In the ever-evolving world of global finance, Chinese stocks have emerged as a significant force in the US trading landscape. This article delves into the reasons behind their popularity, the impact they have on the market, and the opportunities they present for investors.

The Chinese Market's Ascendancy

The allure of Chinese stocks in the US can be attributed to several factors. Firstly, the sheer size and growth potential of the Chinese economy make it an attractive destination for international investors. China's GDP has been consistently on the rise, and with it, the performance of its stock market has been nothing short of impressive.

Diversification and Growth Opportunities

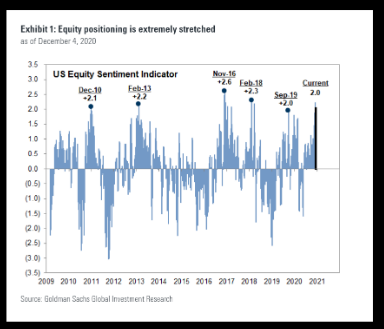

One of the primary reasons investors are flocking to Chinese stocks is for diversification. A well-diversified portfolio is essential for mitigating risk, and the inclusion of Chinese stocks can provide exposure to a market that often moves independently of the US market. This is particularly beneficial during periods of market volatility.

Key Sectors to Watch

Several sectors within the Chinese stock market have caught the attention of US investors. Technology, consumer goods, and healthcare are among the most prominent. Companies like Alibaba, Tencent, and Huawei are not only global leaders but also have a significant presence in the US market.

Alibaba: A Case Study

Alibaba, the e-commerce giant, is a prime example of a Chinese stock that has gained significant traction in the US. Since its IPO in 2014, the stock has seen considerable growth, despite facing regulatory challenges in both China and the US. Its expansion into cloud computing and fintech has further bolstered its position as a market leader.

Regulatory Challenges and Opportunities

The regulatory environment in both China and the US can be complex and sometimes conflicting. However, this does not deter investors who are willing to navigate these challenges. In fact, the regulatory landscape can present opportunities for those who understand the nuances and can capitalize on them.

Investing in Chinese Stocks: A How-To Guide

For investors interested in trading Chinese stocks in the US, here are a few key steps to consider:

Research: Understand the market and the specific companies you are interested in. This includes their financial health, market position, and future growth prospects.

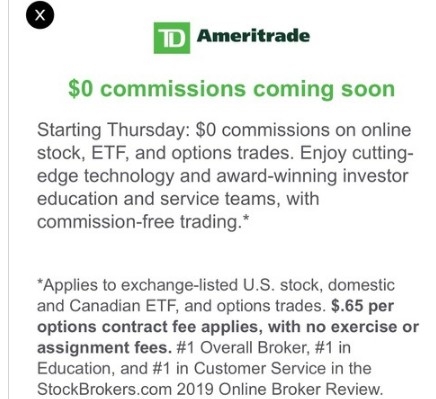

Platform Selection: Choose a reputable brokerage firm that offers access to Chinese stocks. Some platforms may have restrictions or additional fees, so it's crucial to do your homework.

Risk Management: As with any investment, it's important to manage your risk. This includes setting a budget, diversifying your portfolio, and staying informed about market trends.

Stay Informed: Keep up with the latest news and developments in both the Chinese and US markets. This will help you make informed decisions and stay ahead of potential market movements.

Conclusion

Chinese stocks trading in the US market present a unique opportunity for investors seeking diversification and growth. By understanding the market dynamics, navigating regulatory challenges, and conducting thorough research, investors can potentially benefit from the upward trajectory of the Chinese economy.

us flag stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....