In the ever-evolving world of finance, cryptocurrencies have emerged as a significant player. Bitcoin, the pioneer of this digital revolution, has garnered considerable attention from investors and traders alike. This article delves into the relationship between Bitcoin and US stock exchanges, exploring how these platforms are adapting to accommodate this burgeoning asset class.

Understanding Bitcoin

Bitcoin, launched in 2009, is a decentralized digital currency that operates on a technology called blockchain. This technology ensures transparency, security, and immutability in all transactions. Unlike traditional currencies, Bitcoin is not controlled by any central authority, making it a unique asset in the financial landscape.

The Rise of Bitcoin

Over the years, Bitcoin has seen a meteoric rise in value. Its market capitalization has surged, and it has become a popular investment vehicle for many. This has led to a growing interest in integrating Bitcoin with traditional financial systems, including US stock exchanges.

Bitcoin and US Stock Exchanges

US stock exchanges have been slow to adapt to the inclusion of Bitcoin. However, several exchanges have started exploring the possibility of listing Bitcoin and other cryptocurrencies. Here are some key exchanges that are making strides in this area:

- NASDAQ: NASDAQ, one of the world's largest stock exchanges, has shown interest in listing Bitcoin. In 2018, it announced plans to create a regulated Bitcoin futures contract, which would allow investors to trade Bitcoin without owning the actual cryptocurrency.

- CBOE: The Chicago Board Options Exchange (CBOE) was the first US exchange to launch a Bitcoin futures contract in December 2017. This move marked a significant step towards integrating Bitcoin into the traditional financial system.

- BATS Global Markets: BATS has also expressed interest in listing Bitcoin, aiming to provide a regulated platform for investors to trade this digital asset.

Challenges and Opportunities

While the integration of Bitcoin into US stock exchanges presents several opportunities, it also comes with its own set of challenges:

- Regulatory Hurdles: Cryptocurrencies are still largely unregulated, which poses a significant challenge for exchanges looking to list Bitcoin. Regulatory authorities must develop clear guidelines to ensure the safety and legality of these transactions.

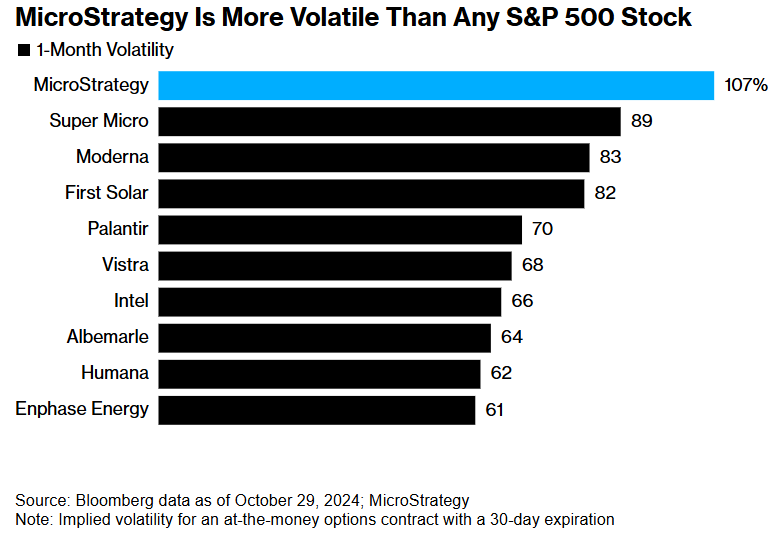

- Market Volatility: Bitcoin is known for its extreme volatility, which can be risky for investors. Exchanges must implement robust risk management systems to protect their clients.

- Security Concerns: The blockchain technology behind Bitcoin is highly secure, but exchanges must ensure that their platforms are equally secure to prevent hacking and theft.

Case Study: CBOE's Bitcoin Futures

CBOE's launch of Bitcoin futures in December 2017 was a landmark event. It allowed investors to gain exposure to Bitcoin without owning the actual cryptocurrency. This move was widely praised, as it provided a regulated and secure platform for trading Bitcoin.

Conclusion

The integration of Bitcoin into US stock exchanges is a significant development in the financial world. While challenges remain, the potential benefits are substantial. As the regulatory landscape continues to evolve, we can expect to see more exchanges embracing this digital asset and providing investors with new opportunities to diversify their portfolios.

us stock market today

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....