The direction of the U.S. stock market is a critical aspect for investors to consider when making decisions about their portfolios. Whether you're a seasoned trader or just dipping your toes into the investment world, understanding the current trends and factors influencing the market is crucial. In this article, we'll explore the key drivers that shape the U.S. stock market's direction and provide insights into what may lie ahead.

Economic Indicators

One of the most fundamental factors influencing the U.S. stock market is the state of the economy. Economic indicators such as GDP growth, unemployment rates, and inflation rates play a significant role in determining market trends. For example, robust economic growth tends to lead to a rising stock market, while slowdowns or recessions can cause a decline.

Case Study: During the COVID-19 pandemic, the U.S. economy faced unprecedented challenges, leading to a sharp decline in the stock market. However, as the economy gradually recovered, the stock market followed suit and reached new highs.

Corporate Earnings

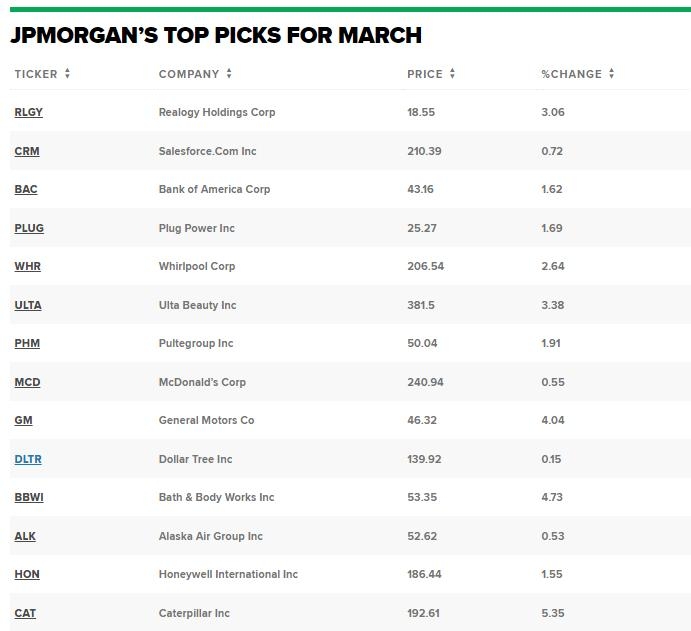

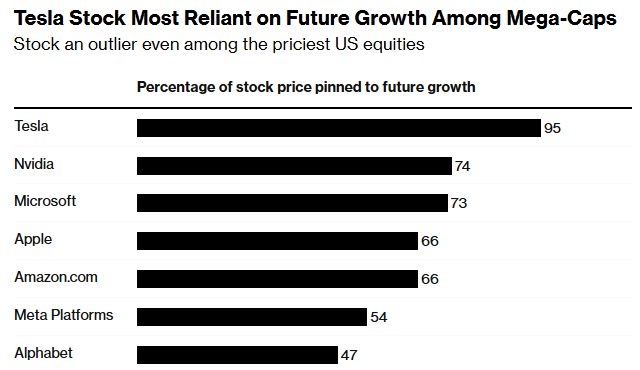

The performance of companies listed on U.S. stock exchanges is another key driver of the market's direction. Corporate earnings are a vital indicator of a company's financial health and are closely watched by investors. Strong earnings reports often lead to increased stock prices, while weak reports can cause a downward trend.

Case Study: Apple, one of the most valuable companies in the world, has consistently reported strong earnings, driving its stock price higher. Conversely, companies like Boeing have faced significant challenges due to product recalls and delays, negatively impacting their stock prices.

Market Sentiment

Market sentiment refers to the overall attitude or mood of investors in the market. This sentiment can be influenced by a variety of factors, including political events, global economic conditions, and technological advancements. Positive sentiment tends to drive the stock market up, while negative sentiment can lead to a decline.

Case Study: The election of a new president often triggers market volatility, with investors reacting to the potential impact on policy and regulation. For example, the election of Donald Trump in 2016 was met with optimism, as investors believed it would lead to a more business-friendly environment, while the election of Joe Biden in 2020 caused uncertainty and volatility.

Interest Rates

Interest rates, set by the Federal Reserve, are a significant influence on the U.S. stock market. Lower interest rates tend to boost the stock market, as they make borrowing cheaper and increase the attractiveness of stocks relative to bonds. Conversely, higher interest rates can put downward pressure on the stock market.

Case Study: The Federal Reserve's decision to raise interest rates in 2018 was met with concern from investors, leading to a period of market volatility. However, as the economy remained strong, the market eventually stabilized.

Global Factors

Global economic and political events can also have a significant impact on the U.S. stock market. Geopolitical tensions, trade wars, and currency fluctuations are just a few examples of global factors that can influence market direction.

Case Study: The U.S.-China trade war in 2019 led to a significant decline in the stock market, as investors worried about the potential impact on the global economy. The eventual trade deal between the two countries helped to stabilize the market.

In conclusion, the direction of the U.S. stock market is influenced by a variety of factors, including economic indicators, corporate earnings, market sentiment, interest rates, and global events. Understanding these factors is crucial for investors looking to navigate the stock market and make informed decisions about their portfolios.

us stock market today

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....