In the fast-paced world of financial markets, news trading has emerged as a powerful strategy for investors seeking to capitalize on market movements. This approach involves analyzing and reacting to breaking news and events that can significantly impact the value of assets. This article delves into the essentials of news trading, offering insights into its principles, techniques, and potential pitfalls.

Understanding News Trading

News trading is based on the premise that market prices often react to significant news events. Whether it's an economic report, corporate earnings announcement, or geopolitical event, these news items can create sudden price movements that savvy traders can exploit. The key to successful news trading lies in the ability to:

- Identify Relevant News: Not all news is equally impactful on the markets. Traders must discern which news events are likely to have a significant effect on asset prices.

- Analyze News: Once relevant news is identified, traders need to analyze its implications for the market. This involves understanding the potential impact on supply and demand dynamics.

- React Quickly: The success of news trading hinges on the trader's ability to react quickly to news events. Delay can mean missing out on significant price movements.

Techniques for Effective News Trading

News trading requires a combination of technical and fundamental analysis. Here are some techniques to help traders navigate this dynamic strategy:

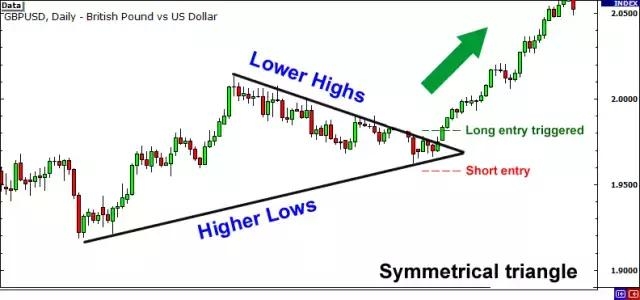

- Technical Analysis: Traders use technical indicators to identify patterns and trends in the market. For news trading, these indicators can help predict potential price movements following a news event.

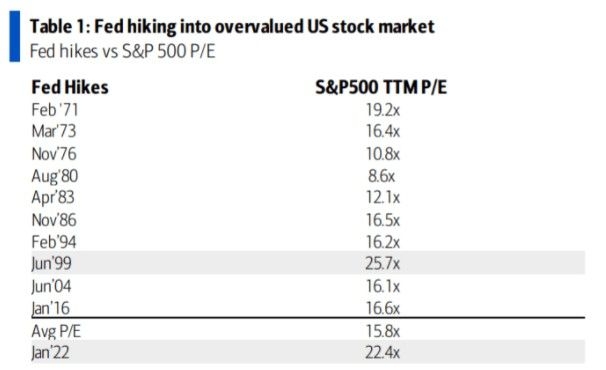

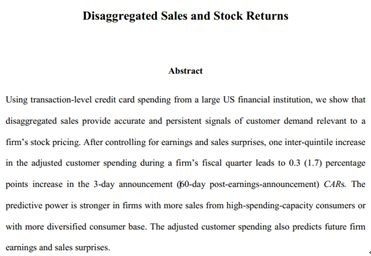

- Fundamental Analysis: This involves analyzing economic, financial, and political factors that can influence asset prices. Understanding these factors is crucial for interpreting the impact of news events.

- Sentiment Analysis: This technique involves gauging the market's reaction to news events. By understanding the sentiment of investors and traders, traders can make more informed decisions.

Case Studies

Case Study 1: The announcement of a company's earnings can lead to significant price movements. A trader who correctly analyzes the earnings report and predicts a positive outcome can capitalize on the resulting price increase.

Case Study 2: A geopolitical event, such as a change in government or a military conflict, can have a profound impact on the market. A trader who quickly reacts to this news and adjusts their portfolio accordingly can benefit from the resulting market movements.

Challenges and Risks

News trading is not without its challenges and risks. Some of the key considerations include:

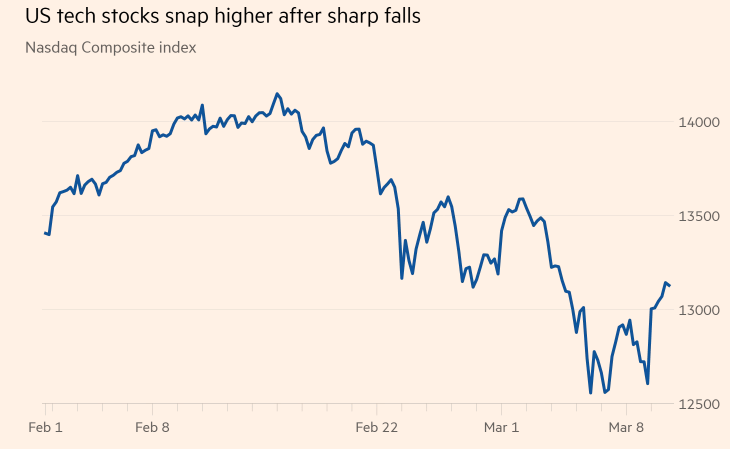

- Market Volatility: News events can cause market volatility, leading to sudden and unpredictable price movements.

- Information Overload: The sheer volume of news available can be overwhelming, making it difficult to identify the most relevant information.

- Emotional Decision-Making: Traders must remain disciplined and avoid making impulsive decisions based on emotions.

Conclusion

News trading is a dynamic and potentially lucrative strategy for investors looking to capitalize on market movements. By understanding the principles, techniques, and risks involved, traders can develop a successful news trading strategy. Remember, the key to success is thorough research, discipline, and the ability to react quickly to news events.

us stock market live

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....