In recent years, the cannabis industry has experienced a surge in growth, and investors are taking notice. The term "pot stock US" refers to publicly-traded companies that are involved in the cannabis industry, from cultivation and manufacturing to retail and technology. This article will provide an in-depth look at the pot stock US market, including key players, trends, and factors to consider when investing.

Understanding Pot Stock US

Pot stock US encompasses a wide range of companies, each with its own unique business model and market focus. Some of the most notable companies in this sector include Canopy Growth Corporation, Aurora Cannabis Inc., and Tilray Inc.. These companies operate in various segments of the cannabis industry, from cultivation and manufacturing to retail and technology.

Key Players in the Pot Stock US Market

Canopy Growth Corporation: As one of the largest cannabis companies in the world, Canopy Growth is known for its innovative approach to cannabis cultivation and product development. The company has a strong presence in both the Canadian and international markets, and has recently expanded its operations in the US.

Aurora Cannabis Inc.: Aurora is another major player in the cannabis industry, with a focus on producing high-quality cannabis products. The company has a diverse product portfolio, including oils, edibles, and dried flowers, and operates in multiple provinces across Canada.

Tilray Inc.: Tilray is a global leader in cannabis research and development, with a focus on producing premium cannabis products. The company has a strong presence in the European market and has recently entered the US market through partnerships with local retailers.

Trends in the Pot Stock US Market

The pot stock US market is characterized by several key trends:

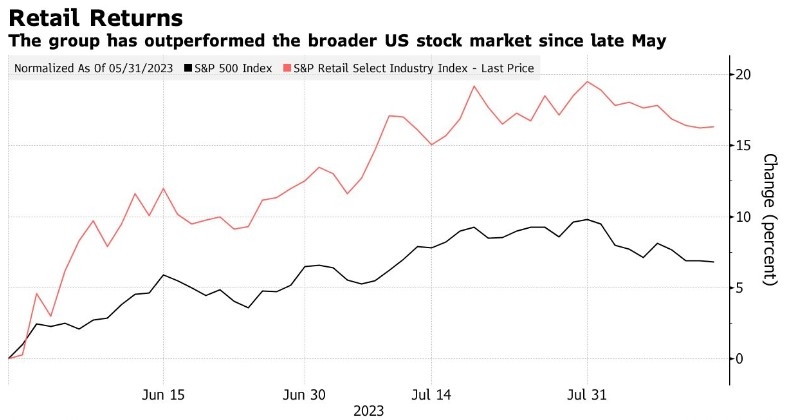

Expansion into New Markets: As more states and countries legalize cannabis, companies are looking to expand their operations into new markets to increase their market share.

Innovation in Product Development: Companies are investing heavily in research and development to create new and innovative cannabis products that cater to a wider range of consumers.

Merger and Acquisition Activity: The cannabis industry is seeing a significant amount of merger and acquisition activity, as companies look to consolidate their market position and increase their scale of operations.

Factors to Consider When Investing in Pot Stock US

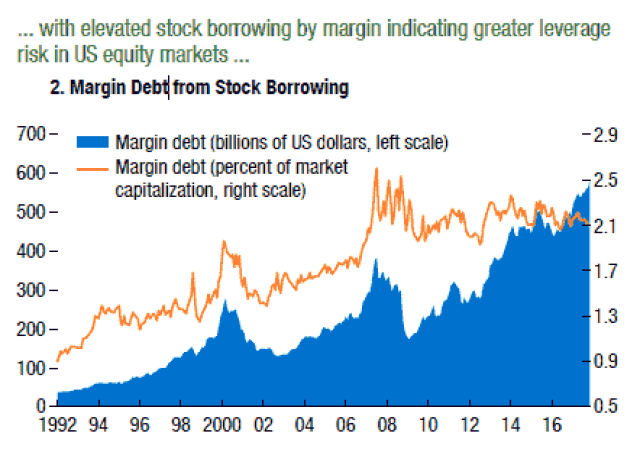

Investing in pot stock US can be a risky endeavor, and it's important to consider several factors before making an investment:

Regulatory Risk: The cannabis industry is heavily regulated, and changes in regulations can have a significant impact on the profitability of companies in this sector.

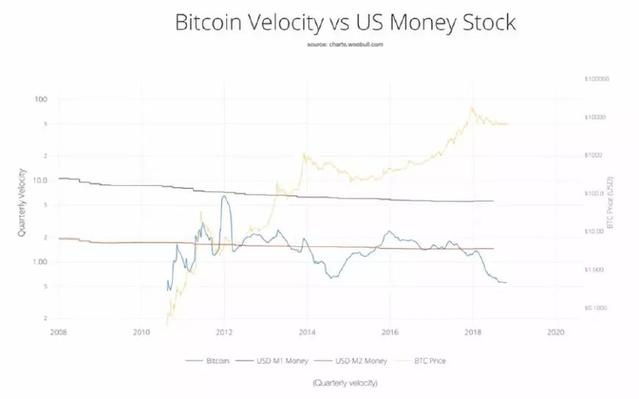

Market Volatility: The pot stock US market is known for its volatility, and prices can fluctuate significantly in a short period of time.

Company Financials: It's important to thoroughly research the financial health of a company before making an investment, including its revenue, expenses, and profitability.

Case Study: Canopy Growth Corporation

Canopy Growth Corporation is a prime example of a company that has successfully navigated the pot stock US market. The company has a strong track record of innovation and has been able to expand its operations into new markets, despite the challenges posed by regulatory risk and market volatility.

In conclusion, pot stock US is a dynamic and rapidly growing market, with numerous opportunities for investors. By understanding the key players, trends, and factors to consider, investors can make informed decisions and potentially benefit from the growth of this exciting industry.

us flag stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....