In today's interconnected global market, the possibility of investing in US stocks from India is not just feasible, but also increasingly popular. This article delves into the various methods and platforms that allow Indian investors to participate in the bustling US stock market, offering insights and practical steps to get started.

Understanding the US Stock Market

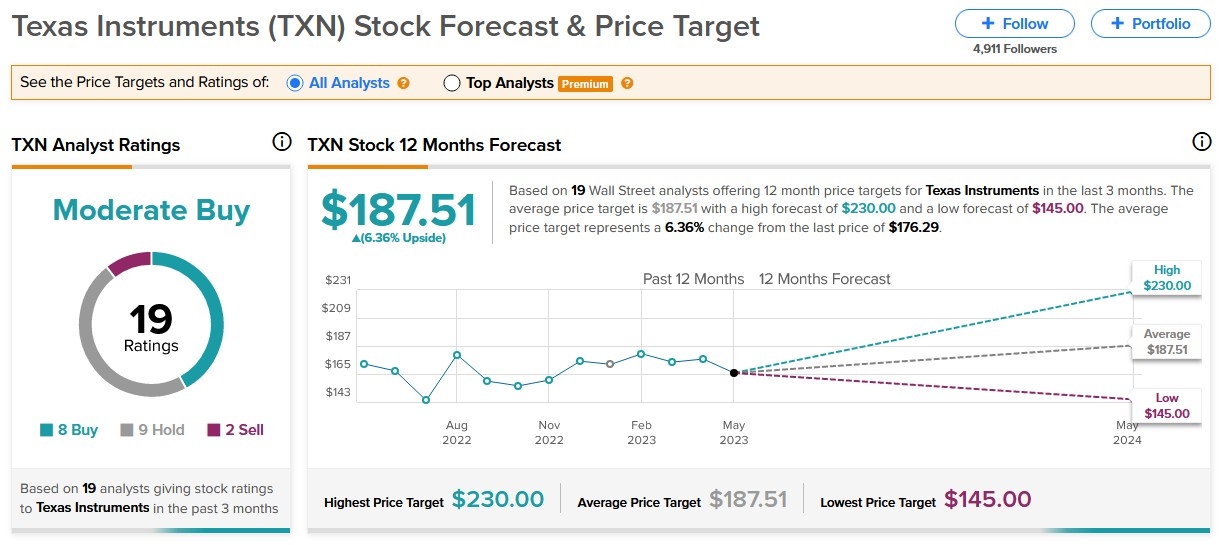

The US stock market, home to some of the world's most influential companies, presents a myriad of opportunities for investors. From tech giants like Apple and Google to pharmaceutical majors like Pfizer, the US market has something for every investor. But what does it take for an Indian investor to invest in these stocks?

Methods to Invest in US Stocks from India

Through a Brokerage Account: The most common method is to open a brokerage account with a US-based brokerage firm. Firms like TD Ameritrade, E*TRADE, and Charles Schwab offer services to international investors. This requires filling out an application, providing identification, and completing a tax form, such as the W-8BEN.

Using a Currency Exchange: Investing in US stocks from India involves converting Indian Rupees to US Dollars. Several online currency exchange platforms like TransferWise and Xoom facilitate this process, often offering competitive exchange rates and low fees.

Through a Mutual Fund or ETF: Indian investors can also invest in US stocks through mutual funds or ETFs (Exchange-Traded Funds) that invest in US companies. This method is less hands-on but allows exposure to a diversified portfolio of US stocks.

Important Considerations

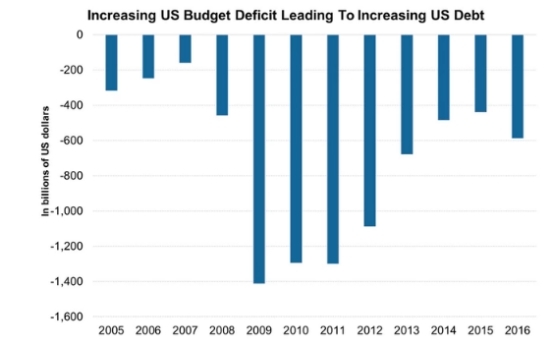

Tax Implications: It's crucial for Indian investors to understand the tax implications of investing in US stocks. While the US does not charge a capital gains tax on foreign investors, India has specific regulations regarding income from foreign investments.

Transaction Costs: Investing in US stocks involves various transaction costs, including brokerage fees, currency exchange fees, and potential wire transfer fees. It's essential to consider these costs while planning your investment strategy.

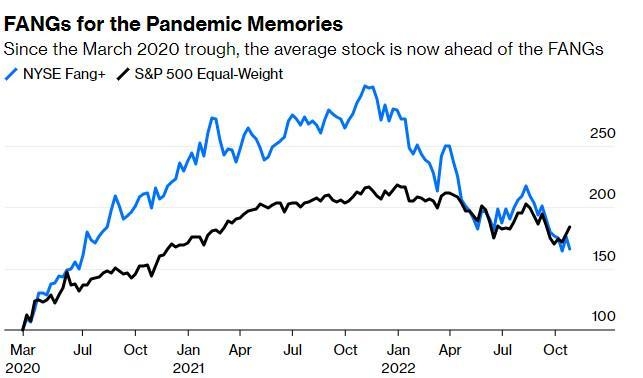

Market Volatility: The US stock market can be highly volatile, especially during economic downturns or geopolitical tensions. It's important to stay informed and be prepared for potential market fluctuations.

Case Study: An Indian Investor's Journey

Consider Ravi, an IT professional from India who wanted to diversify his investment portfolio. He decided to invest in US stocks through a brokerage account with TD Ameritrade. After researching various companies, he chose to invest in Apple, Google, and Microsoft. By carefully managing his investment strategy and staying informed about market trends, Ravi was able to achieve significant growth in his investments over time.

Conclusion

Investing in US stocks from India is not only possible but also offers a range of benefits. With the right approach, Indian investors can access the global opportunities presented by the US stock market. However, it's essential to understand the process, consider the associated costs, and stay informed about market trends.

us spv stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....