Investing in stocks is a significant decision that can shape your financial future. When it comes to choosing between Canadian and US stocks, several factors should be considered. In this article, we will discuss the key differences and similarities between these two markets, helping you make an informed decision.

Understanding the Canadian Market

The Canadian stock market, also known as the Toronto Stock Exchange (TSX), is the eighth-largest in the world by market capitalization. It offers a diverse range of companies across various sectors, including energy, financials, materials, and technology. Here are some reasons to consider investing in Canadian stocks:

- Diversification: Investing in Canadian stocks allows you to diversify your portfolio, reducing exposure to a single market.

- Robust Economy: The Canadian economy is relatively stable, with low inflation and a strong focus on natural resources.

- Quality Companies: The TSX is home to some of the world's largest and most respected companies, such as Royal Bank of Canada and Toronto-Dominion Bank.

Understanding the US Market

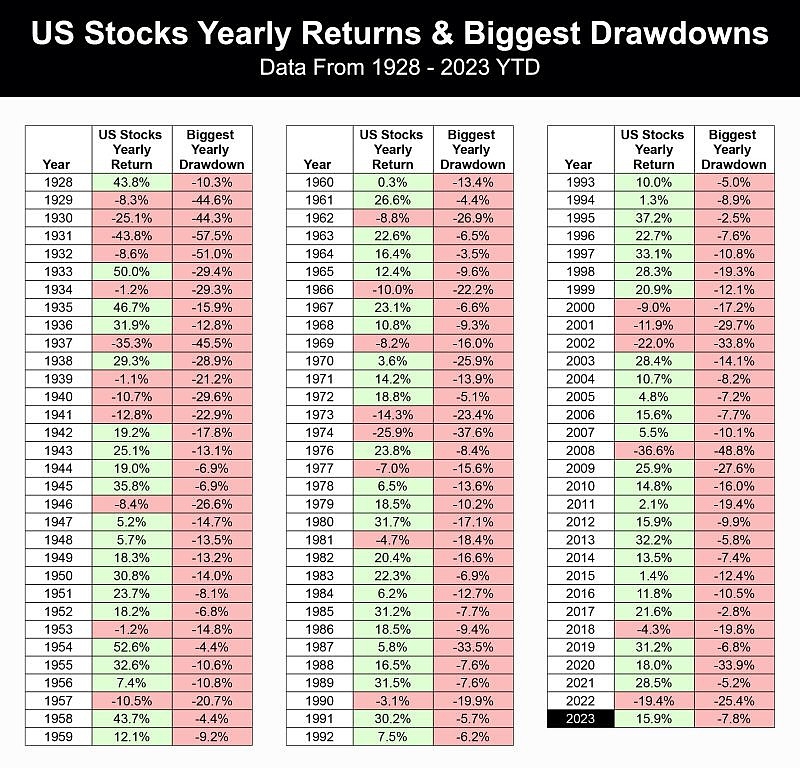

The US stock market, represented by the S&P 500, is the largest and most influential in the world. It offers a wide range of investment opportunities across various sectors, including technology, healthcare, and consumer goods. Here are some reasons to consider investing in US stocks:

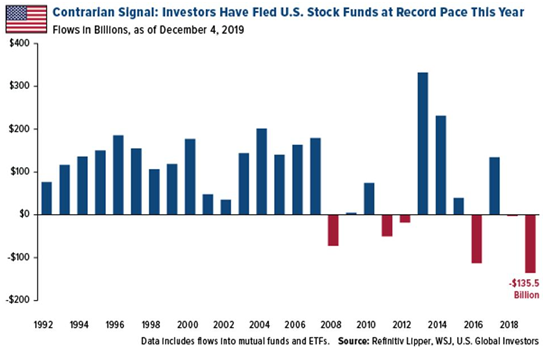

- Size and Liquidity: The US market has a higher trading volume and liquidity, making it easier to buy and sell stocks.

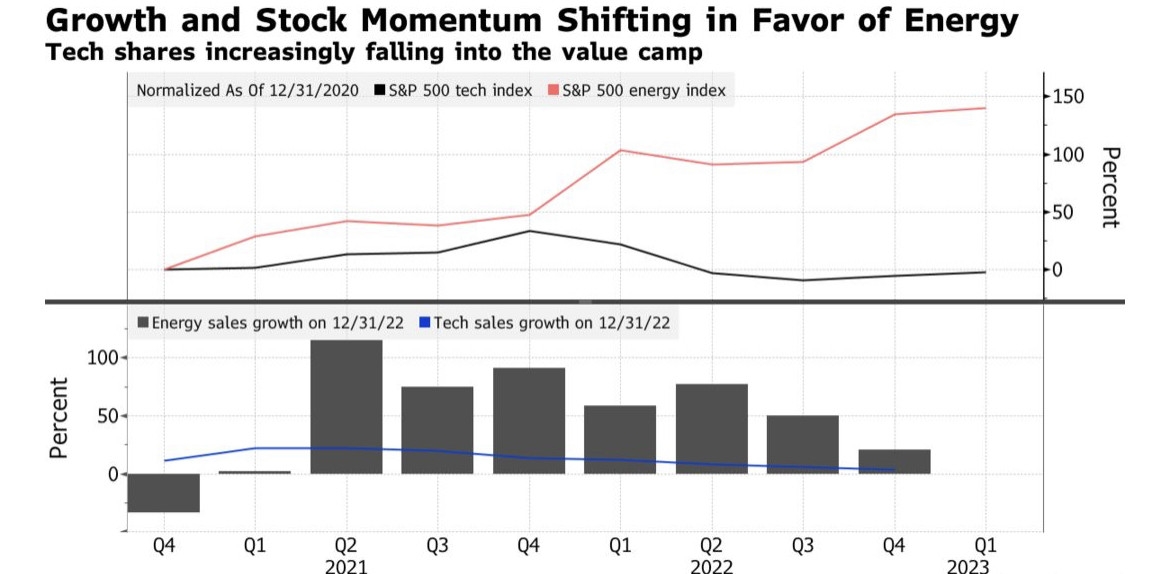

- Innovation: The US is known for its technological advancements, which often translates to significant growth potential for companies in the tech sector.

- Diverse Economy: The US has a diversified economy, which can help mitigate risks associated with market downturns.

Key Differences Between Canadian and US Stocks

- Market Size: The US market is significantly larger than the Canadian market, offering more investment opportunities.

- Dividends: Canadian companies tend to have higher dividend yields compared to US companies.

- Currency: Canadian stocks are denominated in Canadian dollars, while US stocks are denominated in US dollars. Fluctuations in currency exchange rates can impact returns.

Factors to Consider When Choosing Between Canadian and US Stocks

- Risk Tolerance: If you prefer lower risk, investing in Canadian stocks may be a better option. If you're comfortable with higher risk, the US market may offer more growth potential.

- Investment Strategy: Consider your investment strategy and the sectors you are interested in. For example, if you're looking for exposure to the energy sector, Canadian stocks may be more appealing.

- Currency Exposure: If you're investing in Canadian stocks, you'll be exposed to fluctuations in the Canadian dollar. Conversely, investing in US stocks will expose you to fluctuations in the US dollar.

Case Studies

- Royal Bank of Canada (RBC): RBC is one of the largest banks in Canada, with a strong presence in the financial services sector. It offers stability and a higher dividend yield compared to many US banks.

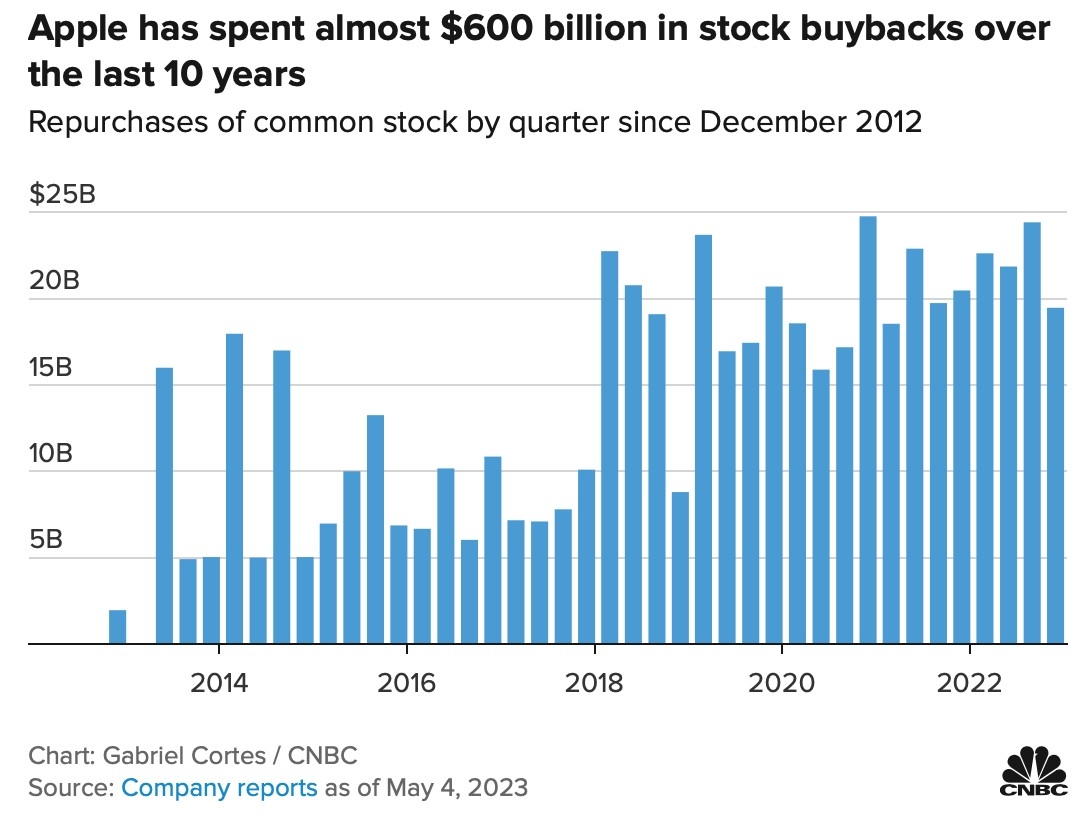

- Apple Inc.: Apple is a leading technology company with a significant presence in the US market. It offers growth potential and exposure to the rapidly evolving tech sector.

In conclusion, both Canadian and US stocks have their advantages and disadvantages. The best approach is to carefully consider your investment goals, risk tolerance, and market preferences before making a decision. Diversifying your portfolio with stocks from both markets can help optimize your returns and mitigate risks.

us spv stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....