Are you considering buying US steel stock? If so, you're not alone. The steel industry has seen a surge in interest due to its economic resilience and potential for growth. This article will delve into the key factors to consider when purchasing US steel stock, providing you with a strategic investment guide to make informed decisions.

Understanding the US Steel Industry

The US steel industry has a long and storied history, with roots dating back to the early 19th century. Today, it's a crucial component of the global economy, with applications ranging from construction to manufacturing. Here's what you need to know about the industry:

- Economic Resilience: The steel industry has proven to be relatively resilient during economic downturns, often weathering storms better than other sectors.

- Growth Potential: As the global economy continues to grow, so does the demand for steel. This presents a promising opportunity for investors looking to capitalize on the industry's expansion.

- Government Influence: Government policies and trade agreements can significantly impact the steel industry. It's crucial to stay informed about any potential changes that could affect the market.

Key Factors to Consider When Buying US Steel Stock

Before diving into the stock market, it's essential to understand the key factors that can influence the performance of US steel stocks. Here are some key considerations:

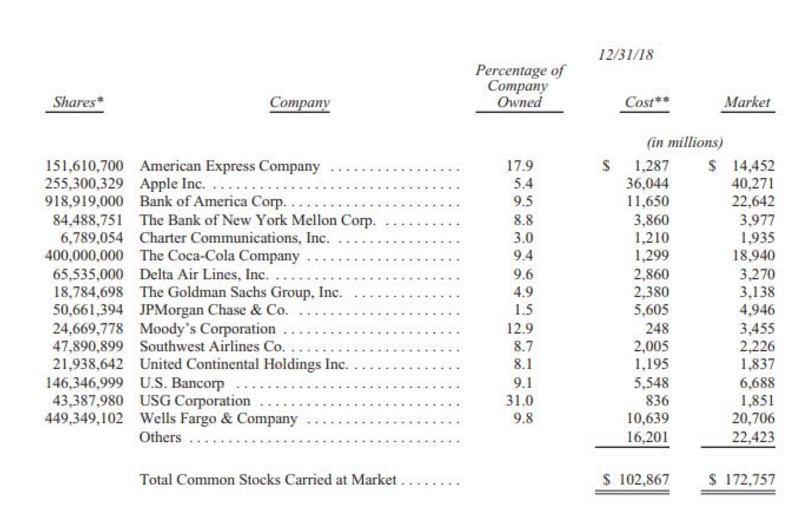

- Company Financials: Evaluate the financial health of the steel companies you're considering. Look at metrics such as revenue, profit margins, and debt levels.

- Market Trends: Stay informed about the latest market trends, including the demand for steel and the availability of raw materials.

- Competitive Landscape: Understand the competitive landscape within the steel industry, including major players and their market share.

- Management Team: Research the management team of the steel company, as their experience and leadership can significantly impact the company's performance.

Top US Steel Stocks to Consider

Here are some of the top US steel stocks to consider for your investment portfolio:

- U.S. Steel Corporation (X): As one of the largest steel producers in the United States, U.S. Steel Corporation has a strong presence in the global market.

- Nucor Corporation (NUE): Nucor is known for its innovative business model and has a reputation for being a leader in the steel industry.

- AK Steel Holding Corporation (AKS): AK Steel is a leading producer of flat-rolled steel products, serving various industries, including automotive, construction, and manufacturing.

Case Study: Nucor Corporation

To illustrate the potential of investing in US steel stocks, let's take a look at Nucor Corporation. Over the past decade, Nucor has experienced significant growth, with its stock price increasing by nearly 400%. This success can be attributed to several factors:

- Innovation: Nucor has been at the forefront of technological advancements within the steel industry, which has helped the company maintain a competitive edge.

- Diversification: Nucor has diversified its product offerings, which has allowed the company to capitalize on various market segments.

- Strong Management: The company's management team has demonstrated a commitment to driving growth and profitability.

By understanding the key factors to consider when buying US steel stock and conducting thorough research, you can make informed investment decisions and potentially capitalize on the industry's growth. Remember to stay informed about market trends and government policies, as these factors can significantly impact the performance of steel stocks.

us spv stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....