If you're looking to grow your Tax-Free Savings Account (TFSA) with investments in US stocks, you're in the right place. The US stock market is renowned for its robustness and potential for high returns. However, navigating this market can be complex. This guide will help you understand how to invest in US stocks through your TFSA, the potential benefits, and the risks involved.

Understanding TFSA and its Benefits

A TFSA is a registered account that allows Canadians to save and invest tax-free. The primary benefit is that the earnings, including interest, dividends, and capital gains, are not taxed. Moreover, you can withdraw funds from your TFSA without incurring taxes, making it an excellent tool for long-term savings and investment.

Investing in US Stocks Through Your TFSA

To invest in US stocks through your TFSA, you need to follow a few simple steps:

Open a TFSA: If you haven't already, open a TFSA account. You can do this through a bank, credit union, or a mutual fund company.

Choose a Brokerage: Next, you need to choose a brokerage firm that offers access to US stocks. Many Canadian brokerages offer this service, including Questrade, TD Ameritrade, and Interactive Brokers.

Fund Your TFSA: Transfer funds from your chequing or savings account to your TFSA. Remember, you can only contribute up to the annual contribution limit set by the Canadian government.

Buy US Stocks: Once your TFSA is funded, you can buy US stocks through your brokerage account. You can choose individual stocks or invest in a diversified portfolio through ETFs (Exchange-Traded Funds).

Benefits of Investing in US Stocks Through Your TFSA

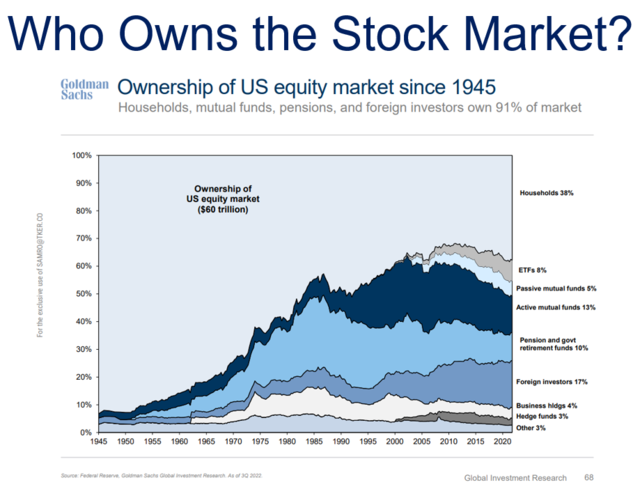

Diversification: Investing in US stocks can diversify your portfolio and reduce risk. The US stock market is vast and includes a wide range of industries and sectors.

Potential for High Returns: The US stock market has historically offered higher returns compared to the Canadian market. This can help grow your TFSA faster.

Tax-Free Earnings: Since your TFSA is tax-free, you won't pay taxes on the earnings, dividends, or capital gains.

Risks to Consider

Currency Risk: Investing in US stocks exposes you to currency risk. If the Canadian dollar strengthens against the US dollar, your returns in Canadian currency may be lower.

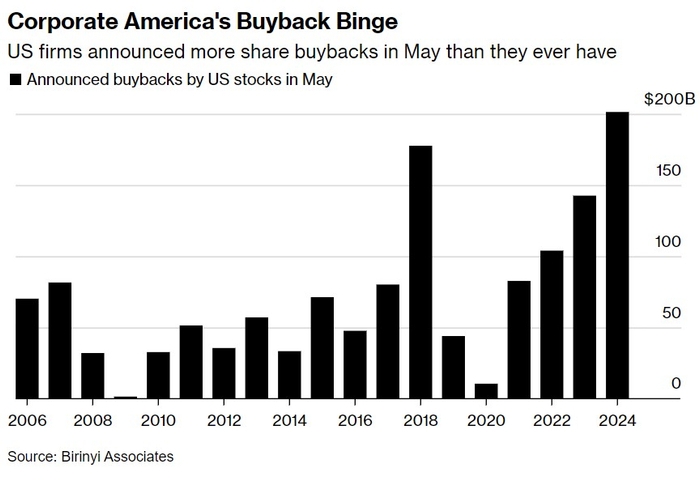

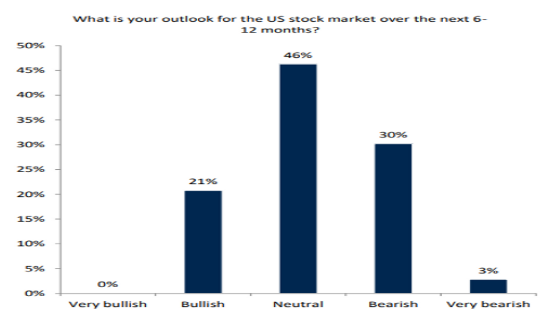

Market Volatility: The US stock market can be volatile, and prices can fluctuate widely. This can lead to significant gains or losses.

Regulatory Risks: Different regulatory frameworks in the US can pose challenges and risks.

Case Study: Investing in Apple Inc.

One of the most popular US stocks is Apple Inc. (AAPL). Investing in Apple through your TFSA can be a great way to gain exposure to the technology sector. Over the past decade, Apple has consistently delivered strong returns, making it an attractive investment for TFSA holders.

Conclusion

Investing in US stocks through your TFSA can be a smart move to grow your savings and potentially achieve higher returns. However, it's essential to understand the risks and do your research before making investment decisions. By following this guide, you can navigate the US stock market and maximize your TFSA investments.

us stock market today

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....