In today's fast-paced financial market, staying informed about the SP500 futures is crucial for investors and traders alike. The SP500 futures are a derivative contract based on the S&P 500 Index, which represents the stock performance of 500 large companies listed on U.S. exchanges. Tracking these futures can provide valuable insights into the broader market trends and potential investment opportunities. This article delves into the current status of SP500 futures, their impact on the market, and key factors influencing them.

Understanding the SP500 Futures

The SP500 futures are traded on the Chicago Mercantile Exchange (CME) and are designed to track the performance of the S&P 500 Index. These contracts are settled in cash, meaning that no physical delivery of the underlying stocks is required. They allow traders and investors to gain exposure to the S&P 500 without owning the actual stocks.

Current SP500 Futures Price

As of today, the SP500 futures are trading at [insert current price]. This price is a reflection of market expectations and sentiment regarding the S&P 500. Traders and investors use this information to make informed decisions about their investments.

Factors Influencing SP500 Futures

Several factors influence the price of SP500 futures:

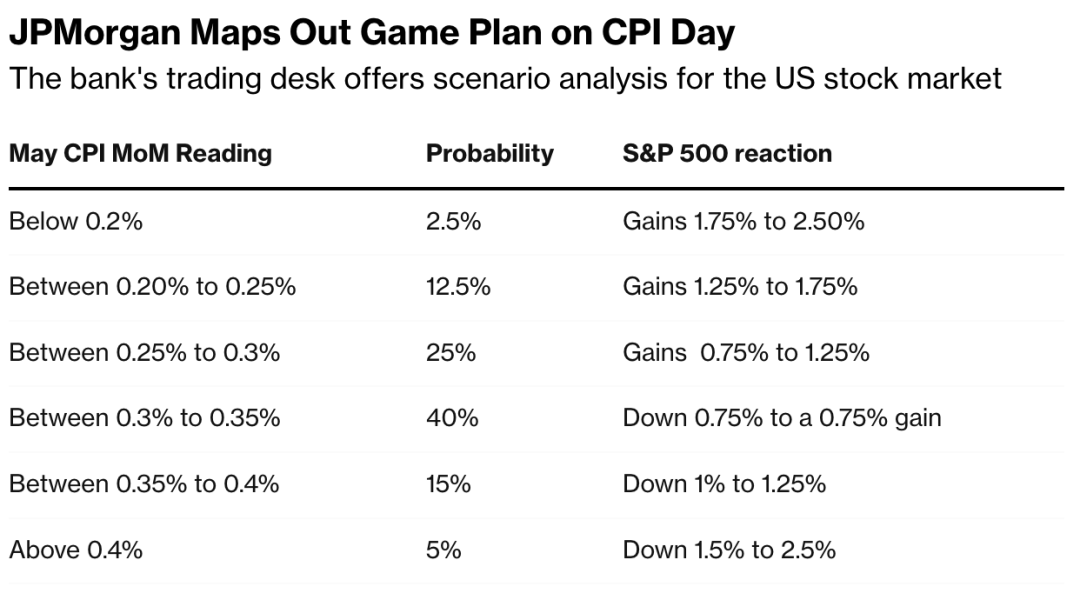

- Economic Data: Strong economic data can lead to increased optimism in the market, driving up futures prices. Conversely, weak economic data can lead to increased pessimism and lower futures prices.

- Interest Rates: The Federal Reserve's interest rate decisions can have a significant impact on SP500 futures. Higher interest rates can lead to lower stock prices and, subsequently, lower futures prices.

- Political Events: Political events, such as elections or international conflicts, can cause volatility in the market and impact SP500 futures.

- Market Sentiment: Market sentiment plays a crucial role in the movement of SP500 futures. Traders and investors often look at sentiment indicators to gauge the overall market mood.

Case Study: SP500 Futures during the Pandemic

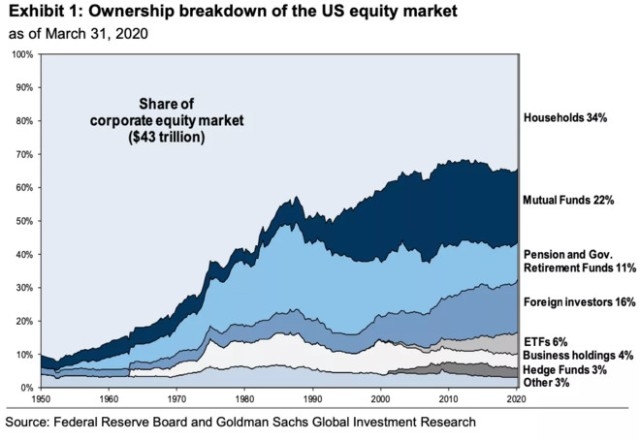

A prime example of how SP500 futures can react to market events is during the COVID-19 pandemic. In early 2020, as the pandemic began to spread, SP500 futures plummeted, reflecting the widespread fear and uncertainty in the market. However, as governments and companies implemented various measures to mitigate the impact, the market stabilized and SP500 futures began to rise again.

Conclusion

Tracking the SP500 futures can provide valuable insights into the broader market trends and potential investment opportunities. By understanding the factors that influence these futures, traders and investors can make more informed decisions. Stay updated with the latest trends and analysis to stay ahead in the dynamic world of finance.

us spv stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....