The Dow Jones Industrial Average (DJIA), commonly known as the Dow, is one of the most iconic stock market indices in the United States. Tracing its history allows us to understand the evolution of the market and the economy at large. In this article, we delve into the fascinating journey of the Dow, highlighting key milestones and analyzing its impact on the financial landscape.

The Inception of the Dow

The Dow was first introduced by Charles Dow, a renowned journalist and co-founder of The Wall Street Journal, in 1896. The initial index included just 12 stocks, representing various industries such as mining, manufacturing, and transportation. This groundbreaking move provided investors with a comprehensive gauge of the overall market performance.

Historical Milestones

The Dow has seen numerous ups and downs over the years. One of the most significant milestones occurred during the 1920s, often referred to as the "Roaring Twenties." This period marked the Dow's first major bull market, reaching an all-time high of 381 points in September 1929. However, the Dow's trajectory took a turn for the worse following the Great Depression, plummeting to just 41 points in 1932.

The Bull Market of the 1950s and 1960s

The post-World War II era witnessed a remarkable bull market, with the Dow surging to over 1,000 points by 1972. This growth was fueled by technological advancements, expansion of the middle class, and increased corporate earnings. Notably, the Dow reached 1,000 points for the first time on February 8, 1972, reflecting the market's resilience and expansion.

The 1980s: The Rise of Technology Stocks

The 1980s were marked by a significant shift in the composition of the Dow, with the addition of technology stocks such as IBM and Microsoft. This era witnessed the birth of the tech boom, leading to the Dow's rapid expansion. In 1987, the Dow experienced one of its most dramatic crashes, known as "Black Monday," when it plummeted over 20% in a single day. However, the market quickly recovered, and the Dow continued to soar.

The Dot-Com Bubble and Beyond

The 1990s saw the rise of the dot-com bubble, which ended with a dramatic burst in 2000. Despite the market's tumultuous period during the early 2000s, the Dow recovered and reached new highs in subsequent years. The financial crisis of 2008 sent shockwaves through the global economy, but the Dow managed to stage a remarkable recovery.

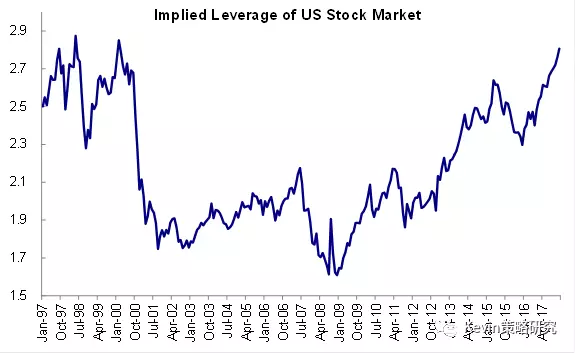

Recent Trends

In recent years, the Dow has been influenced by various factors, including geopolitical tensions, trade wars, and technological advancements. The index has experienced periods of volatility but has consistently shown resilience. As of this writing, the Dow stands at over 26,000 points, reflecting the market's overall strength and stability.

Case Studies

To illustrate the Dow's impact on the financial landscape, consider the following case study: During the 2008 financial crisis, the Dow dropped to around 6,547 points, marking a 54% decline from its pre-crisis level. However, the market quickly rebounded, reaching a new high of 14,164 points in May 2013, showcasing the Dow's ability to recover from major downturns.

Conclusion

The history of the Dow is a testament to the resilience and adaptability of the United States stock market. By examining the milestones and trends, we can gain valuable insights into the evolution of the market and its impact on the economy. As investors and market enthusiasts, understanding the Dow's past helps us navigate the future with greater confidence.

us stock market today

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....