As we approach the year 2025, investors are eagerly anticipating the holiday season's impact on the US stock market. The holiday season, traditionally a period of increased consumer spending, has historically influenced stock market trends. This article delves into the potential implications of the holiday season on the US stock market in 2025, analyzing key sectors and providing insights into potential investment opportunities.

Consumer Spending and Retail Sectors

The holiday season is a crucial period for the retail sector, with significant spikes in consumer spending. In 2025, factors such as economic stability, consumer confidence, and emerging trends in e-commerce will play a pivotal role in shaping the retail landscape.

E-commerce Growth

The rise of e-commerce has transformed the retail industry, and this trend is expected to continue in 2025. Online shopping platforms like Amazon, Walmart, and Target are likely to see increased sales during the holiday season. Emerging technologies such as augmented reality (AR) and virtual reality (VR) could further enhance the online shopping experience, driving higher sales.

Consumer Electronics and Technology

Consumer electronics and technology companies often see a surge in sales during the holiday season. In 2025, smart home devices, gaming consoles, and 5G-enabled smartphones are expected to be hot-selling items. Companies like Apple, Samsung, and Microsoft are likely to benefit from this trend.

Healthcare and Pharma

The healthcare sector is another area that could see significant growth during the holiday season. With the increasing focus on health and wellness, demand for pharmaceuticals, medical devices, and telemedicine services is expected to rise. Companies like Johnson & Johnson, Pfizer, and Amazon's healthcare division, Amazon Web Services (AWS), could witness increased investment.

Emerging Sectors

Several emerging sectors are poised to gain traction in the US stock market in 2025. These include renewable energy, artificial intelligence (AI), and biotechnology.

Renewable Energy

The renewable energy sector is expected to see substantial growth due to increasing environmental concerns and technological advancements. Companies specializing in solar, wind, and hydroelectric power could witness significant investment during the holiday season.

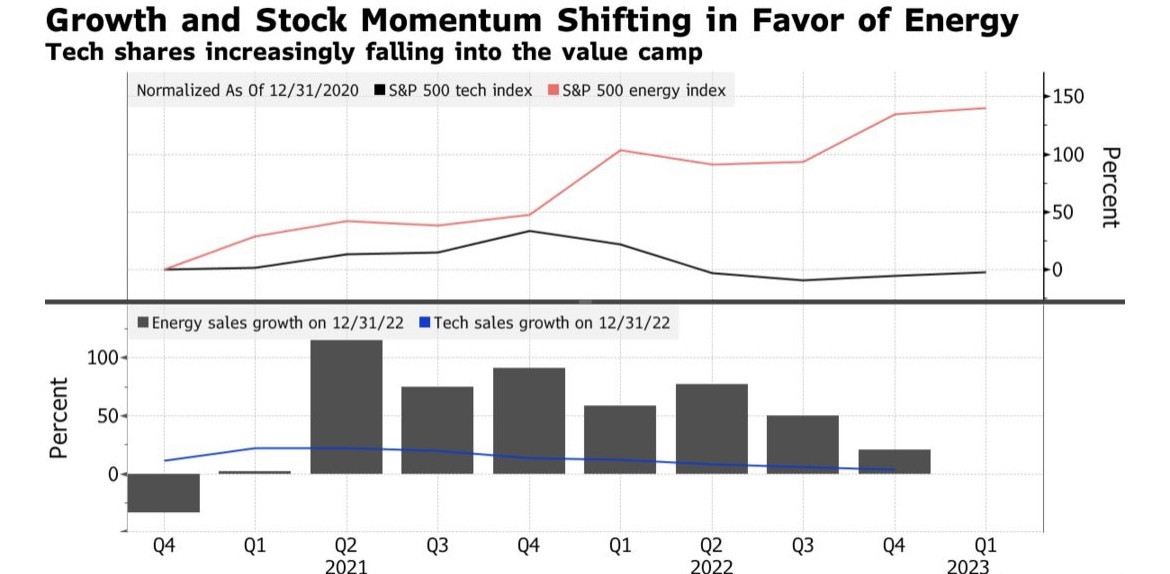

Artificial Intelligence

AI continues to revolutionize various industries, and this trend is expected to persist in 2025. AI-driven technologies like automation, machine learning, and data analytics are likely to attract investment, with companies like IBM, Google, and Microsoft leading the charge.

Biotechnology

The biotechnology sector is witnessing rapid advancements, with numerous breakthroughs in drug development and genetic engineering. Companies like Novartis, Amgen, and Gilead Sciences could see increased investment as they continue to innovate in this field.

Conclusion

As we move closer to 2025, the holiday season is poised to have a significant impact on the US stock market. By focusing on key sectors such as retail, consumer electronics, healthcare, and emerging technologies, investors can identify potential opportunities for growth. As always, it is crucial to conduct thorough research and consult with financial advisors before making any investment decisions.

new york stock exchange

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....