In the world of finance, understanding overnight market prices is crucial for both amateur and professional traders. These prices, which reflect the value of assets at the end of the trading day, can have a significant impact on investment strategies and decision-making. This article delves into the concept of overnight market prices, their importance, and how they can shape your trading journey.

What Are Overnight Market Prices?

Overnight market prices refer to the closing prices of financial instruments at the end of the trading day. These prices serve as a benchmark for the next trading day, influencing the opening prices and overall market sentiment. When trading instruments like stocks, currencies, or commodities, overnight prices play a vital role in determining your investment outcomes.

Why Are Overnight Prices Important?

Risk Management: Knowing the overnight prices allows traders to assess the potential risks associated with holding positions overnight. For example, a stock that experiences significant price fluctuations overnight may require additional risk management measures to protect your investment.

Profitability Analysis: Traders can analyze their profitability by comparing the closing price with the opening price of the next trading day. This helps in evaluating the effectiveness of their trading strategies and identifying areas for improvement.

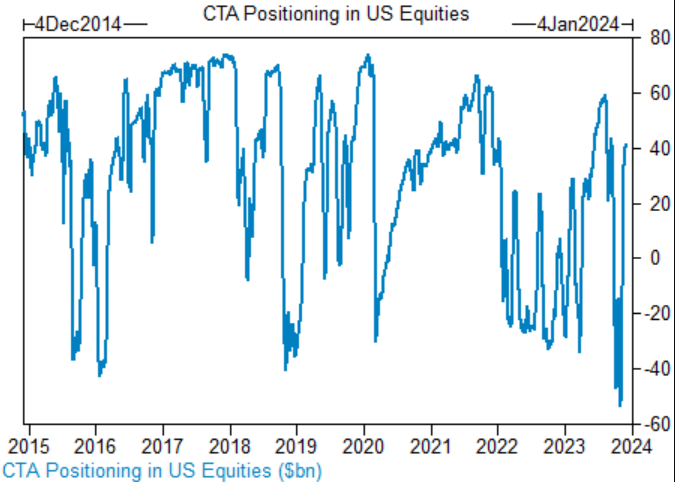

Market Sentiment: Overnight prices often reflect market sentiment and can provide valuable insights into potential market trends. By monitoring these prices, traders can make informed decisions about entering or exiting positions.

Understanding Overnight Price Fluctuations

Overnight price fluctuations can be caused by various factors, including:

Economic Announcements: Economic reports, such as GDP data or unemployment rates, can significantly impact overnight prices. For instance, a higher-than-expected GDP growth rate may lead to an increase in stock prices.

Political Events: Political instability or major events, such as elections or policy changes, can cause significant volatility in overnight prices.

Market Speculation: Traders often speculate on future market movements, leading to overnight price fluctuations.

Case Study: The Impact of Overnight Prices on Cryptocurrency Markets

Consider a scenario where a cryptocurrency experiences a sudden surge in demand overnight. This could be due to a positive news report or a new partnership announcement. As a result, the opening price of the next trading day would likely be higher, reflecting the increased demand. Traders who entered the market before the surge could benefit from the price increase, while those who missed the opportunity would need to reassess their strategies.

Tips for Trading with Overnight Prices

Stay Informed: Keep yourself updated with the latest news and economic reports to anticipate potential overnight price fluctuations.

Use Technical Analysis: Technical analysis tools, such as trend lines and moving averages, can help you identify patterns in overnight prices and make informed trading decisions.

Implement Stop-Loss Orders: Use stop-loss orders to protect your investment from sudden price changes.

Monitor Risk: Regularly assess your risk exposure and adjust your trading strategy accordingly.

In conclusion, understanding overnight market prices is essential for successful trading. By staying informed, analyzing price fluctuations, and implementing effective risk management strategies, you can navigate the complex world of finance with confidence.

us flag stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....