Investing in the stock market can be a daunting task, especially for beginners. One of the most crucial elements in making informed investment decisions is the analysis of historical stock price data. This article delves into the importance of historical stock price data, how to interpret it, and its role in shaping investment strategies.

Understanding Historical Stock Price Data

Historical stock price data refers to the past performance of a stock, including its opening, closing, highest, and lowest prices over a specific period. This data is invaluable for investors as it provides insights into the stock's past behavior and potential future trends.

Why is Historical Stock Price Data Important?

Predicting Future Trends: By analyzing historical stock price data, investors can identify patterns and trends that may indicate future price movements. For instance, if a stock has consistently risen over the past year, it may be a good investment opportunity.

Risk Assessment: Historical stock price data helps investors assess the risk associated with a particular stock. A stock with a volatile price history may be riskier than one with a stable price pattern.

Making Informed Decisions: By understanding a stock's past performance, investors can make more informed decisions about when to buy, sell, or hold the stock.

How to Interpret Historical Stock Price Data

Trend Analysis: Look for patterns in the stock's price history. Is the stock trending upwards, downwards, or is it ranging? This can help you predict future price movements.

Volume Analysis: Analyze the trading volume, which represents the number of shares traded over a specific period. High trading volume often indicates significant interest in the stock, which can influence its price.

Support and Resistance Levels: Identify the support and resistance levels, which are price levels where the stock has repeatedly struggled to move above or below. These levels can help you determine potential entry and exit points.

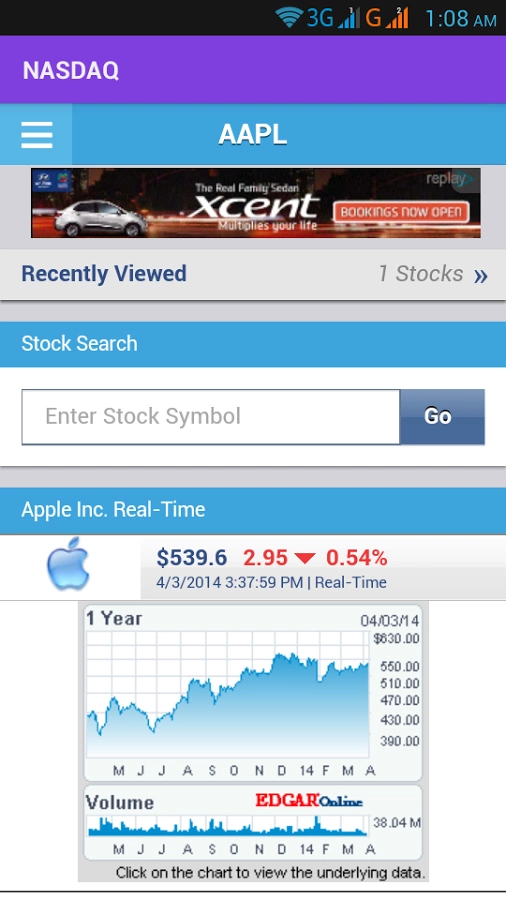

Case Study: Apple Inc. (AAPL)

Let's take a look at Apple Inc. (AAPL) as an example. Over the past five years, AAPL has shown a consistent upward trend, with occasional pullbacks. By analyzing the historical stock price data, investors could have identified several buy and sell opportunities.

In 2016, AAPL experienced a significant pullback, which presented a buying opportunity. Investors who bought at that time would have seen a substantial return over the next few years. Similarly, in 2018, the stock faced a brief correction, which could have been seen as a buying opportunity.

Conclusion

Historical stock price data is a powerful tool for investors looking to make informed decisions. By understanding how to interpret this data, investors can identify potential investment opportunities, assess risk, and make more informed decisions. Whether you're a beginner or an experienced investor, analyzing historical stock price data is a crucial step in your investment journey.

us spv stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....