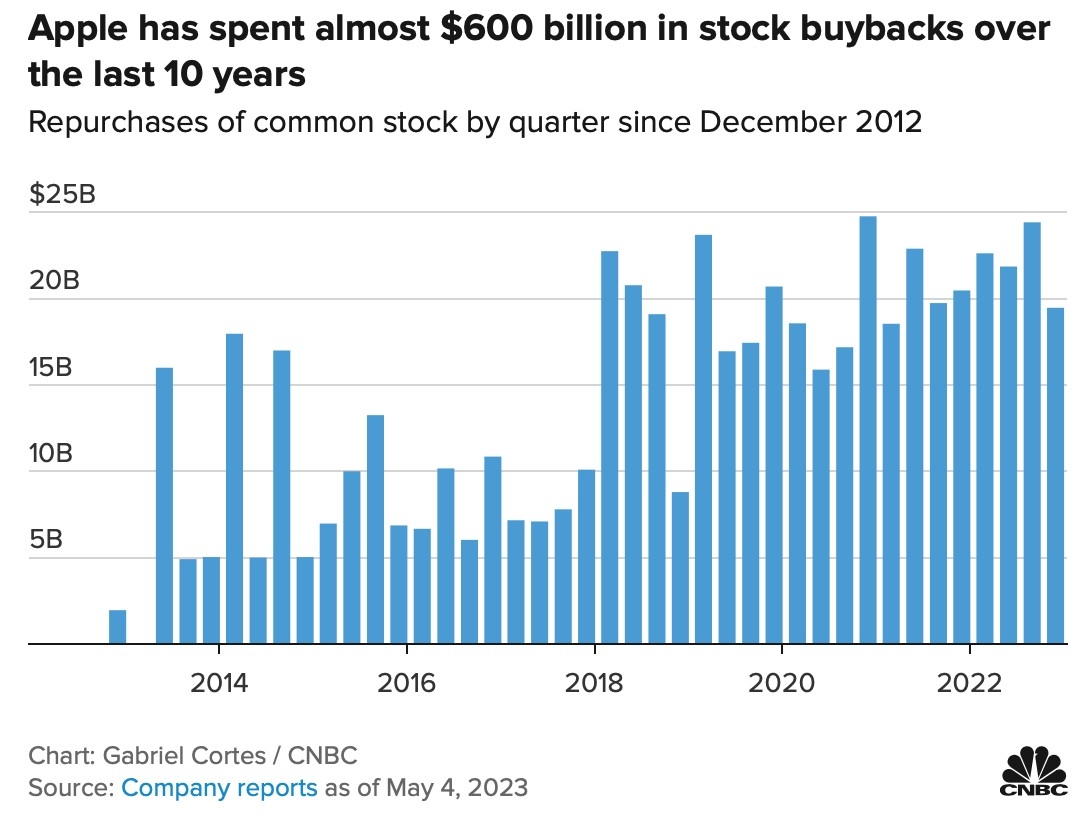

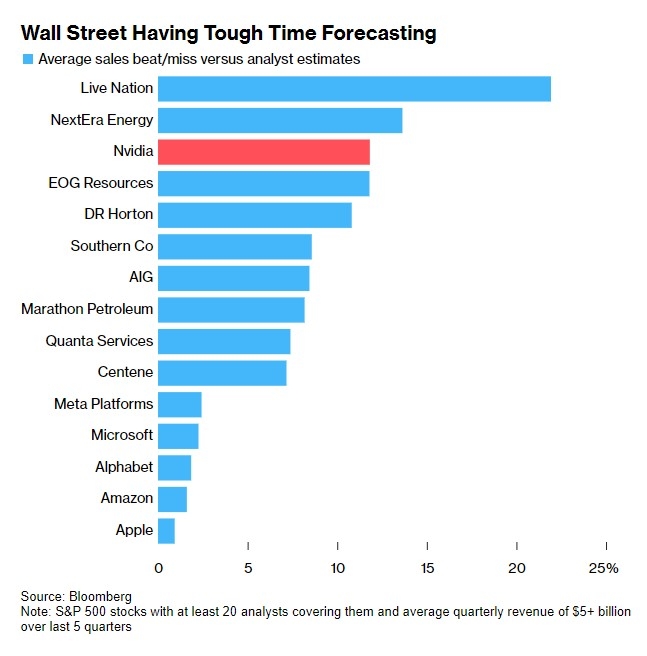

Corporate Earnings

Corporate earnings are another crucial factor that can impact the stock market. In recent quarters, many companies have reported lower-than-expected earnings, which has raised concerns about the overall health of the market. However, some sectors, such as technology and healthcare, have continued to perform well.

Geopolitical Events

Geopolitical events, such as trade tensions and political instability, can also have a significant impact on the stock market. The ongoing trade war between the U.S. and China has created uncertainty in the market, leading to volatility in stock prices.

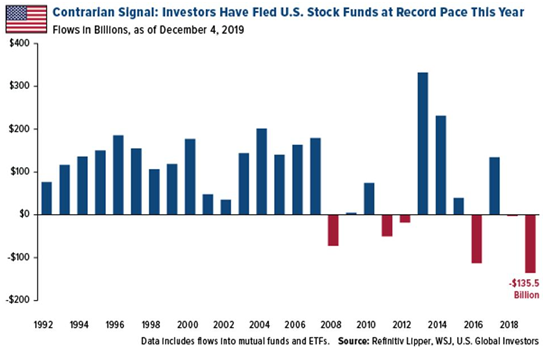

Investor Sentiment

Investor sentiment plays a crucial role in the stock market. When investors are optimistic, they tend to buy stocks, driving up prices. Conversely, when investors are pessimistic, they tend to sell stocks, leading to a decline in prices. The current sentiment in the market is mixed, with some investors remaining optimistic while others are cautious.

The Likelihood of a Crash

While it is impossible to predict the future with certainty, the likelihood of a U.S. stock market crash is relatively low. The market has shown resilience in the face of various challenges over the years. However, there are certain scenarios that could lead to a crash, such as a severe economic downturn, a major geopolitical event, or a sudden loss of confidence in the market.

Case Studies

To illustrate the potential impact of various factors on the stock market, let's consider a few case studies:

2008 Financial Crisis: The 2008 financial crisis was a result of a combination of factors, including the bursting of the housing bubble, excessive risk-taking by financial institutions, and a lack of regulation. The crisis led to a significant drop in stock prices, but the market eventually recovered.

2020 COVID-19 Pandemic: The COVID-19 pandemic caused a sharp decline in stock prices as investors feared a global economic downturn. However, the market quickly recovered as governments and central banks implemented stimulus measures and as companies adapted to the new normal.

Conclusion

While the possibility of a U.S. stock market crash cannot be entirely ruled out, the likelihood is relatively low. The market has shown resilience in the face of various challenges over the years. As investors, it is crucial to stay informed and maintain a diversified portfolio to mitigate risks.

us spv stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....