In the fast-paced world of finance, certain stocks have the power to move markets. These "market moving stocks" can significantly impact the broader market, often leading to substantial price movements and investor interest. Identifying these stocks and making informed investment decisions can be a game-changer for your portfolio. In this article, we'll explore what makes a stock market-moving, how to spot them, and some key strategies for investing in them.

What Makes a Stock Market-Moving?

Market-moving stocks are typically characterized by their high trading volume, significant market capitalization, and substantial news or events that can influence investor sentiment. Here are some key factors that contribute to a stock becoming market-moving:

- High Trading Volume: Stocks with high trading volume are more likely to influence the market due to their significant participation in the trading activity.

- Significant Market Capitalization: Large-cap companies with significant market capitalization have a substantial impact on the market due to their substantial share value.

- Major News or Events: Positive or negative news, product launches, earnings reports, or regulatory changes can trigger significant price movements and market reactions.

How to Spot Market-Moving Stocks

Identifying market-moving stocks requires a keen eye for news, market trends, and technical analysis. Here are some strategies to help you spot these stocks:

- Stay Informed: Keep up with financial news, market trends, and company-specific developments. This will help you identify potential market-moving events.

- Monitor High-Volume Stocks: Focus on stocks with high trading volume, as they are more likely to influence the market.

- Analyze Technical Indicators: Use technical analysis tools to identify patterns and trends that could indicate a stock's potential to move the market.

- Follow Analyst Reports and Ratings: Pay attention to analyst reports and ratings, as they can provide insights into a stock's potential impact on the market.

Key Strategies for Investing in Market-Moving Stocks

Investing in market-moving stocks requires careful consideration and a well-defined strategy. Here are some key strategies to help you navigate this volatile market:

- Diversify Your Portfolio: Don't put all your eggs in one basket. Diversify your portfolio to mitigate risks associated with market-moving stocks.

- Set Realistic Goals: Define clear investment goals and risk tolerance levels before investing in market-moving stocks.

- Use Stop-Loss Orders: Implement stop-loss orders to protect your investments from significant losses.

- Stay Disciplined: Avoid making impulsive decisions based on short-term market movements. Stick to your investment strategy and stay disciplined.

Case Studies

- Tesla (TSLA): Tesla's market-moving potential is evident in its high trading volume and significant market capitalization. The company's innovative electric vehicles and recent news of entering the solar energy market have sparked significant market reactions.

- Amazon (AMZN): As one of the largest companies in the world, Amazon has the power to move markets with its substantial market capitalization and regular earnings reports that impact investor sentiment.

In conclusion, market-moving stocks can significantly impact the broader market and provide opportunities for substantial gains. By understanding what makes a stock market-moving, how to spot them, and implementing a well-defined investment strategy, you can capitalize on these opportunities and enhance your portfolio's performance.

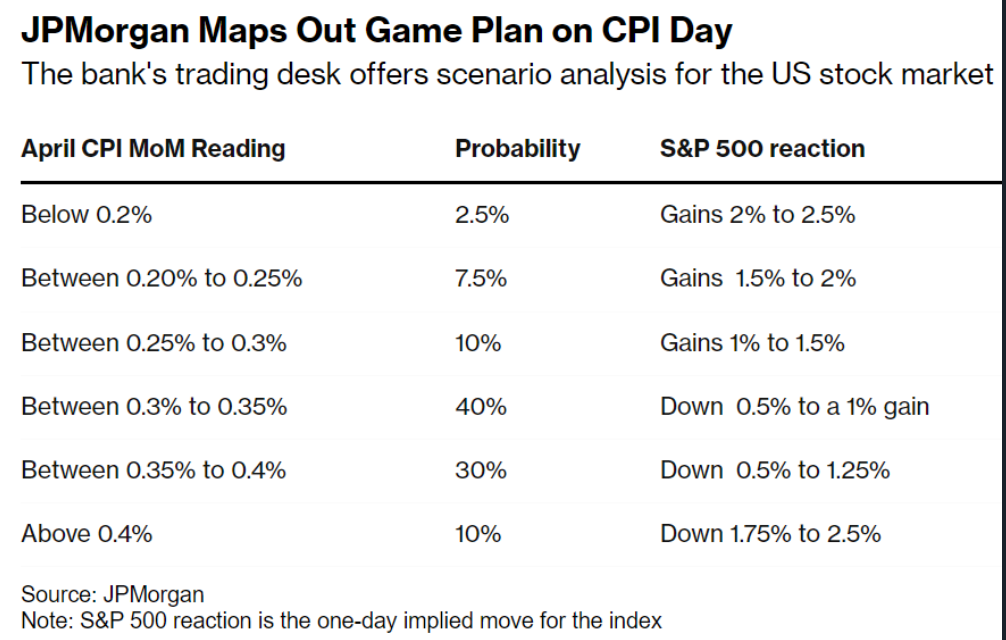

us stock market today

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....