In the vast landscape of the U.S. stock market, large cap value stocks often stand out as solid investments for long-term growth. These stocks are characterized by their market capitalization, which is typically over $10 billion, and their value-oriented approach to investing. To identify the best large cap value stocks, investors need a robust screening criteria. This article delves into the essential factors to consider when screening for U.S. large cap value stocks.

Market Capitalization

The first criterion for identifying large cap value stocks is their market capitalization. These stocks are typically classified as large caps, meaning they have a market capitalization of over $10 billion. This ensures that the companies are well-established and have a strong presence in their respective industries.

Price-to-Earnings (P/E) Ratio

The price-to-earnings (P/E) ratio is a crucial metric for evaluating value stocks. It compares the stock price to the company's earnings per share (EPS). A low P/E ratio indicates that the stock is undervalued relative to its earnings. For large cap value stocks, a P/E ratio below 15 is often considered a good entry point.

Price-to-Book (P/B) Ratio

The price-to-book (P/B) ratio compares the stock price to the company's book value per share. This metric is particularly useful for value investors as it measures the stock's value relative to the company's assets. A P/B ratio below 1 suggests that the stock is undervalued.

Dividend Yield

Dividends are a key component of value investing, and large cap value stocks often offer attractive dividend yields. A dividend yield of 2% or higher is generally considered favorable for large cap value stocks.

Financial Health

It's essential to assess the financial health of a company before investing in its stock. Key financial metrics to consider include debt-to-equity ratio, current ratio, and return on equity (ROE). A low debt-to-equity ratio, a current ratio above 1, and a high ROE indicate a financially stable company.

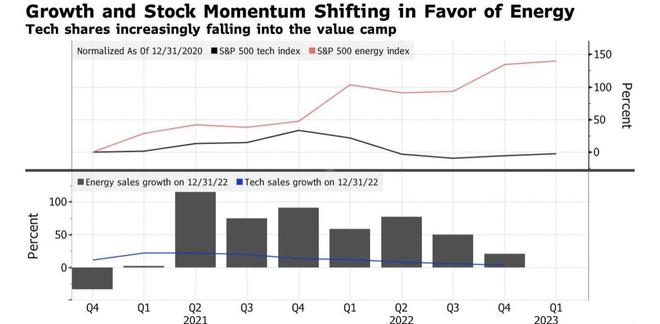

Sector and Industry Performance

Investors should also consider the performance of the company's sector and industry. Large cap value stocks often come from sectors with strong fundamentals and a history of growth. For example, consumer staples, healthcare, and utilities are sectors that tend to perform well over the long term.

Historical Performance

Analyzing the historical performance of a large cap value stock can provide valuable insights into its potential for future growth. Look for companies with a consistent track record of increasing earnings and revenue.

Case Study: Procter & Gamble (PG)

Procter & Gamble (PG) is a classic example of a large cap value stock. With a market capitalization of over $250 billion, PG is one of the largest companies in the world. The company has a low P/E ratio, a P/B ratio below 1, and a dividend yield of over 2%. PG also has a strong financial health, with a low debt-to-equity ratio and a high ROE. Over the past decade, PG has consistently increased its earnings and revenue, making it a solid investment for value investors.

In conclusion, identifying U.S. large cap value stocks requires a comprehensive approach that considers various factors, including market capitalization, P/E ratio, P/B ratio, dividend yield, financial health, sector and industry performance, and historical performance. By using these screening criteria, investors can make informed decisions and identify the best large cap value stocks for their portfolios.

us stock market today

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....