In today's fast-paced financial world, staying informed about market trends and economic forecasts is crucial for investors. At Edward Jones, we provide comprehensive market updates to help our clients make informed decisions. This article delves into the latest market trends, economic forecasts, and investment insights from Edward Jones.

Market Trends

The global economy has experienced significant changes in recent years, and these trends continue to shape the investment landscape. One of the most notable trends is the rise of digitalization. As technology advances, more businesses are embracing digital solutions, which is driving innovation and growth in various sectors.

Economic Forecasts

The economic outlook for the coming years remains a topic of discussion among investors. While there are uncertainties, many experts predict moderate economic growth. Key factors influencing the economic landscape include:

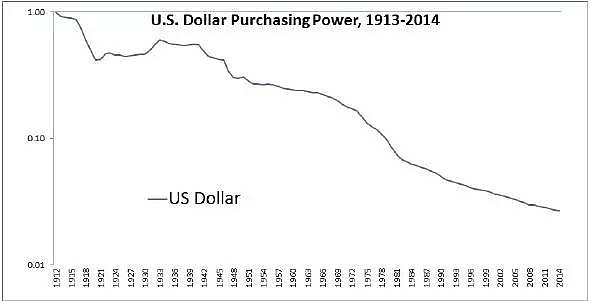

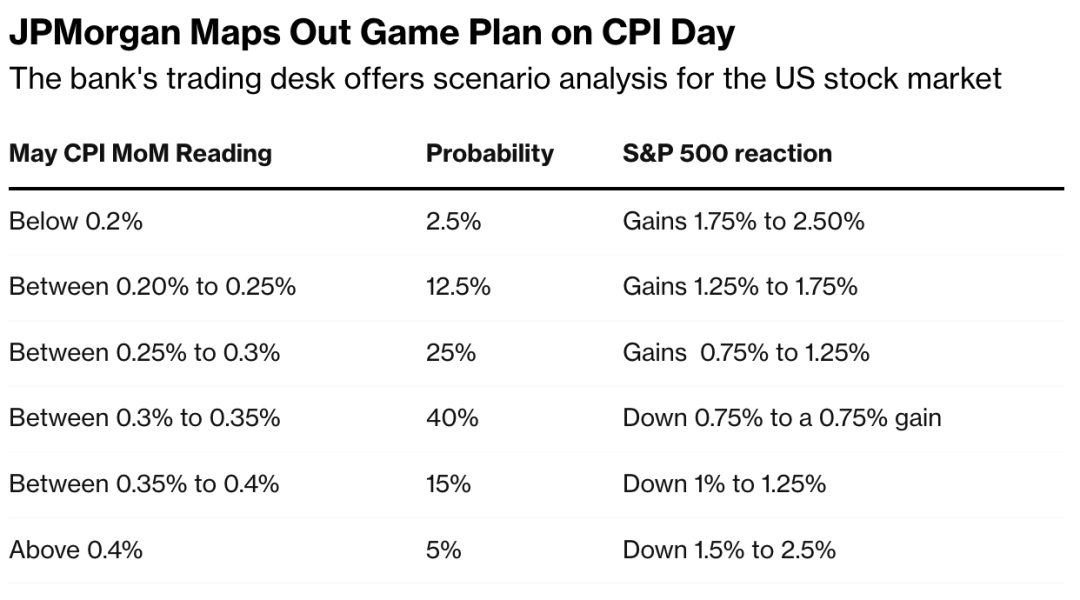

- Inflation: Central banks around the world are closely monitoring inflation rates. Inflation can impact investment returns, so it's important to stay informed about these trends.

- Interest Rates: Changes in interest rates can affect bond prices and other fixed-income investments. Understanding the potential impact of interest rate changes is crucial for making informed investment decisions.

- Geopolitical Events: Geopolitical tensions can impact global markets. Staying informed about international relations and political developments is essential for navigating these risks.

Investment Insights

At Edward Jones, we believe in a diversified investment strategy that aligns with your financial goals and risk tolerance. Here are some key insights to consider:

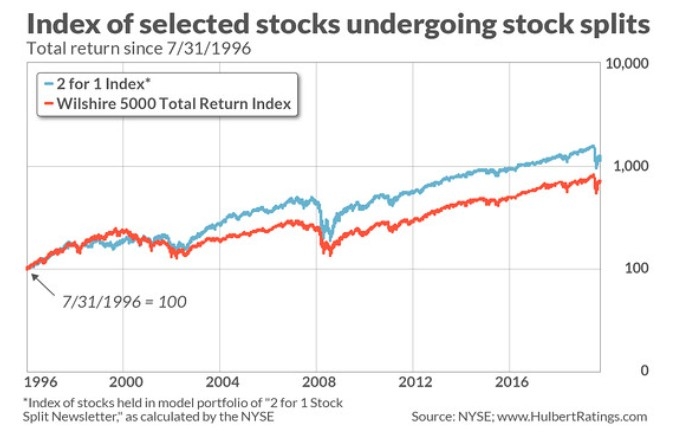

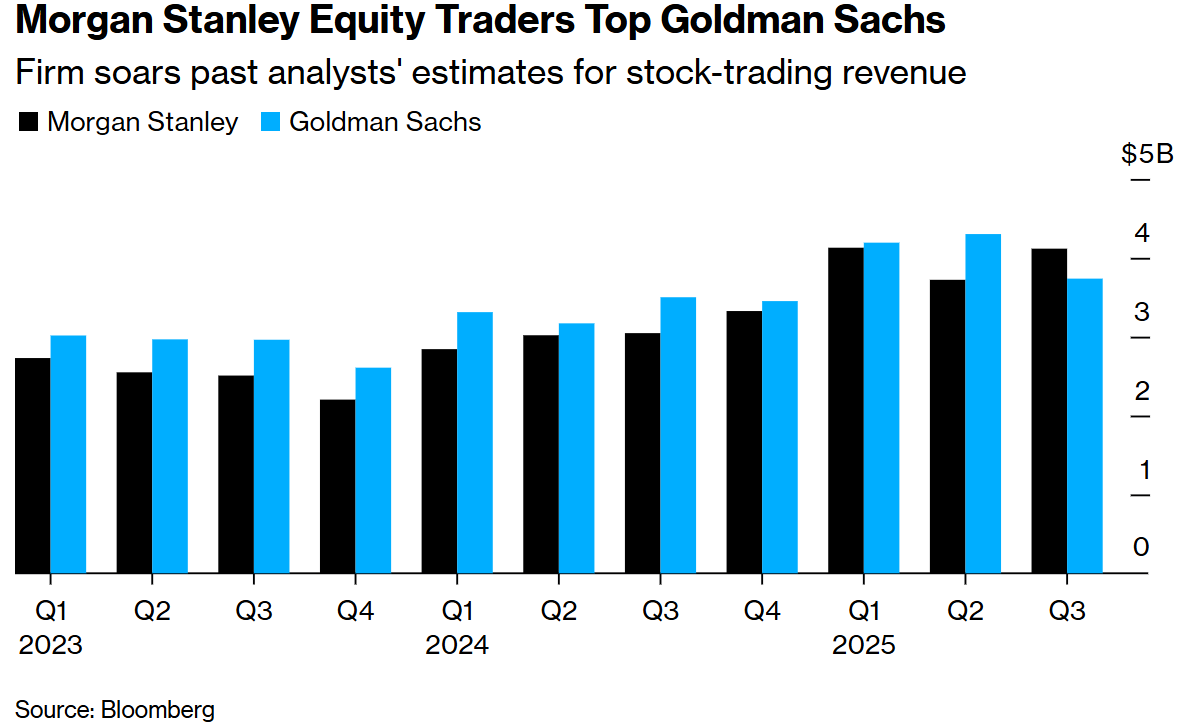

- Equities: Investing in stocks can provide long-term growth potential. However, it's important to carefully select companies with strong fundamentals and growth prospects.

- Bonds: Bonds can provide income and stability to your investment portfolio. Understanding the different types of bonds and their risk profiles is essential for making informed decisions.

- Alternatives: Alternative investments, such as real estate and commodities, can offer diversification and potentially enhance returns. However, these investments often come with higher risk and may not be suitable for all investors.

Case Study: Technology Sector

The technology sector has been a significant driver of growth in recent years. Companies like Apple, Microsoft, and Amazon have seen substantial increases in their stock prices. However, it's important to note that technology stocks can be volatile. As an investor, it's crucial to conduct thorough research and consider your risk tolerance before investing in this sector.

Conclusion

At Edward Jones, we are committed to providing our clients with up-to-date market updates and investment insights. By staying informed about market trends and economic forecasts, you can make informed decisions to help achieve your financial goals. Remember, investing involves risk, and it's important to consult with a financial advisor before making any investment decisions.

us flag stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....