In today's globalized economy, the relationship between the Russian and US stock markets is a topic of significant interest. Both markets have their unique characteristics, and their interconnectedness can impact investors worldwide. This article delves into the dynamics of these markets, highlighting key similarities and differences, and providing insights into potential investment opportunities.

Understanding the Russian Stock Market

The Russian stock market, known as the Moscow Exchange (MOEX), is one of the largest in Eastern Europe. It is dominated by energy and commodities companies, reflecting the country's vast natural resources. The market has been subject to volatility due to geopolitical tensions and economic sanctions. However, it also offers attractive growth prospects, especially in sectors like technology and telecommunications.

Key Factors Influencing the Russian Stock Market

Several factors influence the Russian stock market:

- Geopolitical Tensions: Relations between Russia and the West have been strained in recent years, leading to sanctions and trade restrictions. These factors can impact investor confidence and market performance.

- Energy Prices: As a major energy exporter, Russia's economy is highly sensitive to global oil and gas prices. Fluctuations in energy prices can significantly impact the stock market.

- Economic Sanctions: Sanctions imposed by Western countries have had a detrimental effect on the Russian economy, leading to currency depreciation and inflation.

Understanding the US Stock Market

The US stock market, represented by indices like the S&P 500 and the NASDAQ, is one of the most influential in the world. It is characterized by a diverse range of sectors, including technology, healthcare, and finance. The US market is known for its stability, innovation, and regulatory environment.

Key Factors Influencing the US Stock Market

Several factors influence the US stock market:

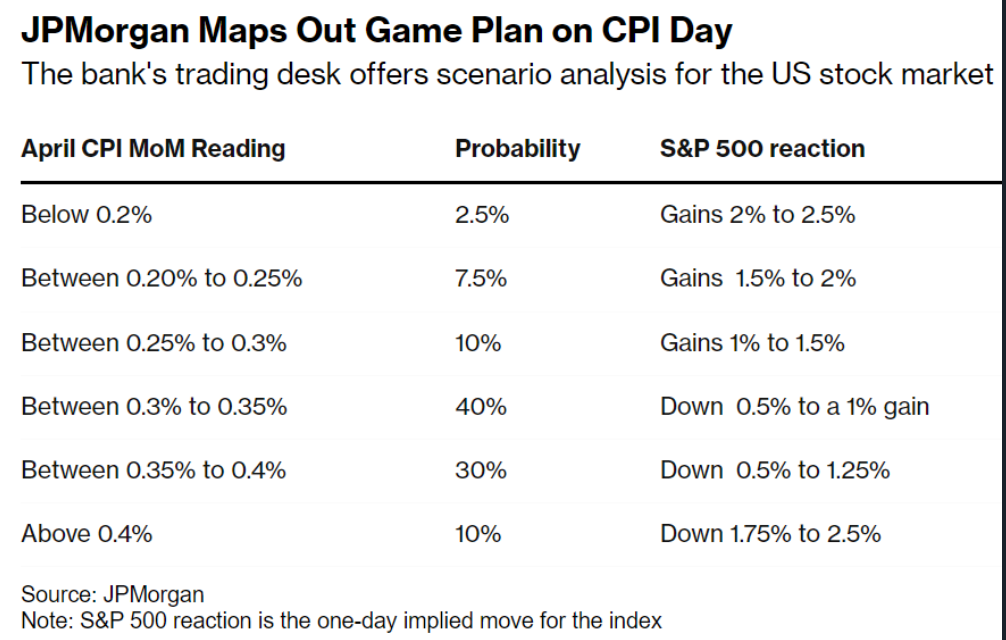

- Economic Data: Economic indicators, such as GDP growth, unemployment rates, and inflation, play a crucial role in shaping market sentiment.

- Corporate Earnings: The performance of companies listed on US exchanges is a key driver of market movements.

- Interest Rates: The Federal Reserve's monetary policy, particularly changes in interest rates, can significantly impact the stock market.

Comparing the Russian and US Stock Markets

Despite their differences, the Russian and US stock markets share some common characteristics:

- Interconnectedness: Globalization has led to increased integration between these markets, making them more sensitive to global economic trends.

- Technology: Both markets have seen significant growth in technology stocks, particularly in sectors like software and cloud computing.

Potential Investment Opportunities

Investors looking to capitalize on the relationship between the Russian and US stock markets should consider the following opportunities:

- Diversification: Investing in both markets can help reduce risk and exposure to geopolitical and economic uncertainties.

- Technology Stocks: Both markets offer attractive opportunities in the technology sector, particularly in areas like artificial intelligence and cybersecurity.

- Emerging Sectors: The Russian market offers potential investment opportunities in emerging sectors like telecommunications and consumer goods.

Conclusion

The relationship between the Russian and US stock markets is complex, influenced by a range of factors. Understanding these dynamics can help investors make informed decisions and identify potential opportunities. By diversifying their portfolios and focusing on emerging sectors, investors can navigate the challenges and capitalize on the strengths of both markets.

new york stock exchange

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....