The financial world is buzzing with anticipation as the Dow Jones Industrial Futures prepare to open tomorrow. This article delves into what traders and investors can expect, providing a comprehensive outlook on the market trends that could shape the trading day ahead.

Understanding the Dow Jones Industrial Futures

The Dow Jones Industrial Average (DJIA) is one of the most widely followed stock market indices in the world. It represents the stock performance of 30 large companies in the United States. The Dow Jones Industrial Futures are financial contracts that allow investors to bet on the future price of the DJIA. Traders use these futures to hedge their portfolio or speculate on the direction of the stock market.

Market Trends to Watch

Economic Indicators: Economic data releases, such as unemployment rates, consumer spending, and inflation, can significantly impact the stock market. Traders should pay close attention to any upcoming economic reports that could influence the market sentiment.

Corporate Earnings: The performance of individual companies can drive the overall direction of the DJIA. Companies reporting earnings ahead of the market open can cause volatility in the futures market.

Global Events: Geopolitical events, such as elections or trade disputes, can create uncertainty in the market. Investors should stay informed about global events that could impact the stock market.

Technological Advancements: Advances in technology can disrupt entire industries, leading to significant changes in the stock market. Companies at the forefront of technological innovation can see their stock prices soar or plummet.

Key Factors to Consider

Futures Prices: The price of the Dow Jones Industrial Futures can indicate market sentiment. If futures prices are higher than the current DJIA level, it suggests that traders are bullish on the market.

Volume: High trading volume can indicate strong market interest in the DJIA. Traders should pay attention to trading volume levels to gauge the strength of market movements.

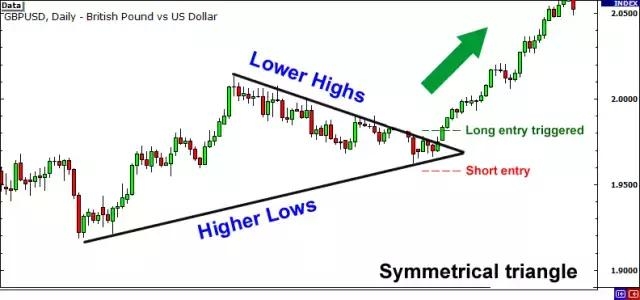

Option Activity: The trading volume and open interest in DJIA options can provide insights into market sentiment. Traders often use options to hedge their positions or speculate on the future direction of the stock market.

Case Study: The 2020 Market Crash

A perfect example of how futures prices can influence the stock market is the 2020 market crash. On March 9, 2020, the Dow Jones Industrial Futures opened significantly lower than the current DJIA level. This led to a massive sell-off in the stock market, causing the DJIA to plummet over 2,000 points in a single day.

Conclusion

The Dow Jones Industrial Futures are a valuable tool for investors and traders to predict market movements. By staying informed about market trends, economic indicators, and global events, traders can make informed decisions and capitalize on potential opportunities. As the market prepares to open tomorrow, investors should keep a close eye on these key factors to navigate the trading day ahead.

us stock market live

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....