In the ever-evolving landscape of financial markets, understanding the total US stock market capitalization is crucial for investors and financial analysts alike. As we approach October 2025, it's essential to have a clear picture of where the US stock market stands. This article delves into the latest figures, trends, and predictions regarding the total US stock market capitalization.

What is Stock Market Capitalization?

Stock market capitalization refers to the total value of all the shares of a company that are outstanding. It's calculated by multiplying the current market price of a single share by the total number of shares available. The higher the stock market capitalization, the larger the company's market value.

Total US Stock Market Capitalization in October 2025: Key Figures

As of October 2025, the total US stock market capitalization is expected to be around $40 trillion. This figure reflects the combined market values of all publicly traded companies in the United States.

Factors Influencing the Total US Stock Market Capitalization

Several factors contribute to the growth and fluctuations of the total US stock market capitalization. These include:

- Economic Growth: A robust economy typically leads to higher corporate earnings and, consequently, higher stock prices.

- Interest Rates: Changes in interest rates can impact the cost of borrowing and, subsequently, a company's profitability.

- Inflation: Inflation can erode purchasing power and impact corporate earnings.

- Political Stability: Political instability can create uncertainty, leading to volatility in the stock market.

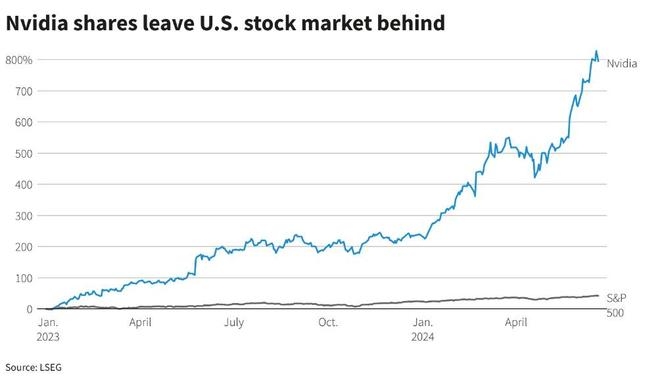

- Technological Advancements: The rise of new technologies and innovative business models can significantly boost stock market capitalization.

Trends in the Total US Stock Market Capitalization

Over the past few years, the total US stock market capitalization has experienced both growth and volatility. Some key trends include:

- Record Highs: The US stock market has set numerous record highs in recent years, driven by strong corporate earnings and a recovering economy.

- Sector Rotation: Investors have been rotating between sectors, seeking out the most promising opportunities.

- Diversification: Diversification remains a crucial strategy for investors looking to mitigate risk in their portfolios.

Case Studies: Companies Driving Stock Market Capitalization

Several companies have played a significant role in driving the total US stock market capitalization. Here are a few examples:

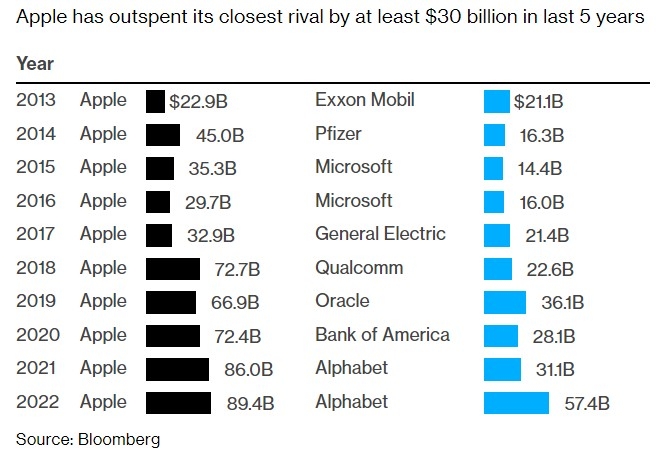

- Apple Inc.: As the world's largest company by market capitalization, Apple has been a major driver of the US stock market's growth.

- Amazon.com Inc.: Amazon's expansion into various sectors, including cloud computing and e-commerce, has contributed to its significant market value.

- Microsoft Corporation: Microsoft's diversified business model, which includes software, cloud computing, and gaming, has made it a key player in the stock market.

Conclusion

As we approach October 2025, the total US stock market capitalization is expected to reach new heights. Understanding the factors influencing this growth and the key trends can help investors and financial analysts make informed decisions. By keeping a close eye on the total US stock market capitalization, you can stay ahead of the curve in this dynamic market landscape.

us stock market today

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....