In the ever-evolving world of finance, keeping a close eye on stock performance is crucial for investors. One such stock that has caught the attention of many is SWI. This article delves into the performance of SWI stock in US dollars, analyzing key factors that have influenced its trajectory. By understanding these factors, investors can make more informed decisions about their investments.

Understanding SWI Stock

Before diving into the performance of SWI stock, it's important to have a basic understanding of the company. SWI is a publicly-traded company that operates in the technology sector. The company specializes in providing innovative solutions to various industries, including healthcare, finance, and retail. With a strong focus on research and development, SWI has managed to establish itself as a leader in its industry.

Historical Performance

Over the past few years, SWI stock has shown a remarkable performance in US dollars. The stock has seen significant growth, making it an attractive investment for many. One of the key factors that have contributed to this growth is the company's strong financial performance. SWI has consistently reported robust revenue and profit margins, which have been a testament to its business model and operational efficiency.

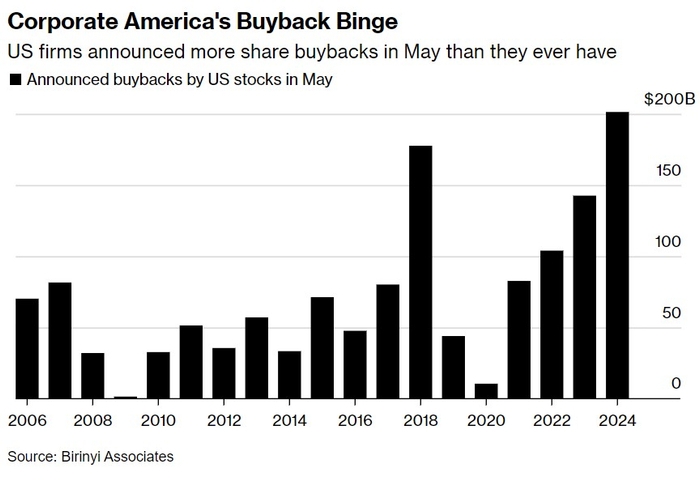

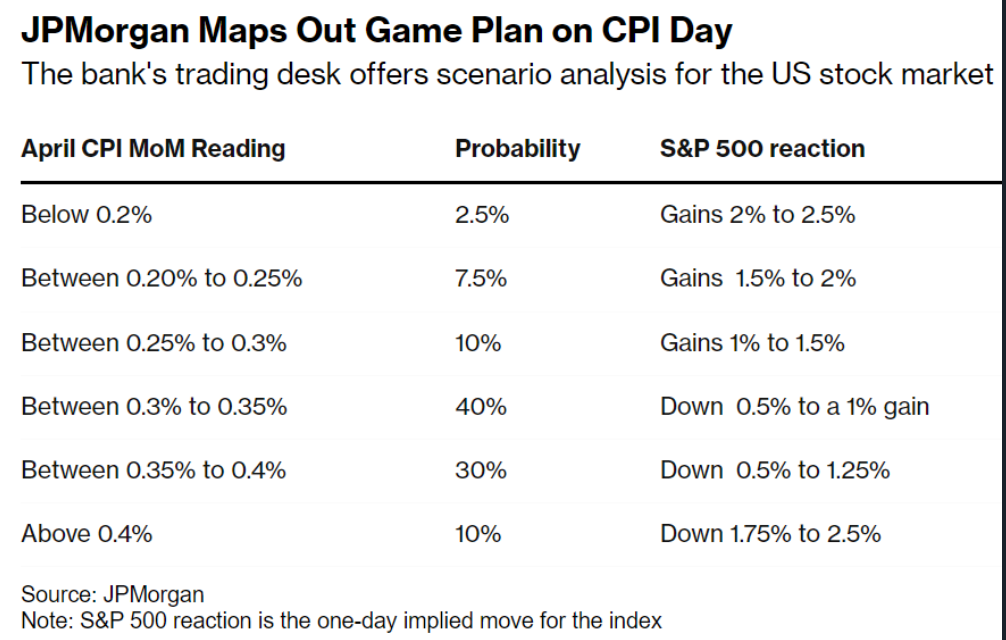

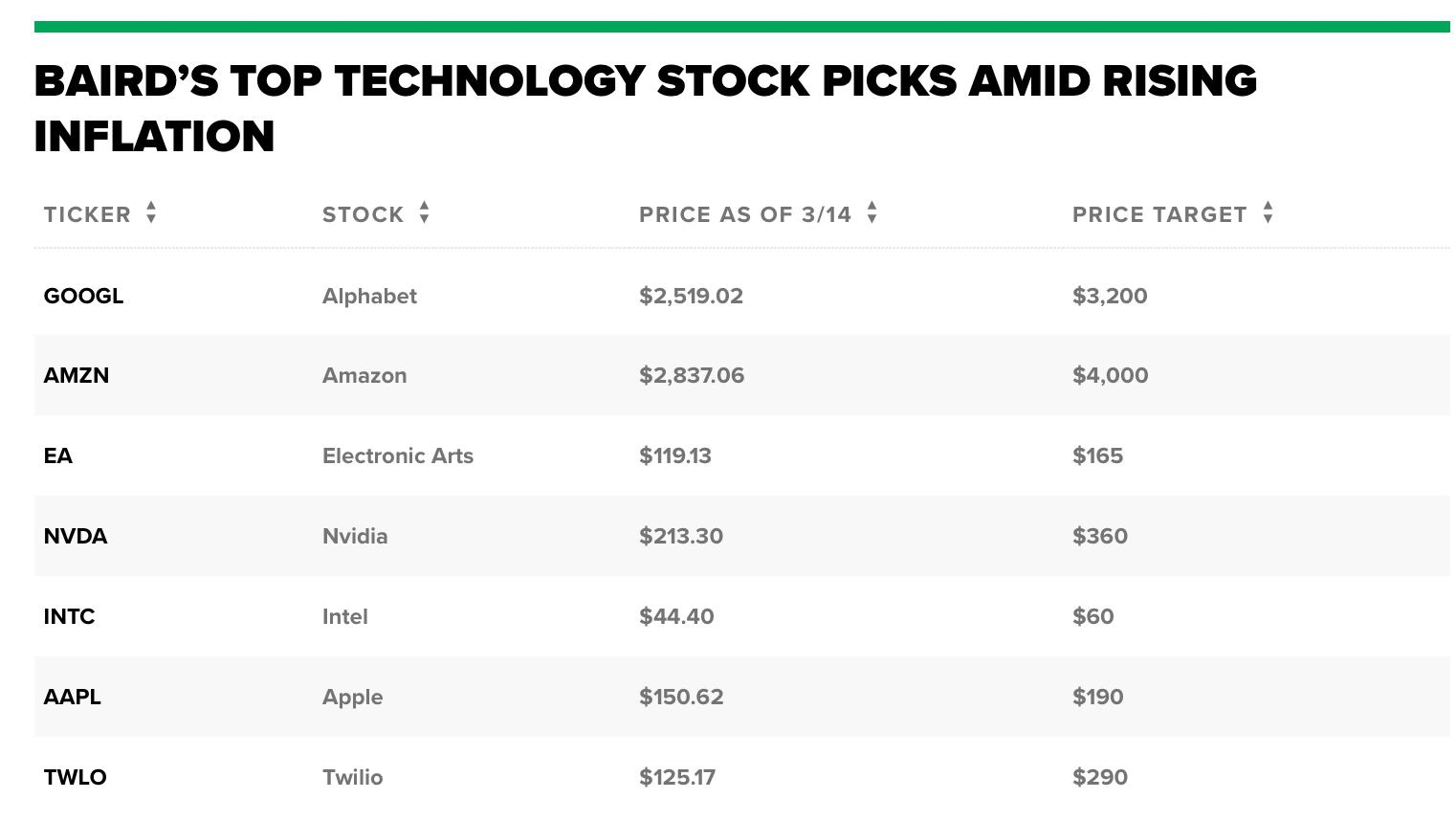

Market Trends and Economic Factors

The performance of SWI stock in US dollars has also been influenced by broader market trends and economic factors. For instance, the technology sector has experienced significant growth over the past few years, driven by increasing demand for digital solutions. Additionally, economic factors such as interest rates and inflation have played a role in the stock's performance. As interest rates have remained low, investors have been more inclined to invest in stocks, which has led to an increase in demand for SWI stock.

Dividend Yields and Stock Split

Another important factor to consider when analyzing the performance of SWI stock is its dividend yields and stock splits. SWI has a strong track record of paying dividends to its shareholders, which has made it an attractive investment for income-focused investors. Moreover, the company has also implemented stock splits, which have helped to increase the liquidity of the stock and make it more accessible to a wider range of investors.

Case Studies

To further understand the performance of SWI stock, let's take a look at a couple of case studies:

Q1 2021 Performance: In the first quarter of 2021, SWI reported a significant increase in revenue and profit margins. This strong performance was driven by the company's successful product launches and strategic partnerships. As a result, the stock saw a significant surge in its value, making it one of the top-performing stocks in the technology sector during that period.

COVID-19 Impact: The COVID-19 pandemic had a significant impact on the global economy, and the technology sector was no exception. However, SWI managed to navigate through the challenges posed by the pandemic, thanks to its diverse product portfolio and strong operational efficiency. This resilience helped the company maintain its stock performance, even during the most challenging times.

Conclusion

In conclusion, the performance of SWI stock in US dollars has been impressive, driven by a combination of factors such as strong financial performance, market trends, and economic conditions. By understanding these factors, investors can make more informed decisions about their investments in SWI stock. As the technology sector continues to grow, SWI remains a compelling investment opportunity for those looking to capitalize on the sector's growth potential.

new york stock exchange

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....