This week, the financial markets have come to a halt, and investors are left wondering what this means for their portfolios. Whether you're a seasoned trader or a beginner, understanding the implications of market closures is crucial. In this article, we'll delve into the reasons behind the closures, the potential impact on investments, and what you can do to stay informed and prepared.

Reasons for Market Closures

Markets can close for various reasons, including holidays, technical issues, or natural disasters. This week's closure was likely due to a combination of these factors. For instance, many markets around the world observe certain holidays, and this week may have coincided with a major holiday in one or more countries. Additionally, technical issues or disruptions can lead to temporary closures to ensure the integrity of the trading system.

Impact on Investments

When markets are closed, investors may experience a range of emotions, from anxiety to relief. Here's what you need to know about the potential impact on your investments:

- Stock Prices: During market closures, stock prices can remain stagnant or fluctuate based on off-market trading. However, once the markets reopen, prices may adjust to reflect the latest information and sentiment.

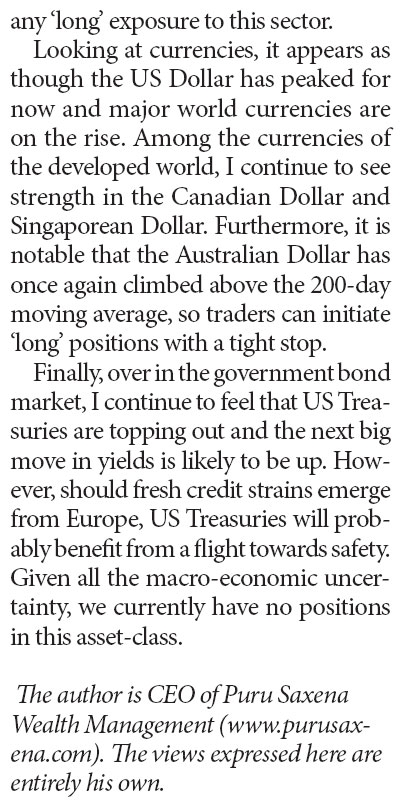

- Interest Rates: The closure of financial markets can also affect interest rates, as central banks may take advantage of the lull to make policy changes.

- Dividends: Investors who rely on dividends may find their income temporarily interrupted during market closures.

What You Can Do

While you can't control when markets close, you can take steps to mitigate the impact on your investments:

- Stay Informed: Keep an eye on financial news and updates to stay informed about market closures and their potential impact on your investments.

- Diversify Your Portfolio: Diversifying your portfolio can help protect against the volatility associated with market closures.

- Review Your Investment Strategy: Consider reviewing your investment strategy to ensure it aligns with your financial goals and risk tolerance.

Case Study: The 2020 Market Shutdown

One notable example of a market closure was the unprecedented shutdown in March 2020 due to the COVID-19 pandemic. This closure lasted for several weeks and caused significant volatility in the markets. Investors who were well-informed and had diversified portfolios were better equipped to navigate the uncertainty and protect their investments.

Conclusion

While the closure of financial markets can be unsettling, understanding the reasons behind the closures and the potential impact on your investments can help you stay calm and focused. By staying informed, diversifying your portfolio, and reviewing your investment strategy, you can navigate market closures with confidence and minimize the impact on your financial well-being.

us flag stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....