The latest downgrade by Moody's has sent shockwaves through the US stock market, sparking a mix of concerns and speculation. This article delves into the details of the downgrade and the subsequent reaction of investors and market professionals.

What Caused the Downgrade?

Moody's downgrade of the US stock market was primarily driven by a range of factors, including rising inflation, slowing economic growth, and increasing political uncertainties. The agency cited these factors as reasons for the downgrade, indicating that the US stock market may not be as resilient as previously thought.

Impact on Investors

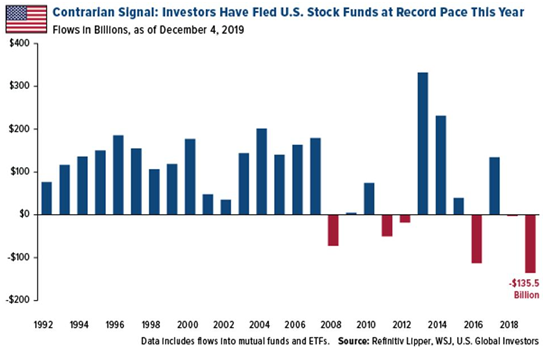

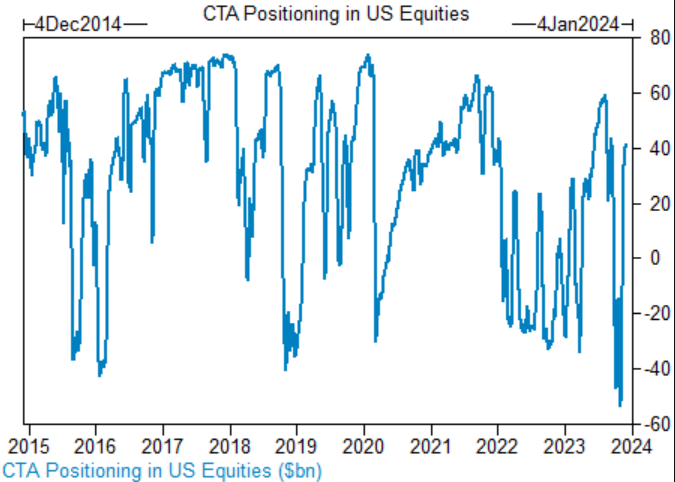

The immediate reaction to the downgrade was a significant sell-off in the stock market. Investors, concerned about the potential economic impact of the downgrade, rushed to sell their stocks, leading to a sharp decline in market indices. Many investors, however, viewed the downgrade as an opportunity to buy low and are now waiting for the market to stabilize.

Market Professionals' Perspectives

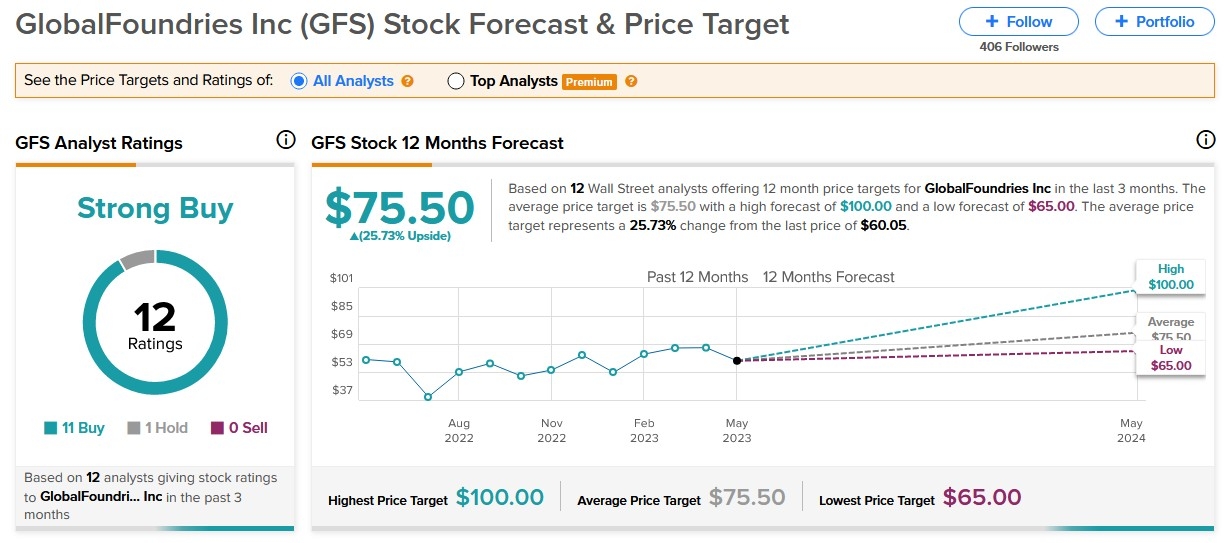

Market professionals, including financial analysts and economists, have offered a variety of perspectives on the downgrade. Some argue that the downgrade is a reflection of the current economic challenges faced by the US, while others believe that the downgrade is an overreaction and that the stock market will recover in the near future.

Historical Precedents

A look back at historical precedents reveals that downgrades by rating agencies often lead to short-term volatility but do not necessarily result in long-term negative impacts on the stock market. For example, the downgrade of the US credit rating by Standard & Poor's in 2011 caused a brief sell-off, but the market quickly recovered.

Case Study: The 2011 S&P's Downgrade

In 2011, Standard & Poor's downgraded the US credit rating from AAA to AA+. The immediate reaction was a sharp sell-off in the stock market, with the S&P 500 falling by more than 6% in a single day. However, the market quickly recovered, and within a year, the S&P 500 had gained more than 15%.

Conclusion

The recent downgrade by Moody's has undoubtedly caused a stir in the US stock market. While the immediate reaction was a sell-off, market professionals and investors are closely monitoring the situation, with many believing that the market will stabilize in the near future. As with any economic challenge, time will tell how the stock market will respond to this latest downgrade.

us spv stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....