In the fast-paced world of finance, the DJIA after hours market has emerged as a crucial component for investors seeking to capitalize on market movements outside of regular trading hours. The Dow Jones Industrial Average (DJIA), often referred to as "the Dow," is a widely followed stock market index that tracks the performance of 30 large, publicly-owned companies in the United States. This article delves into the world of DJIA after hours trading, exploring its significance, potential benefits, and risks.

Understanding DJIA After Hours Trading

The traditional trading hours for the DJIA are from 9:30 a.m. to 4:00 p.m. Eastern Time (ET). However, with the advent of electronic trading platforms, the market has expanded beyond these hours. DJIA after hours trading allows investors to buy and sell stocks in the hours following the regular trading day. This extended trading window can provide several advantages, including:

- Enhanced Liquidity: DJIA after hours trading can increase liquidity, making it easier for investors to enter or exit positions.

- Immediate Execution: In some cases, investors may find better prices and faster execution in the after-hours market.

- Risk Management: DJIA after hours trading can be used for risk management strategies, such as hedging or locking in profits.

Benefits of DJIA After Hours Trading

One of the key benefits of DJIA after hours trading is the opportunity to react quickly to significant news or events that occur after the regular trading day. For example, if a major company in the DJIA reports earnings after the market closes, investors can react immediately in the after-hours session. This can be particularly valuable for active traders looking to capitalize on short-term market movements.

Another advantage is the ability to adjust portfolios without the risk of overnight market volatility. By trading after hours, investors can avoid potential losses that may arise from unexpected market events during the overnight period.

Risks of DJIA After Hours Trading

While there are benefits to DJIA after hours trading, it's important to be aware of the risks as well. Here are some key considerations:

- Volatility: The after-hours market can be more volatile than the regular trading day, as there may be fewer traders participating.

- Limited Information: The information available during the after-hours session may be limited compared to the regular trading day, which can lead to unpredictable market movements.

- Execution Risks: There may be execution risks, such as slippage or delays, in the after-hours market due to lower liquidity.

Case Study: Apple's DJIA After Hours Movement

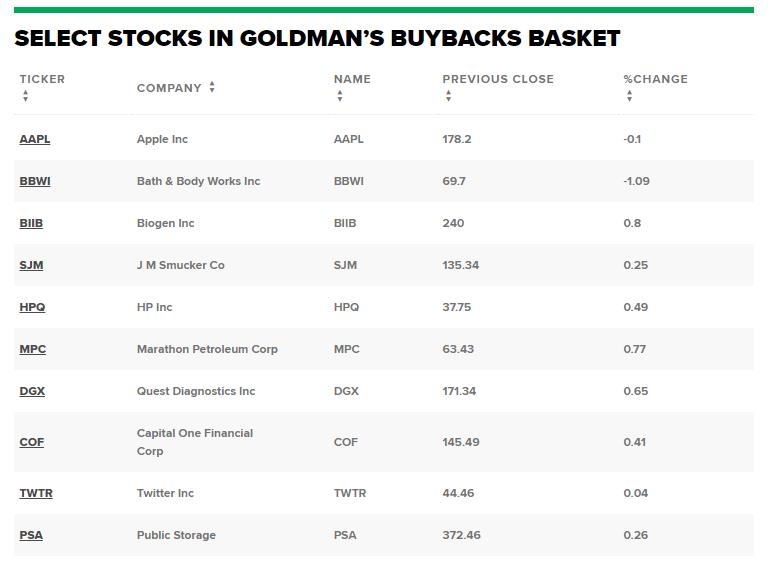

A prime example of the impact of DJIA after hours trading can be seen with Apple Inc. (AAPL), a member of the DJIA. In February 2021, Apple reported earnings after the market closed. The company's results were better than expected, leading to a significant increase in its stock price during the after-hours session. This movement had a notable impact on the DJIA, which includes Apple as one of its 30 components.

Conclusion

DJIA after hours trading offers investors a unique opportunity to capitalize on market movements outside of regular trading hours. While there are risks involved, the potential benefits can be substantial, especially for active traders and those looking to manage risk effectively. Understanding the intricacies of the DJIA after hours market is crucial for investors seeking to stay ahead of the curve in the dynamic world of finance.

us spv stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....